Bitcoin Startup Ideas Soaring in Spite of Bitcoin Price

The saying “Bitcoin resembles the Internet during the 90s” is not just a platitude evangelized by our community. For some, it’s nostalgia. For those familiar with the mistake, trying to explain the Internet 20 years ago is similar to explaining Bitcoin today. As Andreas Antonopolous has pointed out in his presentations, even email used to be a nightmare to explain.

The saying “Bitcoin resembles the Internet during the 90s” is not just a platitude evangelized by our community. For some, it’s nostalgia. For those familiar with the mistake, trying to explain the Internet 20 years ago is similar to explaining Bitcoin today. As Andreas Antonopolous has pointed out in his presentations, even email used to be a nightmare to explain.

Of course, I don’t remember anyone claiming that the text-based, multi-user dungeon Legend of the Red Dragon would foreshadow a $5 billion gaming industry in North America. There weren’t newspaper articles (because people still paid for those) heralding the great paradigm shift as we began the journey from industrial to digital. Those articles thought the biggest appeal of the Internet was shopping from home in your pajamas.

The point that it took serious brain power and effort to build the Internet was not even an aside. The marvelous tools and technology that work behind the scenes that powers the Internet got to stay behind the curtain. Mostly, no one cared about the Internet, and they still don’t. The consumer cares about apps, social networks, and buying underwear at 3AM.

The message that Bitcoin can do for money and banking what the Internet has done for communication is powerful but outside of technology circles it’s meaningless. The rise of the Internet/Software shows that people only care about effect. All that disruptive technology is nice but what does it do for me right now? I have to click how many times? Single or double? What do I type? Why do I have to type that again? Can’t I just type it once? This thing is broken. I didn’t do anything I just came over, and it was like this. Does this mean my bitcoins are gone?

It’s part of the role of Venture Capital to sift through candidates and find the folks who are going to grow the technology horizontally and vertically. Think of vertical and horizontal integration as propagation. When US Steel bought the mines, shipping trucks, storage units, and refineries for their steel it was Vertical Integration. When they developed those businesses in each of those markets, they became more horizontally integrated.

Bitcoin integration is low. Just like when the Internet offered bulletin boards and text-based games. The Internet reached new markets, integrated vertically, because there were entrepreneurs who recognized problems and found new, better ways to solve them with the Internet. Text-based games grew to simulate immersive virtual realities with applications in healthcare, and military training.

All because some entrepreneurs said it could be done and went out and started building something. Bitcoin is like a tiny ball of super dense potential waiting for the right hands to mold it. Venture capitalists get involved later after the person has proven the idea. This stage of growth called the Startup.

Also read: 10 Bitcoin Jobs at Growing Startups

Bitcoin Startup Ideas

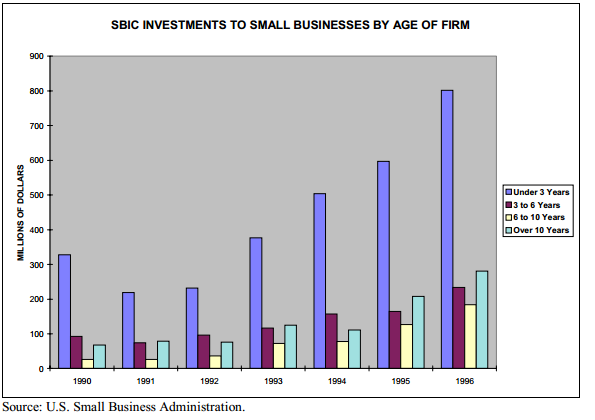

In 2013, there was more capital than entrepreneurs. While waving money around tends to attract attention. The U.S. Small Business Administration Office of Advocacy had this to say in a 1997 report, Trends in Venture Capital Funding in the 1990s.

“From 1991 to 1995, venture-capital-backed companies enjoyed revenue growth of approximately 38 percent. Because the average start-up company does not generate significant revenues in the early years of development, it spends its venture capital equity on equipment, inventory, and other necessary assets for growth.

Venture capital helps to accelerate growth in four key areas: research and development; job creation; export sales generation; and plant, property, and equipment. The ability to place venture capital investments in these areas in the critical years of a company’s development enables fast growth that leads to future financial success.”

Now, don’t let the numbers fool you too much. There’s more:

“From 1981 to 1985, the average amount of venture capital funds needed for a company’s first five start-up years was $7 million. From 1988 to 1992, the average amount needed was $19.1 million, a 173 percent increase. Today (1997 – Author’s note)a company needs an average of $16 million in venture capital during the first five start-up years, a 129 percent increase from 1985. 2/3 to 3/4 of a venture-capital-backed company’s total equity is supplied by venture funding.”

Bitcoin Startup Ideas to Watch

Which Bitcoin startup ideas have received the most money? The following is a list of companies chosen by venture capitalists to define what Bitcoin will look like in five and ten years.

The following are the top ten Bitcoin startups based on venture capital funds received

Bitcoin Startup Ideas have received around $400 million in venture capital so far. For perspective, in 1996 software was tied with telecommunications at $1.6 billion and had 486 deals.

What’s next? What’s Bitcoin’s Killer App? Comment below

Images from CBInsights.com, https://norcalsbdc.org/, and Shutterstock.