Stock Market Bull Tom Lee: Buy the Trade War-Induced S&P 500 Dip

Stock market bull Thomas Lee of Fundstrat has invited investors to “back up the truck” and load up on the trade war induced dip. | Source: AP Photo / Mark Lennihan

Stock market bull Thomas Lee of Fundstrat has invited investors to “back up the truck” and load up on the trade war-induced dip in the S&P 500. His client letter comes at the end of an action-packed week full of economic data, a landmark interest rate decision, and political wrangling that caused volatility to spike across the board.

Friday’s July payrolls data was largely overshadowed as the Fed stole the spotlight on Thursday. Even though the central bank cut rates for the first time in 11 years, Chairman Powell’s comments were not enough to satiate the bulls. Powell left little confirmation on the table for further rate cuts later in the year.

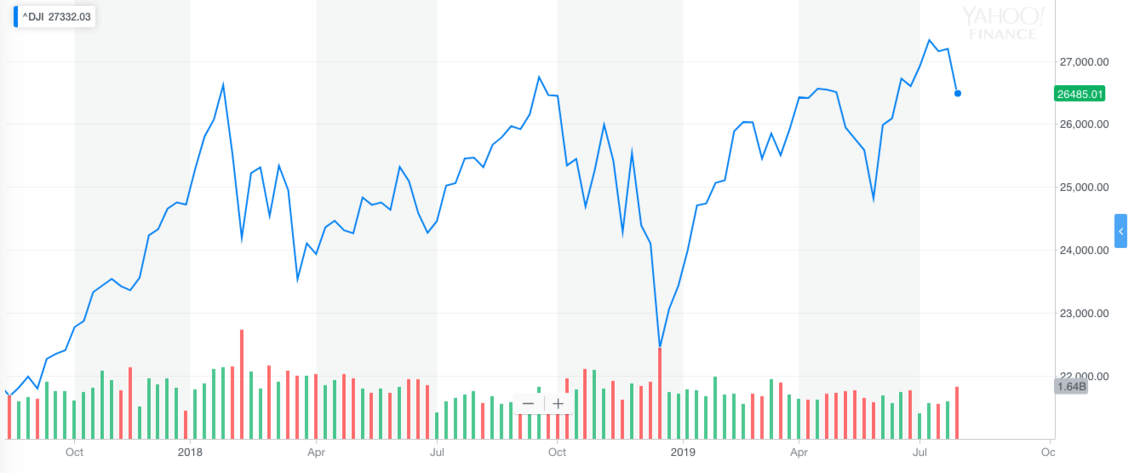

That and the unexpected announcement of an additional $300 billion tariff move by President Trump was more than the market could handle. Stocks finished sharply lower with the Dow Jones Industrial Average down by 2.6% or 707 points for the week to 26,482 by close on Friday.

Tom Lee Remains a Committed Bull

Despite mixed feelings from market commentators, Lee appears to stand firm in his bullish convictions. Fundstrat’s co-founder has been an avid buyer in recent months even as recessionary calls grow louder.

Lee expects the longest-running expansion in U.S. history to continue into the second half of the year. This is a traders’ market, and investors would have performed relatively well buying into any weakness.

Despite Powell’s lackluster comments on Thursday, market participants are still anticipating a 100% chance of a rate cut come September. That is “adding gasoline” to the stock market fire, according to Lee. The resulting trends in other asset classes also confirm his bullish thesis, as CNBC reports :

“We see a falling 10-yr and weakening USD and higher odds of a September cut as VERY BULLISH—hence, we strongly urge investors to take advantage of this weakness”

The Stock Market Is Six of One and Half-a-Dozen of the Other

The market has mostly traded sideways since 2018, highlighting the ongoing uncertainty that long-term investors are facing.

However, Lee suggests that another 10% is up for grabs, which would bring the Dow Jones to an all-time high just above the 29,000 handle.

If he’s right, time may be short before the truck pulls away.