Cash is King: Assets Held in Money Market Funds Now Above $3 Trillion

Volatility in the stock markets has driven investors towards cash, sending assets held in money market funds swelling to their highest levels since March 2010.

After spending much of the last eight years in the $2 trillion range, the assets held in money market funds surged above $3 trillion mid last month, according to CNBC .

Assets held in money market funds have reached $3,066.51 billion with institutional investors holding more cash than retail investors. While retail investors hold approximately $1.2 trillion in money market fund assets, institutional investors hold approximately $1.9 trillion, according to Investment Company Institute (ICI).

The low or nearly non-existent interest rates were part of the reasons why investors considered holding cash unattractive. But with the U.S. Federal Reserve Bank increasing short-term interest rates four times in 2018, the situation has changed.

Rising Yields

Speaking to Reuters , Scwab Center for Financial Research’s fixed income director, Collin Martin, said the yields from for money market funds have become attractive while still remaining as safe as savings accounts:

Cash is attractive at today’s levels. Yields have come up a lot without taking on too much risks.

While assets held in money market funds ballooned, equity funds and bond funds suffered at the beginning of the year. According to ICI, equity funds registered outflows of $11.3 billion in the week ending January 2nd. Bond funds recorded outflows of $14.2 billion during the same week.

Specifically, withdrawals from exchange-traded funds (ETFs) have increased by $7 billion this year. Between January 6th and January 12th, penny stock-focused ETFs registered outflows of over $1 billion while ETFs tracking tech stocks recorded withdrawals of more than $0.7 billion.

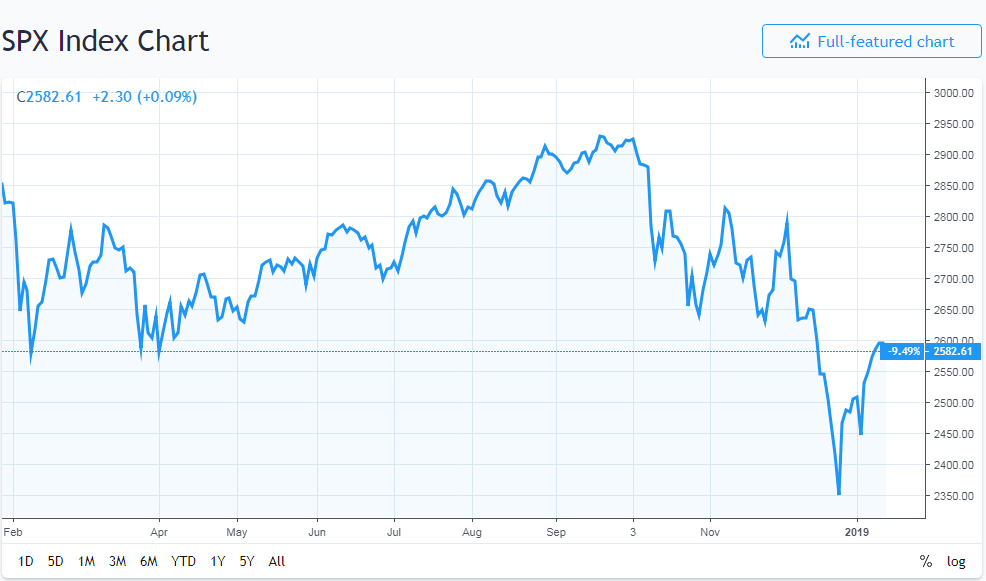

Seeing Red

This comes even as S&P 500 index has recovered since recording its worst Christmas Eve trading ever when it fell 2.7%, consequently slipping into bearish territory. Then, the index slipped below the 2350 mark but is now eyeing the 2600 resistance level.

Though the fears and worries that sent stocks plummeting last year have rescinded to an extent, some analysts are still urging caution. This includes Oppenheimer’s chief investment strategist, John Stoltzfus:

It’s clear to us (and to many investors we’d think) that we’re not out of the woods yet in what we expect will be a do-over or work-out year as political, geopolitical, economic and corporate matters play out in the months ahead.

Featured image from Shutterstock.