Bitcoin Scammers Take Advantage of Already-Dismal Square Earnings

Jack Dorsey already has to battle with crypto giveaway scams at Twitter. Now the scammers are going after Square's bitcoin users, too. | Source: AP Photo / Richard Drew

Just when Jack Dorsey’s week was starting to look up, he must contend with yet another cryptocurrency giveaway scam. But while Twitter has long been rife with these fraudulent schemes, this particular bitcoin scam targets his other company – digital payments firm Square.

Square Earnings Attract Bitcoin Giveaway Scammers

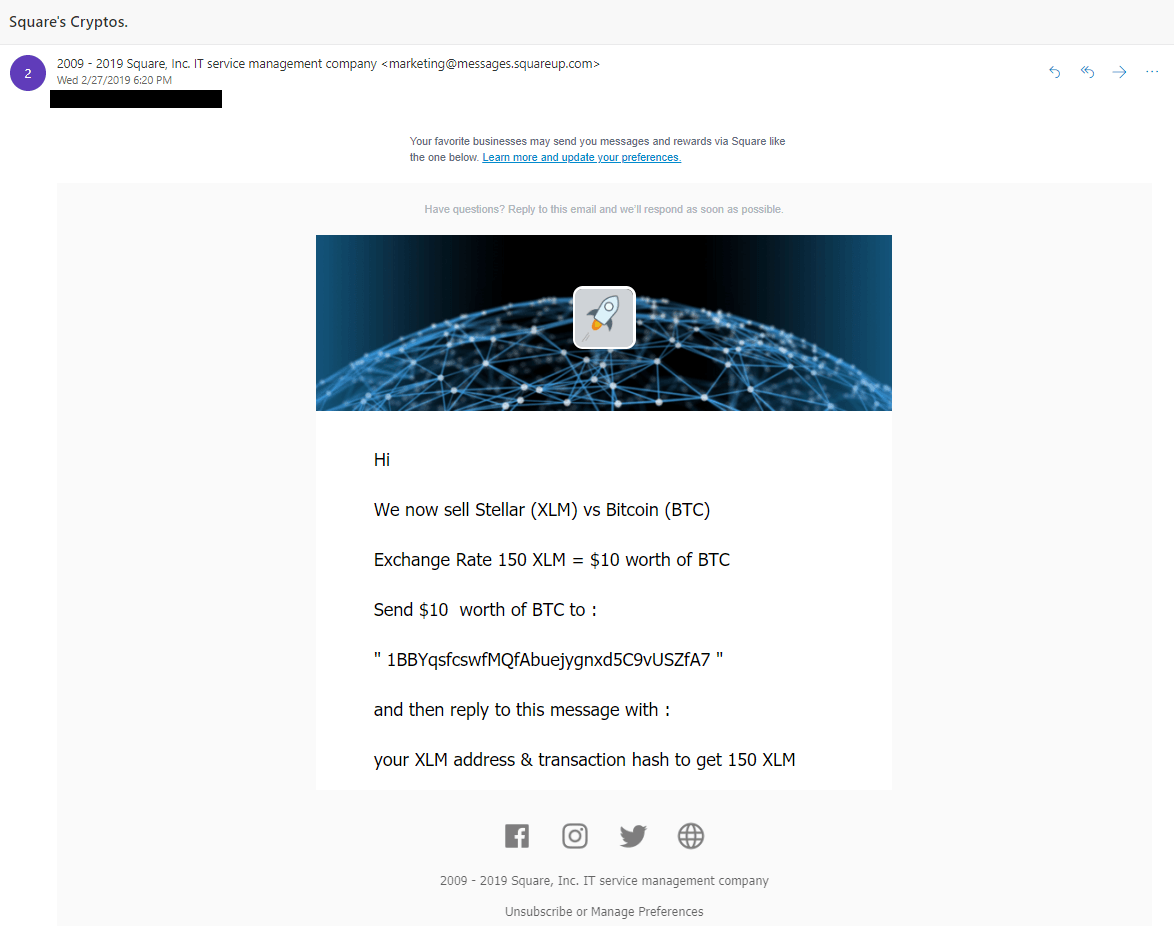

In tandem with Square’s earnings results on Wednesday, scammers began sending emails – purportedly from the company – announcing that they had added support for the stellar (XLM) cryptocurrency.

That is false.

The email further asks users to send $10 worth of bitcoin to a certain address in exchange for 350 XLM, currently worth around $30. Thankfully, the address had not received any payments since the email’s distribution – at least as of the time of writing on Thursday.

The company has warned in the past about fraudulent emails similar to this. The scammers haven’t limited their schemes to individuals, either. They’ve have also targeted small businesses where Square is used to process payments.

Such schemes became so prolific that they garnered the attention of the U.S. Better Business Bureau (BBB). It found that scammers are taking advantage of the popularity of Square’s services by sending phishing emails that appear to be official correspondence.

Bitcoin Scam Worsens Sour Square Earnings

The latest crypto giveaway scam in Jack Dorsey’s side added to an already-disappointing earnings season for Square.

Ahead of Wednesday’s earnings report, Square released a letter to its shareholders. In it, officials boasted about the company’s gains.

“We accelerated top-line growth at significant scale in the fourth quarter of 2017. Total net revenue was $616 million, up 36% year over year, and Adjusted Revenue was $283 million, up 47% year over year. This is an increase from the third quarter of 2017, when total net revenue and Adjusted Revenue grew 33% and 45%, respectively, year over year.”

