Boeing Hasn’t Sold a Single 737 Max in 3 Months

Boeing stock continues to teeter on the brink, with the company admitting it hasn't taken a single 737 Max order in three months. | Source: Jason Redmond / AFP

Plane manufacturer Boeing is stuck in market purgatory as its stock flounders in the wake of stubbornly low demand.

On Tuesday, the company reported that it had not received any new orders for its beleaguered 737 Max aircraft, making it the third straight month that the world’s largest airplane manufacturer had not sold a single one of what was once its best-selling jet.

Boeing Stock Sits on Sidelines of Market Rally

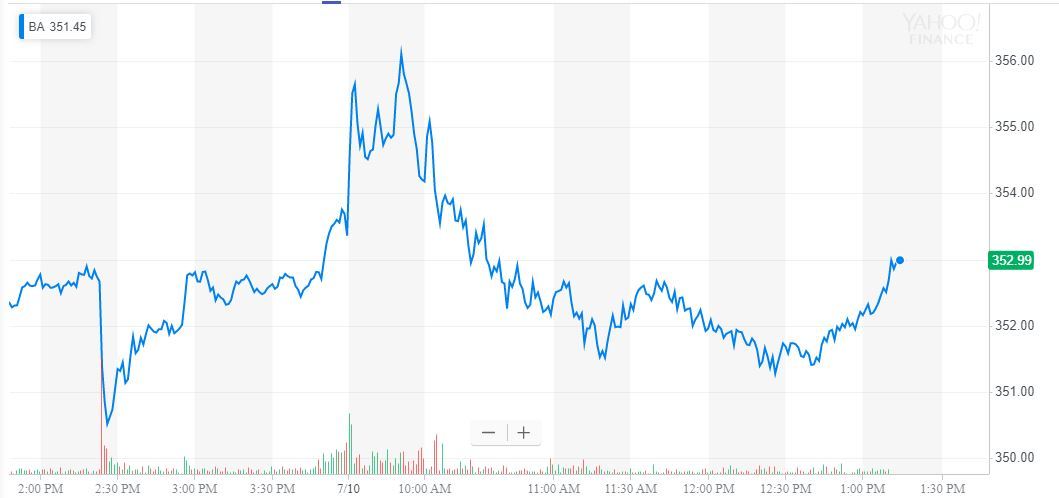

Boeing stock flatlined on the news, exiling BA shareholders to the sidelines amidst a broad stock market rally.

While Boeing has reportedly fixed the software problem with the anti-stall system that caused the 737 Max air disasters, the planes remain grounded indefinitely.

More worrisome is that a poll conducted by the NPR showed that 60 percent of travelers said they would not fly on the 737 Max even if the current ban is lifted. Could this spell a move towards services offered by the best private jet companies instead?

Boeing’s stock has been pummeled by the Max debacle, losing around $50 billion of its market value since March. BA shares currently trade at $353, placing its market cap just below $200 billion.

Boeing is reportedly negotiating a deal to sell 200 Max jets to the parent company of British Airways, but the order has not yet been finalized.

But even current orders are not necessarily safe. Just this week, Saudi airline Flyadeal pulled out of a $5.9 billion order it had already placed, opting instead for the 737 Max’s archenemy, the Airbus A320.

Market Waits to See What Happens Next

The aircraft manufacturing company has had to reduce the production rate of the plane to 42 per month instead of the projected 57 it had initially planned to achieve. There is also a long backlog of around 4,600 planes, which the company is expected to deliver before receiving payments.

With analysts not sure if the plane will be cleared to fly till the last quarter of the year and increasingly-dissatisfied airlines seeking compensation from the airplane manufacturer, it is looking to be a very long Q3 for Boeing.

Eternal rival Airbus, on the other hand, is capitalizing on Boeing’s woes to increase sales of its A320. Already, Airbus has delivered 389 planes in the first half of 2019 and plans to deliver 890 by the end of the year.