Bitcoin Price: Why the Nasdaq Dotcom Bubble Suggests BTC Will Surge 200%

The Nasdaq's breakneck recovery following the dotcom bubble could Source: Shutterstock

The Nasdaq, which plunged in value following both the dotcom bubble and financial crisis, more than doubled in value in the following five years of post-bubble recovery. Like the Nasdaq, bitcoin could recover rapidly in the medium-term, analysis suggests.

With the 200-day moving average of bitcoin reversing its trend for the first time in 16 months and various technical indicators demonstrating a positive near-term trend for the asset, many industry executives and investment firms like Pantera Capital believe bitcoin has bottomed out.

If $3,122 Was the Bottom, Bitcoin is En Route to a Strong Recovery

As suggested by Bloomberg’s emerging markets analyst Michael Patterson, if bitcoin found its bottom at $3,122 in December 2018, the dominant cryptocurrency may be en route to a strong upside price movement in the years to come.

“If Bitcoin has in fact bottomed out, history suggests there could be further upside. The Nasdaq more than doubled in the five years after its post-bubble low and has since reached record highs that are well above its peak during dot-com mania,” Patterson wrote .”

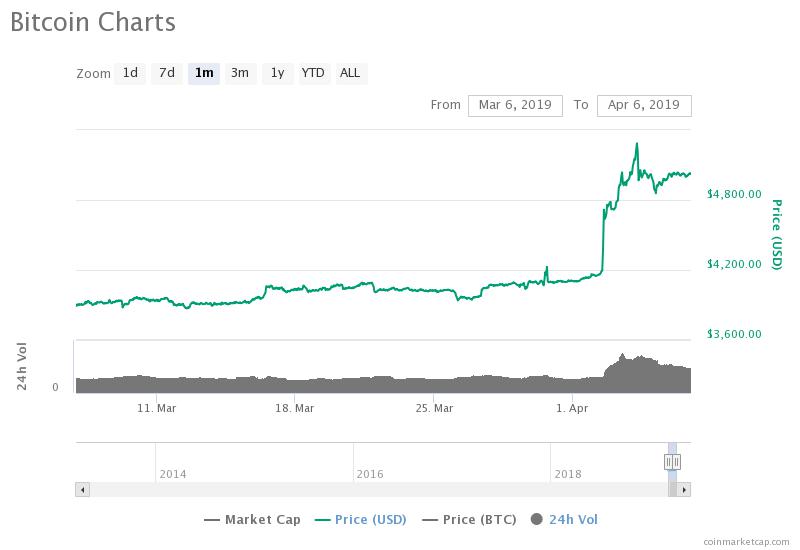

Since hitting its 12-month low, the bitcoin price has rebounded to $5,000, recording a staggering 60 percent increase in value within less than four months.

Previously, former International Monetary Fund (IMF) economist Mark Dow said that bitcoin investors should head for the exits if the asset fails to recover to the $5,000 to $6,000 region, as it would lead the asset vulnerable to a potentially large downside movement.

What Makes Analysts Confident Bitcoin Found its Bottom?

Earlier this week, economist and global markets analyst Alex Krüger said that whether bitcoin has reached its bottom at $3,122 or not is not up for debate.

Purely based on technical indicators and data, Krüger emphasized that when the bitcoin price crossed $4,200, it broke out of its 16-month bear trend.

He said:

“The crypto bear market has been over for three months now. BTC breaking above $4,200 will mark the end of the bear trend that started in January 2018. Going to miss this big fellow.”

“This is not a call. Not a matter of aging well or not. A break above 4200 technically ends the bear trend that started Jan 2018. Facts don’t care about opinions. If strong selling resumes later on, that would represent a different trend.”

Moreover, fundamental analysts have said that there exist billions of dollars waiting on the sidelines in the cryptocurrency market to be allocated to crypto assets in the future.

The caution of strategists in the financial sector is that in the 1990s when Japan’s Nikkei plunged during an intense correction, it struggled to recover until 2009.

However, it is difficult to compare the price trend of bitcoin and major stock markets because of contrasting environments.

As seen in previous bull runs of the cryptocurrency market, cryptocurrencies tend to move in cycles. When the market is on an upside trend, parabolic movements are often spotted. When the market initiates a downward movement, it often suffers intensified volatility.

Bitcoin Moves in Short Time Frames

Thomas Lee, the head of research at Fundstrat Global Advisors, said that bitcoin tends to record its biggest gains in a 10-day time frame of every year.

As such, the way bitcoin and the rest of the cryptocurrency market behave in terms of short-term price movement is drastically different than how major markets such as the stock market of Japan moves.

Industry executives remain confident that bitcoin has established its bottom because of the level of activity in the cryptocurrency and blockchain industry across all leading markets including the U.S., Japan, and South Korea.