Bitcoin Price Skyrockets to $9,387: What’s Behind the New 2019 High?

Bitcoin price just went north to hit a 2019-high. | Source: Shutterstock

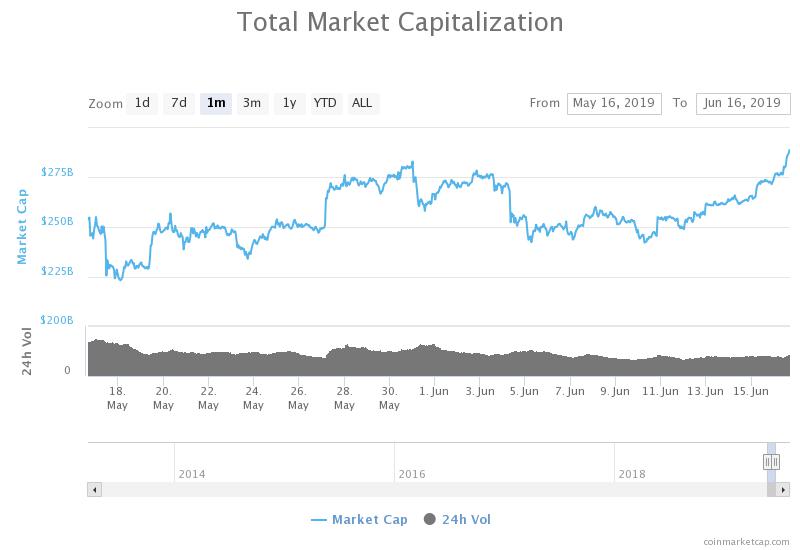

By CCN.com: The bitcoin price has surged by seven percent on the day, recording a 32 percent monthly gain and a 151 percent year-to-date gain against the U.S. dollar.

The strong upside movement of the dominant cryptocurrency has occurred in anticipation of the opening of the CME bitcoin futures market on Monday.

Factors behind the bitcoin price rally

Earlier this week, when the bitcoin price was hovering at around $8,100, the “real 10” volume of the asset was at around $600 million.

The real 10 volume of bitcoin refers to the verifiable volume of the asset based on the methodology presented by Bitwise Asset Management which found that only ten exchanges in the bitcoin market have a real daily volume of over $1 million with the exception of BitMEX.

As of June 16, the real 10 volume of bitcoin remains above $1.1 billion, up nearly two-fold within a seven-day span.

The contributing factors behind the rally of bitcoin are considered to be:

- The anticipation of the CME bitcoin futures market open

- Intensifying geopolitical risks as a result of the trade war

- A general improvement in the sentiment around the crypto market

- Facebook’s entrance into the crypto market with large-scale corporations as key partners

- Several important fundamental factors such as the upcoming halving of bitcoin in 2020

Placeholder VC general partner Chris Burniske suggested that investors may have panic sold experimental assets including bitcoin In late 2018 due to the uncertainty in the global macro landscape.

Burniske said :

In Dec 2018 BTC was maybe more affected by the global macro scare than people realized. In such a scare, people sell their most experimental assets, such as bitcoin and other cryptoassets (exacerbated by endogenous doubt).

But following the December 2018 global macro scare, central banks (including the US Fed) got dovish, injecting liquidy and assurance back into the markets. And so risk-appetite has increased, including for BTC. Furthermore, the US’s trade war with China, China’s tightening of capital controls to limit funds fleeing the country, and a weakening yuan all added fuel to BTC’s fire.

The sell-off led to a sudden decrease in the bitcoin price, dropping to as low as $3,150.

However, as the global equities market began to recover and the medium term trajectory of the global economy started to show signs of improvement despite the fallout of the U.S.-China trade deal, the appetite of investors towards the crypto market may have increased.

It may be far-fetching to claim that investors are rushing to buy bitcoin at the current phase of market development as a result of fears towards the slowdown of the global economy. But, in the long term, investors like Burniske foresee bitcoin evolving into an established safe-haven asset and a risk-off hedge.

“Then, when bitcoin nears the end of its growth stage and has matured into being a multi-trillion dollar macro asset that sits alongside gold, it will be predominantly used as a risk-off hedge against the whims of nation-states,” said Burniske.

Alternative cryptocurrencies also recovering

When Binance, the world’s largest crypto exchange by daily volume, first announced the closure of its services in the U.S. and the launch of a separate platform in the form of Binance.US to target the U.S. market, the value of many alternative cryptocurrencies dropped as investors feared for the decline in traders in the alternative cryptocurrency market.

Fueled by the recovery of bitcoin, in the past 24 hours, most alternative cryptocurrencies have recovered against the U.S. dollar but still remain down against bitcoin.

Click here for a real-time bitcoin price chart.