Bitcoin Price Stable Following SegWit Activation

The Segregated Witness (SegWit) soft fork activated last night, initiating significant changes to the bitcoin protocol. The bitcoin price experienced a slight uptick following the SegWit deployment, stabilizing its single-day performance. The wider markets saw a minor pullback from Wednesday’s record $154 billion, but several altcoins–including litecoin, managed to press forward.

For most of August 23, the crypto market cap hovered between $150 billion and $155 billion. However, Wednesday evening it dipped to $148 billion. It recovered early Thursday morning, and the total value of all cryptocurrencies currently sits at $151.8 billion.

Bitcoin Price Stable Following SegWit Activation

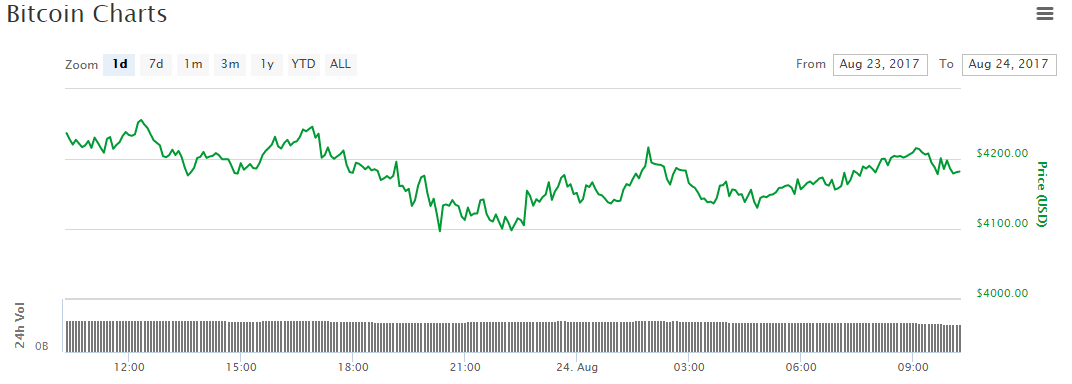

The bitcoin price did not see an immediate bump upon SegWit activation, but it did more or less retain its midweek rally. For the day, the bitcoin price declined a bit less than 1% and currently rests at $4,181. This gives bitcoin a market cap of $69 billion.

Many analysts anticipate that SegWit will cause the bitcoin price to punch through $5,000 by the end of the year, while stock researcher Ronnie Moas forecasts it could rise as far as $7,500. However, the future of the bitcoin price will depend on how the community grapples with the increasingly-heated debates over the November SegWit2x hard fork.

Ethereum Price Holds at $320

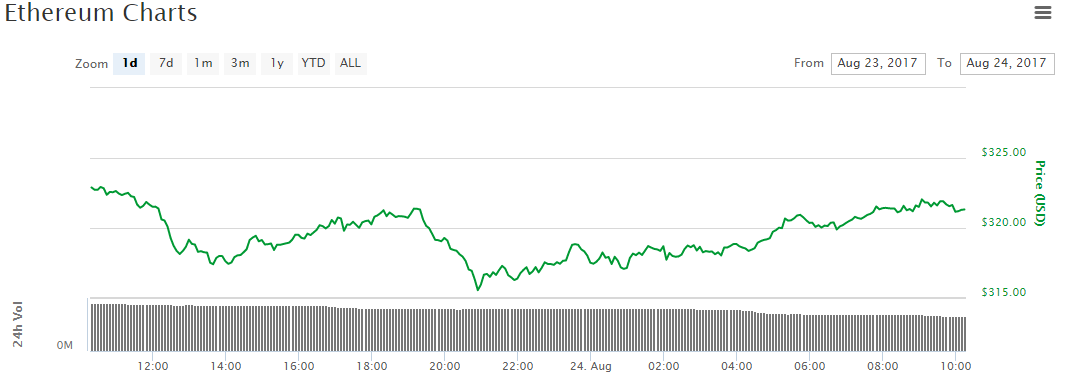

The ethereum price declined about one-half of a percent on Thursday, holding above $320 as the Metropolis hard fork approaches. At present, the ethereum price is $321, which results in a $30.2 billion market cap.

