Cannabis Stocks Could Get High on an Andrew Yang Presidency

Marijuana legalization will have a strong chance if Andrew Yang gets elected president, but there are still headwinds for pot stocks. | Source: (i) AP Photo/Charlie Neibergall (ii) Shutterstock ; Edited by CCN.com

Andrew Yang is the Democratic presidential candidate with the lowest profile. That’s unfortunate because he’s not only one of the more reasonable candidates on the slate, but he also has some very interesting policy ideas – including one that would boost cannabis stocks.

We Want Our Weed and We Want It Now

The legalization of cannabis at the federal level would boost cannabis stocks.

Andrew Yang makes a very good point regarding the legalization trend. Marijuana is already fully legalized in 10 states. It is decriminalized and legal for medical purposes in 10 other states. It is legalized for medicinal purposes only in 16 states and fully illegal in only 10 states.

Marijuana and cannabis legalization is only one of several issues facing candidates, though it enjoys broad-based popularity amongst younger voters and numerous people in some of the older demographics.

Those same people may also be investors in cannabis stocks, so voters have additional incentive to support Andrew Yang.

Yang has taken a temperate approach to the issue. He has said publicly that he does not love marijuana and that he wishes people would not use it heavily. He has also said that it’s safer than many other opiates, which is true but only to a certain extent.

Another very popular position that Andrew Yang holds is pardoning those who are in prison for marijuana-related offenses. There’s also a push for expedited FDA reviews of CBD products.

Thus, cannabis stocks that are in any way tied to CBD would also get a boost.

Andrew Yang Makes a Good Point

Andrew Yang’s position makes a lot of sense for a lot of reasons.

Marijuana-related offenses, except for those involving violent crime, are generally not deserving of prison terms. It would reduce the prison population, thereby reducing state and federal expense and not force states to put violent criminals back on the streets due to overpopulation.

One of the things holding back cannabis stocks is the federal legalization problem.

Legalization Is Popular in Polls

A Rasmussen report from March found that 54 percent of likely U.S. voters favor federal legalization of marijuana and cannabis.

An Axios/SuveyMonkey poll in June found that 63 percent of those surveyed support national legalization of marijuana and cannabis, yet only 26 percent would purchase it for their own use.

The less taboo marijuana becomes, the more support there will be for cannabis stocks.

But does the data support legalization? That’s where cannabis stocks could run into trouble.

Good for Tax Revenues, Bad for Society

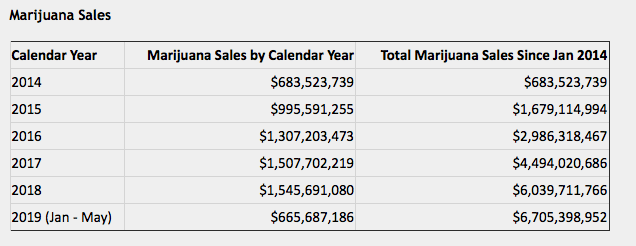

The state of Colorado, which legalized marijuana five years ago, says sales of the drug exceeded $1.54 billion in 2018, reaching a total of $6 billion. The rate of sales growth has been slowing, although it’s difficult to determine if this is because usage is plateauing or prices have been falling and volume is higher.

Meanwhile, Colorado has generated $1.04 billion in total tax revenues.

The social impact, however, has been costly.

The Rocky Mountain High-Intensity Drug Trafficking Area report, a federally funded law enforcement project, reported in October 2017:

- The number of traffic fatalities when a driver was tested positive for marijuana increased to 125 in 2016, up from 55 in 2013.

- While all traffic deaths increased 16 percent between 2013 and 2016 compared to 2009 and 2012, marijuana-related traffic deaths increased 66 percent.

- Marijuana-related emergency room visits increased by 35 percent.

- Hospitalizations related to marijuana has almost doubled to nearly 13,000.

These are the headwinds facing cannabis stocks. Get past the social issues, and pot companies could see a new upswing, especially if Andrew Yang is in office.