Bitcoin Pushing through Resistance

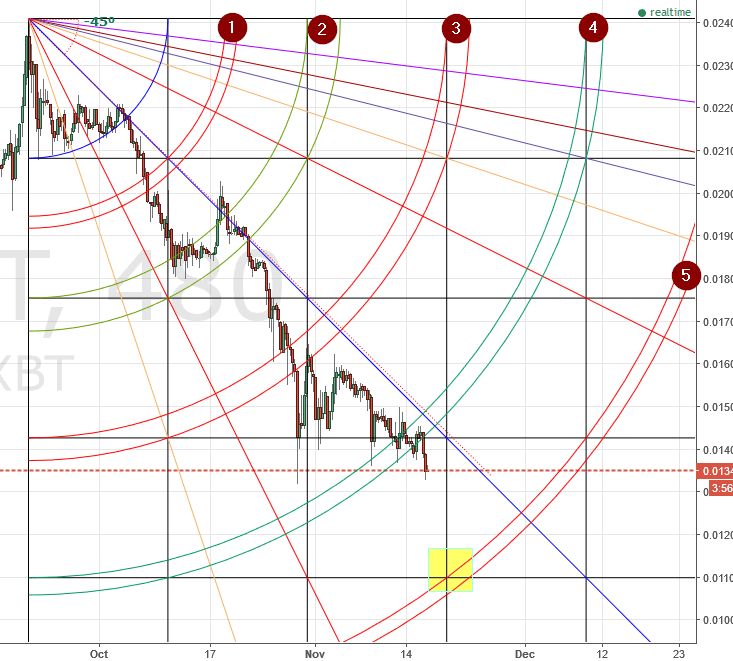

Ethereum has not yet broken through arc resistance – it just can’t seem to get out of the arc pair, which keeps pulling it down. So unsurprisingly, ethxbt has fallen through 5th square support of the setup I was using. This means my setup was too small. Taking the setup to the next larger size yields this picture of the 8-hour chart:

The drop through support, and consequest re-sizing of my setup strongly suggests that contrary to my thinking 12 hours go, it is Bitcoin which will out-perform ethereum for the foreseeable future.

The drop through support, and consequest re-sizing of my setup strongly suggests that contrary to my thinking 12 hours go, it is Bitcoin which will out-perform ethereum for the foreseeable future.

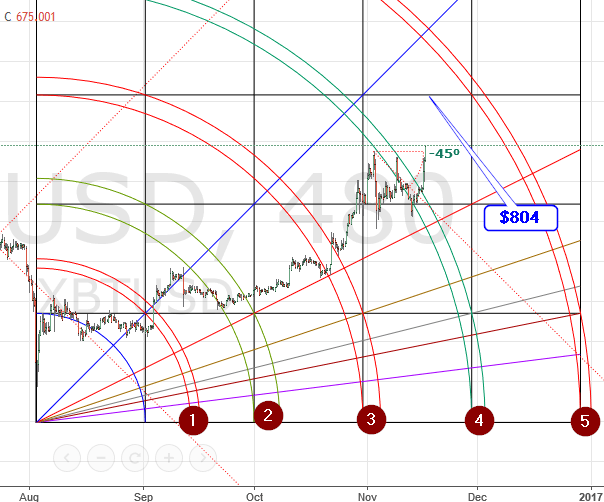

As of this writing it appears that Bitcoin is going to take out the recent $750 high, so it will likely go to at least the 2nd arc of the pair at ~ $790 before it slows. When/if it gets through that arc, there will be a buy signal on the daily chart. (Note that $790 is just above the recent high of $780 in June.)

Resistance is seen on the 8-hour chart, at the top of the square, which is in the same area, though a bit higher:

However, the 5th arc is a more likely target, I suspect. The 5th arc suggests strong resistance ~ $850. (We can move the 3rd pivot along the arc, until we find a place where the geometry of the pitchfork “fits nicely”.) See below:

However, the 5th arc is a more likely target, I suspect. The 5th arc suggests strong resistance ~ $850. (We can move the 3rd pivot along the arc, until we find a place where the geometry of the pitchfork “fits nicely”.) See below:

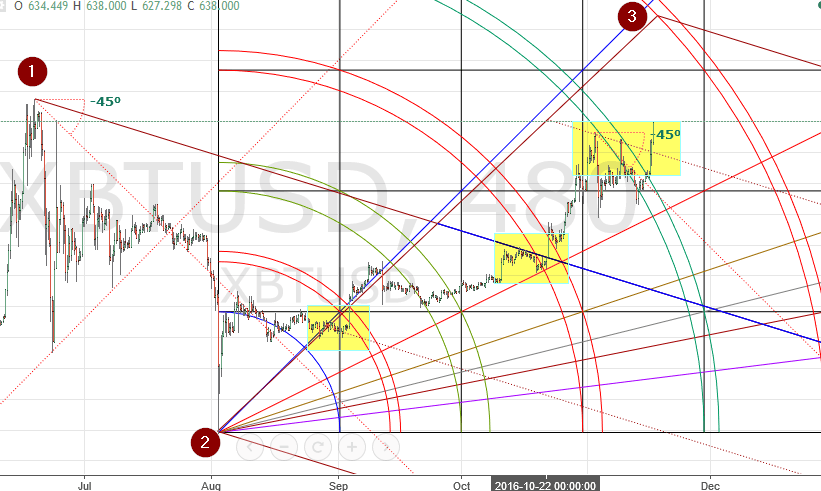

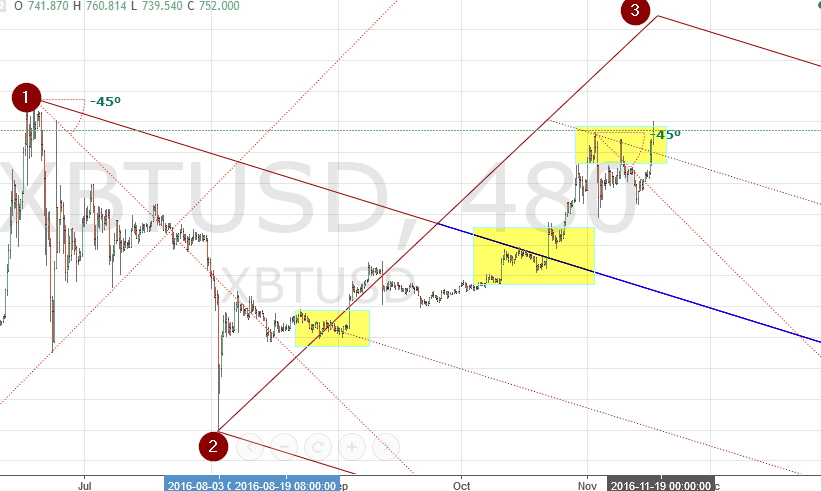

With the 3rd point of the pitchfork at point “3”, the 0 line of the fork, and both the 50% lines (all highlighted in yellow) fall upon now-obvious lines of resistance. It could be a coincidence, but maybe not. To make this confusing picture easier to see, I will hide the gann setup:

With the 3rd point of the pitchfork at point “3”, the 0 line of the fork, and both the 50% lines (all highlighted in yellow) fall upon now-obvious lines of resistance. It could be a coincidence, but maybe not. To make this confusing picture easier to see, I will hide the gann setup:

I think you can see what I am alluding to now. This does not mean price will necessarily go to point 3 of course. It does however suggest that if one is long that might be a great place to take money off the table if it does go there.

I think you can see what I am alluding to now. This does not mean price will necessarily go to point 3 of course. It does however suggest that if one is long that might be a great place to take money off the table if it does go there.

For the more esoteric-minded amongst you, consider this… If that point labelled here as “3” is touched and the market reverses there, it would suggest the market already knew, way back at the highlighted areas, that point 3 would be a pivot. Let’s see if that happens or not. If it does, we can discuss that further.

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.

Image from Shutterstock.