Bitcoin Beats Other Cryptos in ‘Smarter’ Bull Market, Says Billionaire Investor

Bitcoin's dominance will only be more pronounced in this bull market and that'll show in its value, according to Mike Novogratz. | Source: Shutterstock

By CCN.com: Mike Novogratz, the billionaire CEO of Galaxy Capital and a former hedge fund manager at Fortress Investment Group, believes alternative cryptocurrencies, or altcoins, will be outperformed by bitcoin in the bull market.

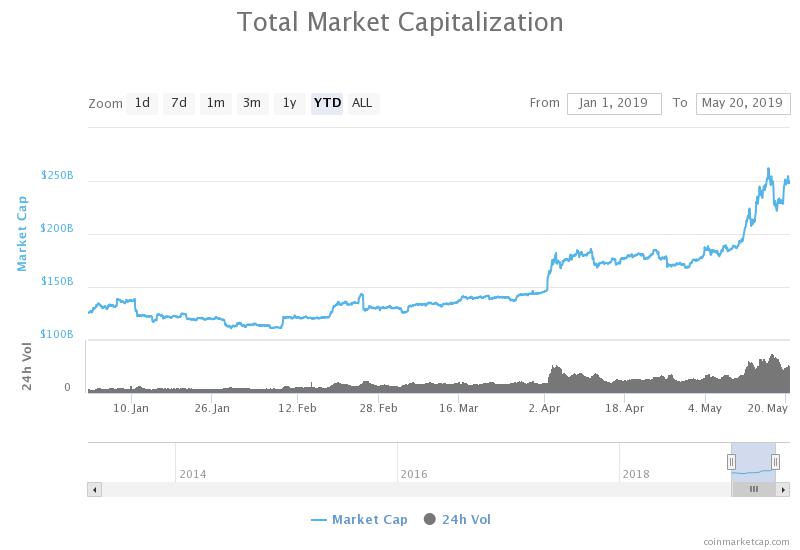

The statement of Novogratz comes after the bitcoin price risen by more than 115 percent year-to-date against the U.S. dollar, leading the crypto market to add $124 billion to its valuation.

Will bitcoin continue to outperform altcoins?

Historically, altcoins have relied on the price trend of bitcoin and have rarely demonstrated independent price movements in extended time frames.

Altcoins typically surge in value when the bitcoin price shows stability at a tight price range, leaving investors to take high-risk and high-return options over the dominant cryptocurrency.

The optimism towards bitcoin, despite the emergence of sophisticated altcoins, is well founded due to the involvement of major financial institutions in the likes of Fidelity and TD Ameritrade building infrastructure on top of bitcoin.

Fidelity and ICE, the parent company of the New York Stock Exchange, are initially launching custodial services for bitcoin, targeting institutional investors.

According to TD Ameritrade’s executive vice president Steven Quirk, tens of thousands of clients at the brokerage already trade crypto assets in some capacity.

But, traders suggest that if the sentiment around the crypto market remains overwhelmingly positive, investors will eventually explore alternative opportunities for high-return trades, which then may fuel a rally for altcoins.

One cryptocurrency trader said that bitcoin is likely to climb further throughout 2019, triggering a healthy market for altcoins:

The rest of this year will be characterized by rapid BTC advances, healthy corrections and periods of sideways price action, when altcoins will fly. Put that nonsense rhetoric about waiting for capitulation and still not making our bear market lows away. Wrong cycle.

Full on degen altcoin season still on track for June. Next few weeks, as BTC finds a range, we’ll continue to see the popular altcoins bounce back 1st. In June, all altcoins across the board will bounce back hard. More disbelief on its way.

The concern of some investors like Novogratz on the prospect of a booming market for altcoins is that many retail investors were hurt in the 2017 bull market taking high-risk trades, trading against stable assets like bitcoin.

As the market matures and as investors in the market become smarter, Novogratz indicated that the appetite for altcoins could decline.

Similarly, Jeff Sprecher, the chairman of the New York Stock Exchange, said in November 2018:

Somehow bitcoin has lived in a swamp and survived. There are thousands of other tokens that you could argue are better but yet bitcoin continues to survive, thrive and attract attention.

At the time, Sprecher emphasized that Bakkt, a futures market operator created by NYSE’s parent company ICE, will focus on building a regulated infrastructure for bitcoin first ahead of other assets.

Sentiment is generally positive

On May 17, as CCN.com reported, the bitcoin price plummeted by 18 percent within hours following an unexpected 5,000 BTC sell order on Bitstamp that led prices of bitcoin and ethereum to crash on BitMEX.

The market absorbed the abrupt decline in the bitcoin price fairly well, indicating that the confidence in the near-term price trend of crypto assets remains strong.

While investors have cautioned that bitcoin has shown oversold conditions in recent weeks as it surpassed key resistance levels, the momentum of the asset could prevent it facing a large correction some expect would occur in the near-term.