The Metropolis protocol upgrade is highly-anticipated among the community, and many expect the ethereum price to break above $350 as it nears.

Bitcoin Cash Price Spikes Near $700

The bitcoin cash price spiked as high as $697 Thursday morning, as another difficulty adjustment enabled BCH mining profitability to reach parity with the main bitcoin blockchain. Bitcoin cash is currently about 15% more profitable to mine than bitcoin, and the bitcoin cash hashrate has gradually increased since the adjustment.

However, the bitcoin cash price was unable to pierce $700, and it quickly fell back to the ~$660 level. At present, the bitcoin cash price is $657, representing a 24-hour decrease of a little more than 1%.

Bitcoin cash maintains a market cap of $10.9 billion to remain in 3rd place on the charts.

Ripple Price Falters; Litecoin Soars

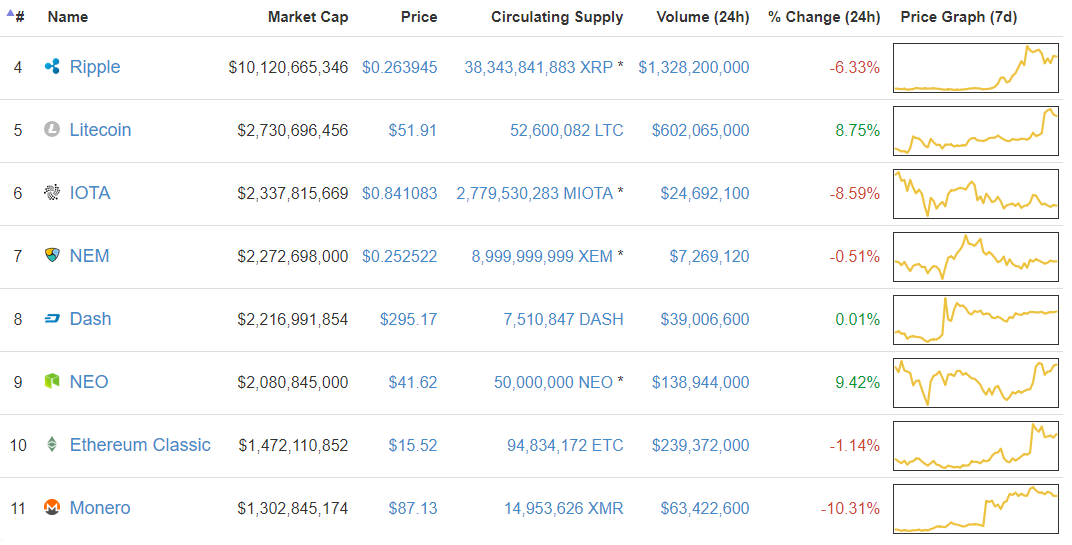

The altcoin markets were mixed on Thursday, although the majority of coins slid into the red. Leading the retreat was the Ripple price, which stumbled following a multi-day rally that returned single-day gains exceeding 50%.

The litecoin price swam against the current to become the only top 5 coin to experience positive movement. After a 9% rise, the litecoin price is now $52; this raised the LTC market cap to $2.7 billion.

Sixth-ranked IOTA, on the other hand, saw its price plunge by 8%. NEM and Dash held steady at their previous levels, while the NEO price broke out of its early week slump with a 9% rally to bring its market cap above $2 billion. This means that the top nine cryptocurrencies all have market caps exceeding that threshold.

The ethereum classic price declined about 1% to round out the top 10, and the markets dealt the Monero price a 10% blow after carrying it to an all-time high a few days ago.

Featured image from Shutterstock.