Bullish Crypto Momentum Will Stick Despite Brutal 11% Bitcoin Dump

Bitcoin''s bullish momentum is here to stay. | Source: Shutterstock

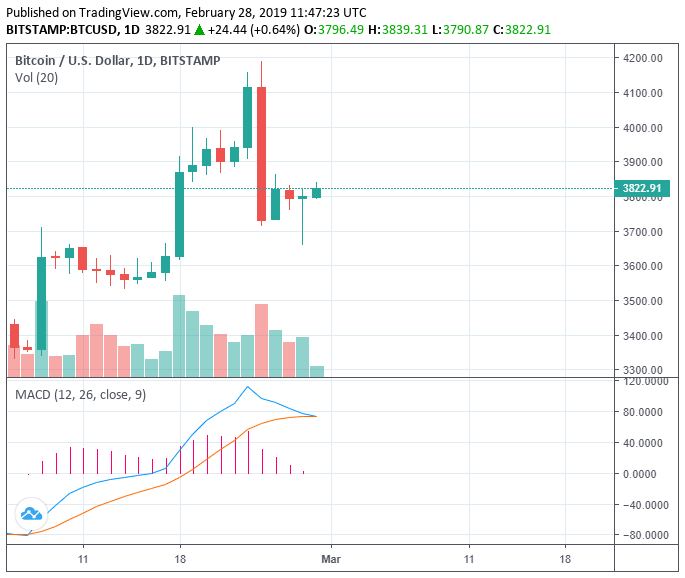

On February 24, within minutes, the Bitcoin price dumped by 11 percent from $4,150 to the mid-$3,000 region, pushing the crypto market to lose $11 billion on a single day.

Investors expected a pullback to occur on the price trend of Bitcoin but many traders were surprised by the magnitude of the drop.

Speaking to CCN.com, a cryptocurrency technical analyst with an online alias “The Crypto Monk” explained that the abrupt price movement was simply a technical movement.

Bitcoin Bullish Momentum Not Over

As soon as Bitcoin cleanly broke out of the $4,000 resistance level and neared $4,200, it dumped to $3,700.

Understandably, some traders claimed that the price movement of the dominant cryptocurrency was a result of market manipulation due to the manner in which it plunged in a short time frame.

In an exclusive interview with CCN.com, the analyst said that from a technical analysis (TA) perspective, Bitcoin has been unable to breakout of a low range from $3,190 to $4,250 for over three months.

When BTC climbed up to $4,150, the supply area over the $4,000 mark absorbed most of the buy orders in the market, disallowing the asset from sustaining its momentum.

The analyst explained:

Combined with multiple factors: decreasing buying pressure, long positions meeting their targets, and thus getting closed and short positions reopened as a switch.

We get exactly what happened on Sunday. A brutal pullback. It doesn’t mean that the bullish momentum is over since important supports are still valid. $3,710 has been holding pretty well and we got an instant bounce reaction from this level.

In recent weeks, a growing number of industry executives and experts have suggested that Bitcoin has hit its bottom at $3,122 and is undergoing a consolidation phase.

Spencer Bogart, a partner at Blockchain Capital for instance, told Bloomberg that Bitcoin may be the most compelling asset in the global market in the current phase of its development.

“I think there’s a strong case to be made that bitcoin is the most compelling asset in the world right now. [The bitcoin market] is a tinder box right now and anything could [set off the next bull run],” Bogart said .

While BTC was not able to break out of the key $4,200 resistance level, there still are two positive takeaways: BTC was able to breach the $4,000 resistance level with strength and it recorded a strong rebound from the $3,700 mark.

Market sentiment and media coverage, which historically have served as important catalysts in reversing long-lasting bear markets, have noticeably improved since early 2019.

On February 28, it CCN.com reported that the sovereign wealth fund of Singapore GIC participated in the $300 million funding round of Coinbase in late last year.

For investors, especially those in the traditional financial sector, movements like the commitment of GIC’s investment in a cryptocurrency company and the entrance of public pension funds into the crypto market could signal that the asset class is not a fad.

What Does the Short-Term Outlook on Crypto Markets Look Like?

Several tokens in the likes of Binance Coin, ICON, EOS, and Nexo have recorded gains in the range of 3 percent to 15 percent against both BTC and the USD on the day.

Although tokens tend to perform strongly when BTC is in a sideways market, until the dominant cryptocurrency demonstrates an upside movement, it is highly likely that tokens will record minimal price movements.

The Crypto Monk also emphasized that BTC is likely to remain stable in the near-term as the market awaits any substantial movement.

“As a swing trader or a macro investor, these small movements shouldn’t get you over excited until key level is breached with volume,” the analyst said.

Click here for a real-time bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView .