Blame Trump for the Next U.S. Recession, Not the Fed: Former RBI Chief

President Trump's trade war with China is costing the U.S. economy very dearly, according to former Reserve Bank of India governor Raghuram Rajan. | Image: AP Photo/Evan Vucci, File

- Donald Trump is sending the U.S. economy close to a recession thanks to his trade war with China.

- Former RBI chief Raghuram Rajan believes that Trump is the biggest threat to the U.S. economy and could be the catalyst for a recession.

- Economic data in the U.S. suggests that Rajan could be right in his view, though Trump could blame a slowdown on the Federal Reserve.

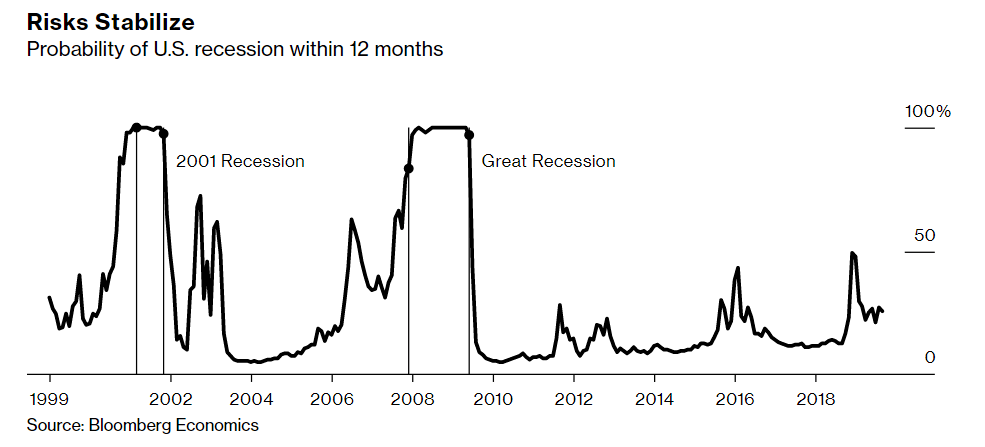

The odds of a U.S. recession seemed pretty high last month, with major Wall Street players indicating that the bad days could arrive as early as next year. But the fears of a recession have subsided to some extent of late. That’s probably because of a potential trade deal between the U.S. and China, though President Trump is back at it again to torpedo any agreement between the two countries.

That’s why it is not surprising to see why the former Reserve Bank of India governor Raghuram Rajan believes that Donald Trump is the biggest threat to the U.S. economy. According to an article authored by Rajan:

Now that the old rules governing macroeconomic cycles no longer seem to apply, it remains to be seen what might cause the next recession in the United States. But if recent history is our guide, the biggest threat stems not from the US Federal Reserve or any one sector of the economy, but rather from the White House.

Trump didn’t take long to justify Rajan’s apprehensions about sending the U.S. economy into a recession.

Trump trade war ravages manufacturing sector

Just last week, it appeared that a trade deal between the U.S. and China is a mere formality and only the venue needed to be agreed on.

That gave the stock market some relief as President Trump’s trade war with China was sending the U.S. economy toward a slowdown. For instance, manufacturers in the U.S. have been caught in the cross-fire of tariffs between the two countries. This is evident from the fact that the U.S. manufacturing purchasing managers index (PMI) has languished below 50 since August.

A reading below 50 indicates that there’s a contraction in manufacturing activity, and a sustained slowdown in the same is a bad sign of an economic downturn. What’s more, Trump’s trade war has been costing the U.S. more than China as evident from the chart below.

Now that Trump has gone on the offensive once again, it is likely that the U.S.-China trade war is all set to go on. Trump reportedly remarked at the Economic Club of New York that:

I tell it to everybody: If we don’t make a deal, we’re going to substantially raise those tariffs, they are going to be raised very substantially,” Mr Trump warned.

This makes it clear that the U.S. and China are having trouble coming to a point where they can strike a deal. And that’s not surprising as Beijing was reportedly looking for more concessions from the U.S. before it signed a deal.

The Fed is a scapegoat, but you should know better

Time and again, Donald Trump has blamed the Federal Reserve for putting the U.S. economy at a disadvantage. The Financial Times reports that according to Trump, the Fed’s policy of not getting into negative interest rates has put the U.S. at a “competitive disadvantage.”

The good news for Trump is that the Fed has obliged this year, cutting interest rates thrice. However, that doesn’t seem to be working in favor of the U.S. economy as the data points suggest. So don’t be surprised to see a spike in the probability of a recession in the coming days after the recent trade deal-triggered dip.

According to Bloomberg’s recession tracker, the chance of a U.S. recession in the next 12 months stands at 26%. That’s down from the 27% odds seen at the beginning of October. A closer look at their tracker indicates that the probability of a recession has been trending higher this year.

So, if Trump starts blaming the Fed once again for sending the U.S. into the clutches of a downturn, you know where the actual blame lies.