Bitcoin to Crack $15,000 This Week amid Waning Trust in Fiat: Max Keiser

Max Keiser believes that the bitcoin price could rally around 40% this week thanks to weak confidence in central banks and fiat currencies. | Source: Shutterstock

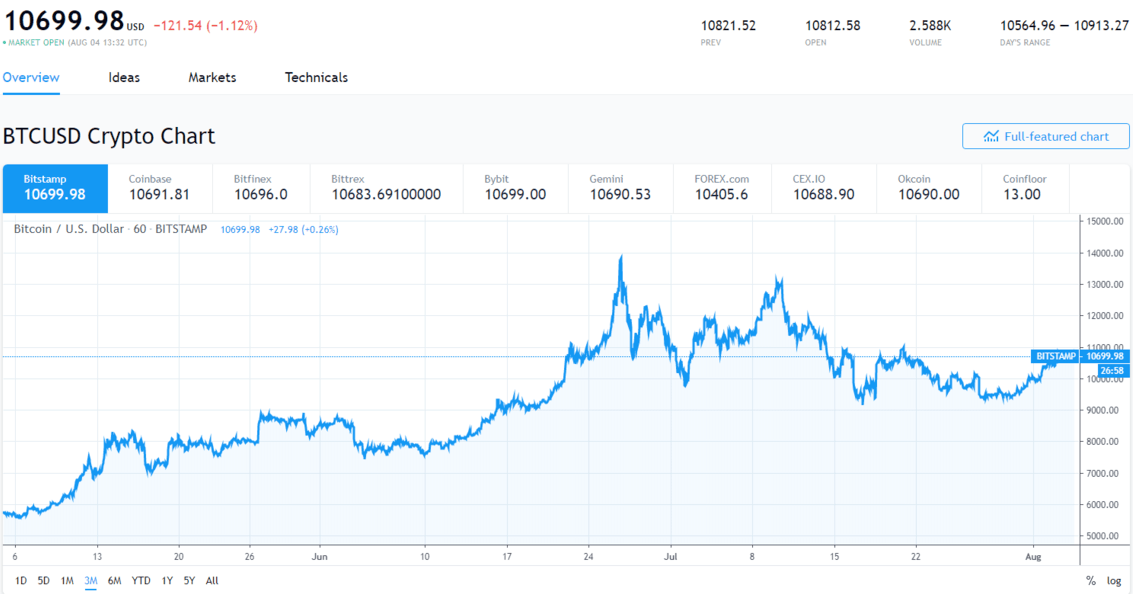

Bitcoin bull Max Keiser already has a six-figure price target for the flagship cryptocurrency. He believes that the digital asset will eventually replace gold as a safe-haven investment and beat the returns of all asset classes. If that claim doesn’t seem ambitious to you, then his latest tweet definitely will. Bitcoin is currently trading at just under $10,700, and the Keiser Report host predicts the cryptocurrency will stage a tremendous rally of 40 percent to $15,000 this week. But is that really possible?

Is Max Keiser’s weekly bitcoin price forecast credible?

Going by past trends, Max Keiser’s $15,000 target for this week cannot be brushed away as a whiff of fantasy. On June 24, bitcoin was trading at the same level as where it is right now, and it didn’t take long for the price to shoot up to almost $13,900 in just a couple of days.

The price of the cryptocurrency shot up around 30 percent in just two days at that time as investors moved money back into bitcoin from Tether, a stablecoin. But the rally didn’t last for long as the price plunged to almost $9,100 toward mid-July. This was a pullback of nearly 30 percent, just as crypto trader Josh Rager had anticipated.

https://twitter.com/Josh_Rager/status/1131039202286755845

However, a 30 percent pullback in the bitcoin price is usually followed by a massive rally of around 150 percent.

https://twitter.com/Josh_Rager/status/1131668130995085312

Assuming that $9,100 was the bottom, the price could zoom to nearly $23,000 by the time the next bull cycle peaks. This makes Keiser’s $15,000 forecast look conservative, though the fact that he expects bitcoin to hit this mark this week is what makes his estimate a bit challenging to achieve.

But don’t be surprised if bitcoin actually ends the coming week at $15,000.

A breakout in the cards

Technical patterns suggest that a bitcoin breakout could happen sooner rather than later. As pointed out by CCN.com’s Kiril Nikolaev, bitcoin’s Bollinger bands are contracting and the daily trading range is getting narrower.

Nikolaev explains that the contraction of the bands, when combined with the formation of a falling wedge bullish continuation pattern, indicates that a surge in the bitcoin price could be in the cards. He goes on to add that bitcoin could hit $12,000 thanks to the falling wedge breakout pattern.

So technical analysis suggests that bitcoin is on track to shoot higher, but Keiser’s prediction is based on a different estimate.

His tweet suggests that people will start buying bitcoin thanks to flailing confidence levels in central banks and governments that control fiat money. His theory seems credible given that the price of bitcoin has been inching up over the past few days in light of the Federal Reserve’s interest rate cut.

The Fed has increased the supply of the U.S. dollar in order to achieve a lower interest rate. This has reduced the value of the dollar and is probably the reason why the price of bitcoin has been on the rise as investors hunt a safe-haven asset.

After all, the supply of bitcoin is limited, so it cannot be manipulated by some central bank. This is why Keiser’s ambitious claim should not be discounted.