Bitcoin Stock-to-Flow Model is Complete Nonsense, Rips Bloomberg Editor

Bitcoin to hit $100,000 two years from now at Christmas 2021? Don't believe it, warns Bloomberg's markets editor. | Source: Shutterstock

- Bloomberg Markets editor bashes the Bitcoin Stock-to-Flow model for allegedly mispredicting the cryptocurrency price.

- Joe Weisenthal says scarcity is not an influential factor in pricing bitcoin in the future.

- People only need to bid up the price of existing bitcoin to make it more expensive, he argues.

A price forecasting model that predicts bitcoin at a $100,00 valuation by Christmas 2021 is complete nonsense, according to Joe Weisenthal.

The Bloomberg Markets editor questioned the much-celebrated Stock-to-Flow (S2F) model for measuring an asset’s future pricing on the basis of its supply rate. He explained that people would naturally bid up bitcoin’s price should they decided to buy the cryptocurrency, adding that “there is no need for more coins at all.”

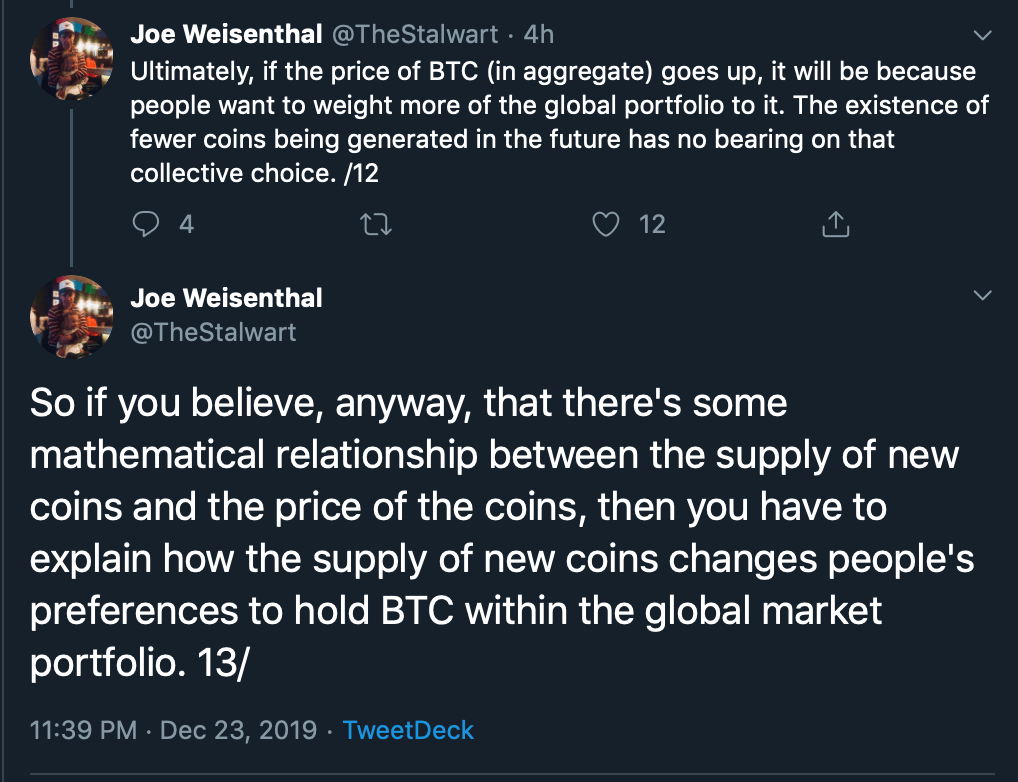

Mr. Weisenthal tweeted :

Let’s suppose society wanted to hold a lot more BTC. Maybe $268 billion […] All people need to do is bid up the price of Bitcoin until it doubles. Then voila. Society’s desire to hold $268 billion of BTC would be satisfied. The math is simple. [The] society holds what it wants.

Dollar-Denominated Portfolios

Bitcoin is not a base asset to measure global portfolios; the US dollar is. So it is more likely for investors to denominate their cryptocurrency holdings in dollars.

Mr. Weisenthal said the price of bitcoin would rise only because people want to weight more of the global portfolio to it.

For instance, the market prices gold based on its relationship with the dollar. An investor who wants to migrate a portion of its gold portfolio to bitcoin does it within the context of its overall investment portfolio; the number of bitcoin he buys does not matter to him.

Bitcoin Scarcity ≠ More Valuable

Unlike Mr. Weisenthal, the S2F model believers tend to compare bitcoin with non-consumable commodity assets like Gold and Silver.

Economist Saifedean Ammous writes in his book ‘The Bitcoin Standard’ that “a low rate of supply for gold is the fundamental reason why it has maintained its monetary role throughout human history.”

Ammous adds that bitcoin’s production rate would become lesser than that of Gold by 2022.

The core argument then falls on whether or not bitcoin behaves like a scarce non-consumable commodity. Famous gold bull Peter Schiff thinks it does not. Excerpts from his May 2019 blog post:

Scarcity is not enough. There must also be a real value. The is also an infinite supply of cryptocurrencies. So they are not really scarce at all.

Alex Krüger, a renowned cryptocurrency market analyst, meanwhile targets the S2F model for its potential demand-side shocks. The argument is simple: What if nobody wants to hold bitcoin in the long-term?

Krüger said:

The Stock to Flow model is to bulls, what the Tether Manipulation paper is to bears. Both based on fancy looking statistical models (more so the latter). Both are flawed. Doubt whoever believes in these extremes will change their minds. The mind believes what it wants to believe.

But the concerns over S2F’s accuracy has not deterred bulls. The model remains 99.6 percent accurate to this date when it comes to predicting bitcoin’s price.