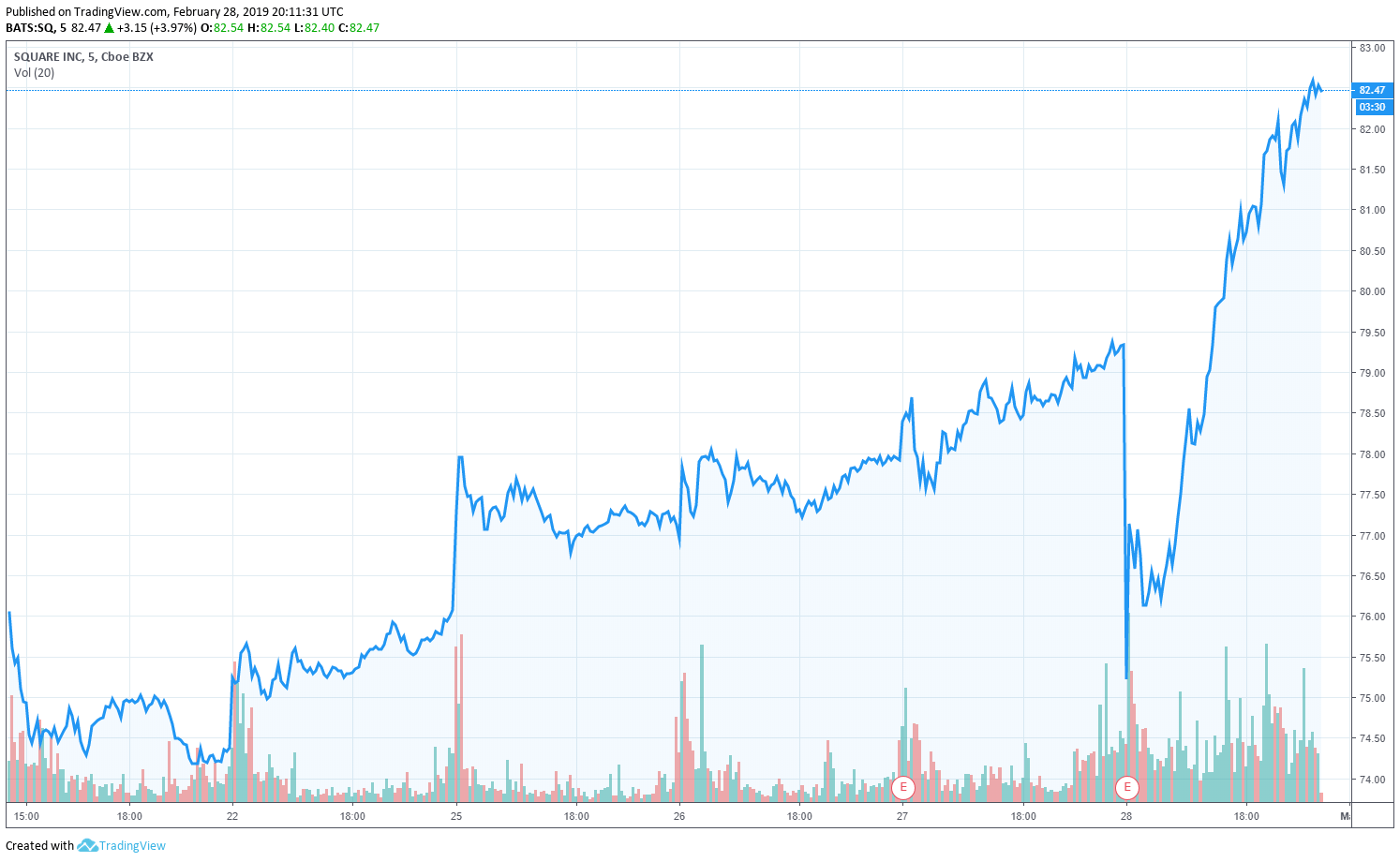

That’s all fine and good, but it wasn’t enough for investors to do away their concerns about the company’s future. The company’s guidance for the first quarter of 2019 didn’t sit well with investors, who initiated a minor sell-off only to drive the stock higher on Thursday.

BTIG analyst Mark Palmer said that Square had reported higher-than-expected spending and weaker-than-expected Q1 and FY2019 outlook, which led him to reiterate his sell rating on the stock.

“While Square’s guidance for 1Q19 and FY19 revenue was in line with Street expectations – the midpoint of its FY19 revenue guidance would represent year-over-year growth of 41%, consistent with the soft guidance that management had provided in November – its lower than-expected bottom-line forecast was due to an increase in spending on newer services outside of its core payment-processing business.”

Square’s Bitcoin Revenue is Climbing

There were few comments from Square executives about cryptocurrencies during the earnings call. Nevertheless, the firm did see revenues from Cash App-based bitcoin trading rise in Q4.

With prodding from bitcoin bull Jack Dorsey, the company has managed to grow its nascent bitcoin service to $166 million in annual revenue.

While that figure represents a small drop in the bucket for the $33 billion company, it also positions the processor to be a market leader in the event of broader bitcoin and cryptocurrency adoption.

Dorsey, who has been outspoken in his support for bitcoin, has been one of the most high-profile tech industry figures to overlap into the world of cryptocurrency.

He’s even said that bitcoin could become the world’s leading currency within 10 years.