Bitcoin Price Teeters on Brink of Brutal ‘Panic-Driven’ Crash

Analysts warn that the bitcoin price risks a major sell-off within the near future. | Source: Shutterstock

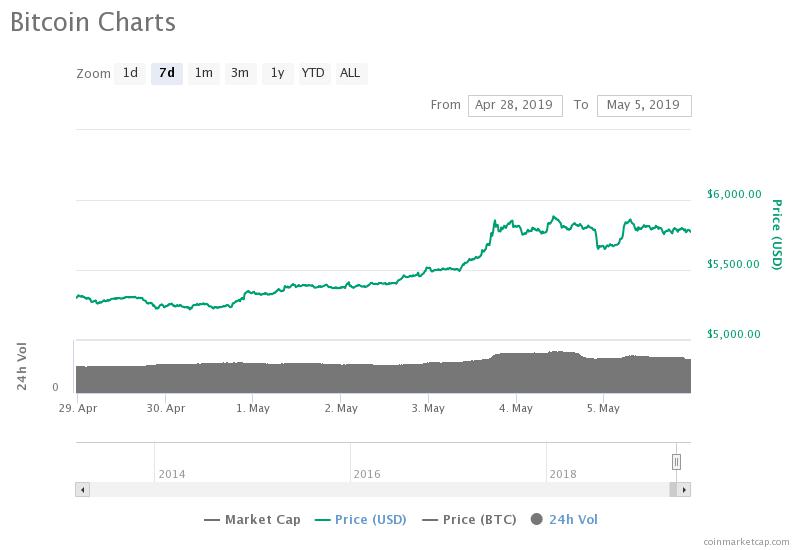

By CCN.com: According to prominent technical analysts including Peter Brandt and DonAlt, the bitcoin price is facing strong resistance at around $6,000 and is vulnerable to a correction in the short-term.

“Just an opinion — there is a chance BTC is topping here, having met its price target at key resistance. A correction could occur before another move toward 6500, then a more significant correction,” Brandt said .

Brandt’s forecast comes after the bitcoin price has surged by 10 percent within the past week against the U.S. dollar, demonstrating strong momentum.

But, over the medium to long term, technical analysts remain fairly positive about the price trend of bitcoin and only expect temporary corrections to occur in the near-term.

Bitcoin Exchange Scandal Encourages Traders to Proceed With Caution

Based on the data provided by OnChainFX, the “real 10” daily volume of bitcoin, which calculates the legitimate spot volume of the dominant crypto asset using the methodology of Bitwise Asset Management, is at around $435 million.

In early March, Bitwise reported that the real daily volume of bitcoin taken from exchanges with at least $1 million in verifiable daily volumes such as Kraken, Binance, and Bitfinex was around $270 million.

“When you remove fake volume, the real BTC volume is quite healthy given its market cap. Gold’s market cap is ~$7 trillion with a spot volume of ~$37 billion implying a 0.53% daily turnover. Bitcoin’s $70 billion market cap would imply a 0.39% daily turnover, very much in-line with that of gold,” the Bitwise team said.

The daily volume of bitcoin is up nearly two-fold in the past 30 days, indicating a noticeable increase in demand for and interest in bitcoin.

However, as suggested by DonAlt, a crypto technical analyst, the Bitfinex scandal could become a threat to the short-term performance of bitcoin, especially if the premium on Bitfinex rises.

On April 25, the office of New York Attorney General Letitia James filed a lawsuit against iFinex, a company that oversees Tether and Bitfinex, alleging Bitfinex of mismanaging $900 million of Tether’s cash reserves to “cover-up” an $850 million loss.

“Our investigation has determined that the operators of the ‘Bitfinex’ trading platform, who also control the ‘tether’ virtual currency, have engaged in a cover-up to hide the apparent loss of $850 million dollars of co-mingled client and corporate funds,” Attorney General James said .

After the filing of the lawsuit, the premium of bitcoin on Bitfinex rose by around $300 to $400, which indicates that Tether holders are selling the stablecoin amidst the recent controversy to buy bitcoin at a higher rate than the spot price.

DonAlt said that this trend is not sustainable and if the premium of bitcoin on Bitfinex remains unreasonably high over the upcoming weeks, it may cause the market to crash.

But, the analyst said that a crash is likely to be avoided if Bitfinex does complete its $1 billion offering, as proposed by its billionaire shareholder Dong Zhao.

“What this does is decrease the risk of a panic-driven short squeeze off of Bitfinex which would’ve led to a huge drop in my opinion. That said the premium still needs to go. As stated in [my first tweet], the most likely way for that to happen, in my opinion, is still a dump,” the analyst said.

Major Crypto Assets Record Large Gains – for Now

As bitcoin demonstrated stability in the $5,700 to $5,800 range, major crypto assets such as bitcoin cash (BCH) recorded fairly large gains against the U.S. dollar, with BCH rising 5.3 percent on the day,