Boeing (BA) Stock Is Preventing Dow from Liftoff as Congress Blasts CEO for Reckless Safety Standards

Boeing CEO Dennis Muilenburg begins congressional hearings on Tuesday. | Win McNamee/Getty Images/AFP

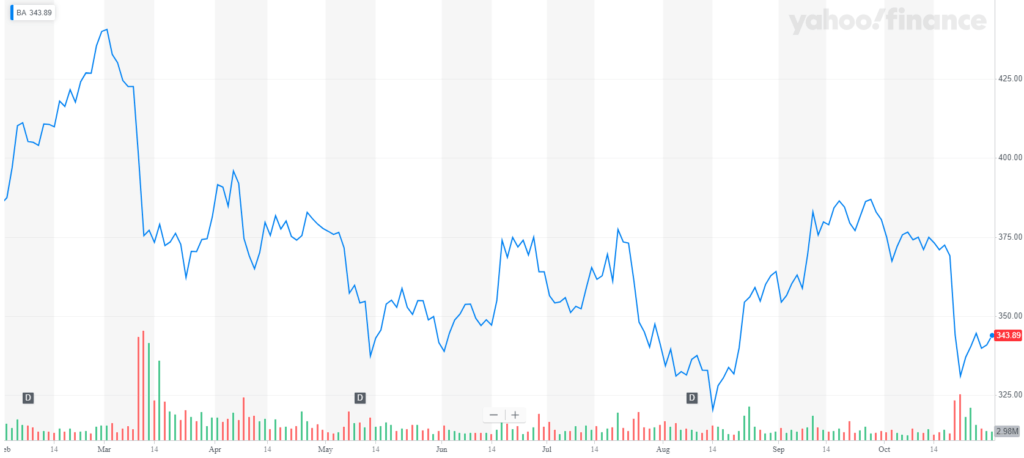

- Boeing shares rose on Monday, but are down sharply this year.

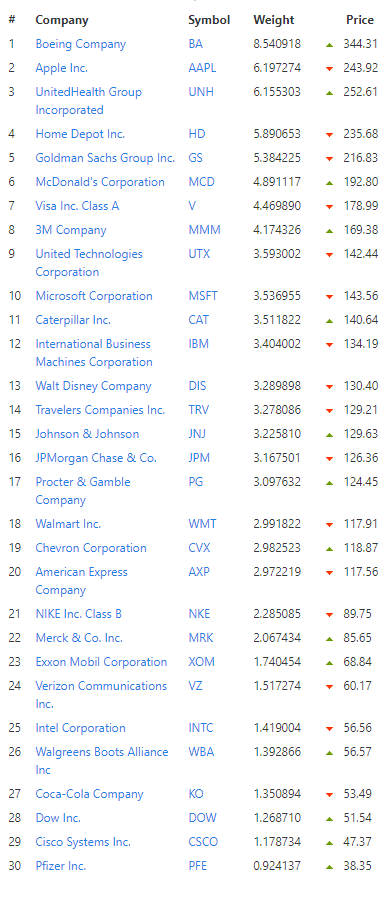

- At 8.5% of the Dow, BA continues to be a significant drag on the blue-chip index.

- Boeing CEO Dennis Muilenburg testified before the Senate Commerce Committee on Tuesday, where his company was criticized for its safety standards and ‘cozy’ relationship with the FAA.

Shares of Boeing Co (NYSE:BA) traded slightly higher on Tuesday, even as CEO Dennis Muilenburg was on the receiving end of scathing criticism from U.S. lawmakers over a pair of airline disasters that exposed the company’s lax approach to safety.

Despite the modest uptick, BA shares have been mired in a nine-month skid amid ongoing investigations into the company’s safety standards and cozy relationship with the Federal Aviation Administration (FAA).

Muilenburg Testifies Before Congress

On Tuesday, Boeing CEO Dennis Muilenburg appeared before the Senate Commerce Committee, where he was questioned about his company’s response to two fatal crashes that have rocked the aviation industry over the past year. In prepared testimony , Muilenberg said:

“We have learned and are still learning from these accidents. We know we made mistakes and got some things wrong. We own that, and we are fixing them.”

Connecticut Democrat Richard Blumenthal took Muilenburg to task over his company’s poor response to the disasters, which took place in October 2018 and March and killed a combined 346 people .

“Those pilots never had a chance. These loved ones never had a chance,” Blumenthal said. “They were in flying coffins as a result of Boeing deciding it was going to conceal MCAS from the pilot.”

Blumenthal was referring to the 737’s Maneuvering Characteristic Augmentation System (MCAS), the flight-control center that was excluded from the pilot manuals.

Boeing has been desperately trying to fix its flight-control system in hopes that the FAA and other aviation authorities will once again clear its 737 fleet for flight.

The FAA is also facing a backlash over its relationship with Boeing. Senate committee chair Roger Wicker, a Republican from Mississippi, criticized the two organizations for exhibiting “a disturbing level of casualness and flippancy.”

BA Stock’s Brutal Year Continues

Boeing’s stock price rose 1% on Tuesday, reaching a session high of $345.00. By comparison, the Dow Jones Industrial Average (DJIA) barely moved.

Even with the gains, BA is down a whopping $100 from its 52-week high and has been a net drag on the Dow for much of 2019. That’s because BA is the Dow’s largest component by weight at just over 8.5%. The second-largest component, Apple Inc. (AAPL), represents 6.2% of the blue-chip index.

Some analysts believe that Boeing’s yearlong slide makes the stock ripe for bottom picking. Using a discounted cash flow (DCF) model, Simply Wall St argues that BA stock could be undervalued by up to 41%. That figure may be hard to justify given Boeing’s disastrous earnings call last week, where it reported a 50% slide in third-quarter profit that was far worse than what analysts had expected.