Blockchain Friendly Payments Play Leads Stock Market Recovery

FleetCor was the best performer in the S&P 500, gaining 8 percent on a day that was making stock market investors very nervous for a while. | Source: Shutterstock

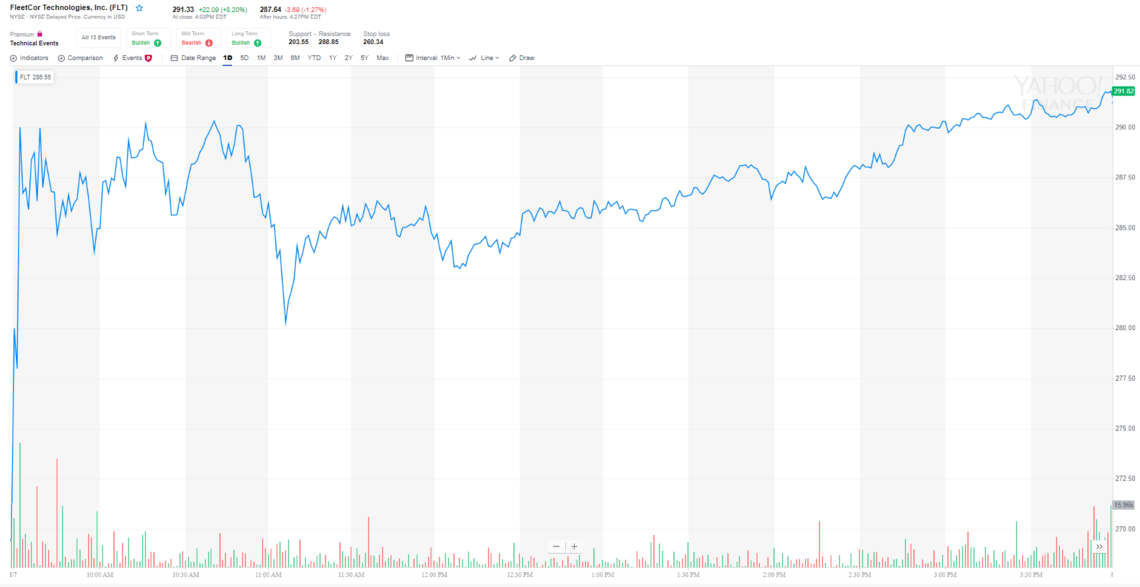

Stock prices were whipsawed in today’s session before ultimately managing to finish relatively flat. Leave it to a payments company to lead the broader stock market higher. FleetCor Technologies, which is a Georgia-based payments company, was the single best performer in the S&P 500 index, gaining 8 percent on a day that was making investors very nervous for a while. The payments platform reported better-than-expected earnings and it appears to be operating on all cylinders. Management raised the full-year outlook, which flies in the face of much of the doom-and-gloom that has been attached to corporate America’s growth picture. FleetCor is pursuing growth in an economy that some say is headed for a recession. Maybe it has something to do with its willingness to embrace tech innovation including the blockchain.

FleetCor Not a Blockchain Pureplay in the Stock Market

FleetCor is more than just a traditional payments company and has experimented with blockchain technology. While it’s not a pure blockchain play in the stock market, it could give investors some exposure to the burgeoning industry. Last year, FleetCor announced a partnership with privately held cross-border payments startup Ripple in which it began testing the use of cryptocurrency XRP via the xRapid product for payments. At the time, an executive at FleetCor’s international payments arm stated :

“We are excited for the insights this pilot program is expected to deliver, and we will use that information to help both Cambridge and FLEETCOR develop our use cases for blockchain in international payments.”

Blockchain startup Ripple has since gone on to partner with MoneyGram for cross-border payments and settlement in cryptocurrency. FleetCor was rumored to be sniffing around Western Union’s payments business, which was reportedly on the block for half-a-billion dollars last year. By all accounts, Western Union appears to have decided to hold onto its Business Solutions division, but it has also decided to cut its workforce by 10 percent .

Stock market investors took some profits in FleetCor in after-hours trading, but shares are still up a whopping 57 percent year-to-date and are trading near the 52-week high.