Bitcoin Price Shakes Off Wednesday Downturn; CFTC Primer Not a Factor

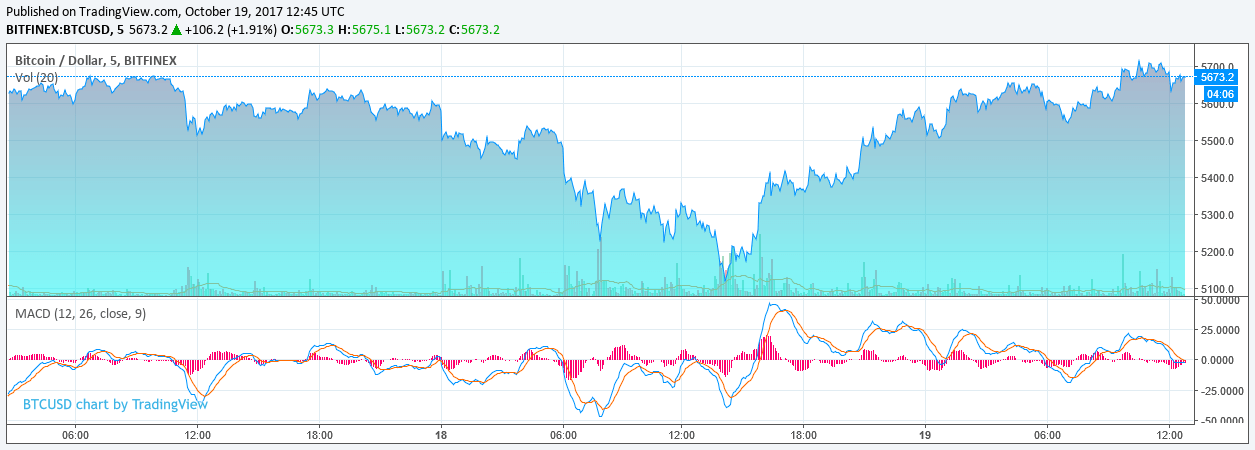

The bitcoin price stormed back to $5,700 on Thursday, shaking off the Wednesday downturn that pulled it as low as $5,114.

Bitcoin Price Recovers from Wednesday Dip

Many investors were surprised when the bitcoin price held above $5,500 after last week’s dramatic rally, which saw bitcoin surge by more than $1,200 in a four-day period. Some analysts even raised their year-end price targets in response to the record-setting advance. However, the crypto markets took a bearish turn on Wednesday, and the bitcoin price plunged by more than $500.

Luckily, that apparent turn actually proved to be more akin to a glance, as the bitcoin price began to scale the charts leading into Thursday morning. By 12:00 UTC, the global average bitcoin price had climbed as high as $5,701, and some exchanges priced it even higher.

As CCN.com pointed out in an earlier article, today’s recovery has been fueled by an upswell of trading on Japanese exchanges. At the time of writing, the Japanese markets accounted for nearly 38% of all bitcoin volume, while the U.S. dollar followed closely behind with 30% and the South Korean won comprised another 12%. Although Japanese cryptocurrency exchanges have a somewhat-troubled history, the government has recently begun issuing licenses to exchanges to help protect investors from falling prey to Mt. Gox-style incidents, and the country has emerged as a major player within the crypto ecosystem.

CFTC Primer Not a Factor

Several analysts had attributed yesterday’s bitcoin price decline to a virtual currency primer published by the U.S. Commodity Futures Trading Commission’s (CFTC) fintech hub. Specifically, they noted that the primer stated that cryptocurrencies and ICO tokens may fall under the “commodity” classification, making them subject to CFTC regulations. However, the CFTC has classified cryptocurrencies as commodities since 2015, so this is not new information.

The revelation that the CFTC considers some ICO tokens to be commodities provided traders and investors with increased insight into the commission’s stance on this fundraising mechanism, but if this was the trigger, the downturn should have had a much more outsized-impact on ethereum than it did.

If anything, the primer should bring some relief to investors. No one expects that U.S. regulators will stay on the sidelines forever, and it would create a hectic situation if regulatory agencies such as the CFTC and SEC adopted different stances on ICO markets. According to the primer, though, the CFTC does not see any conflict between its determination that some ICO tokens may be commodities, and the SEC’s ruling that some tokens are subject to securities laws. Perhaps most importantly, the CFTC suggested that, like the SEC, it will consider a token’s “particular facts and circumstances” when determining its classification, which is a far better policy than lumping all tokens under a single classification.

Consequently, the most likely scenario is that the market downturn was triggered by traders looking to cash out a portion of the profits they reaped during last week’s rally.

Featured image from Shutterstock.