Bitcoin’s Second Moon Landing is Nothing Like the First One: SFOX

The bitcoin price skyrocketed back across $10,000 on Thursday, reversing much of the cryptocurrency's recent plunge. | Source: Shutterstock

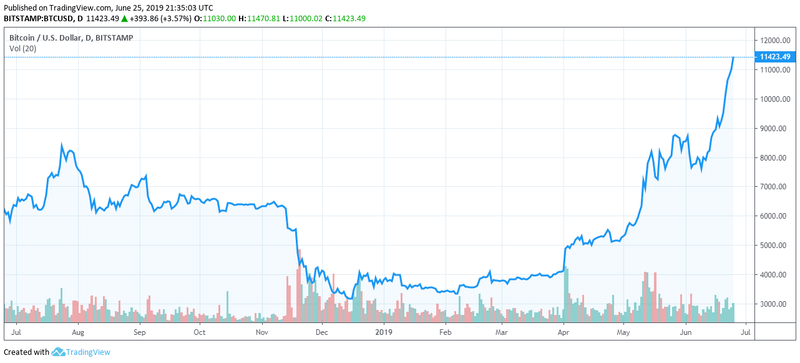

The growing consensus among crypto pundits and experts is that this Bitcoin bull run is decidedly different from the one that left so many wide-eyed retail investors who succumbed to FOMO in 2017 out in the cold just months later.

Why 2019 is Different Than 2017

For one thing, it appears retail FOMO has only begun in traces around the periphery.

For another, institutional interest plays a prominent driving force at present. This may or may not continue as the market fluctuates.

Whatever the case, this isn’t like before. Bitcoin only touched $11,000 for short increments before. It was as unexpected as it was short-lived: soon after that, the prices were pushing up and up.

As crypto prime dealer SFOX wrote in a recent blog :

“The relatively sustained increase in BTC’s price over the past couple of weeks has many crypto veterans and newcomers alike comparing the state of the market to the bull market of late 2017. But the full picture of the similarities and differences between BTC’s two $11,000+ moments illustrates how far crypto has come in a relatively short time — and where it still has opportunities to mature.”

Institutions are coming in waves.

Old-school tech companies are getting on board now. Companies like Uber are joining on with Facebook in their recent crypto push, Libra.

Everywhere you look, it’s blockchain this, token that.

These are the areas where the two bull runs have several similarities. Beyond them, however, there are important notes to take.

Major institutions have embraced blockchain. Some are going through Ripple. Others are going through Stellar and IBM. Walmart China just hopped on board the VeChain platform. Others are doing their own thing. Whatever they’re doing, they’re doing blockchain.

Massive money houses like Fidelity are bringing their customers to the market.

A New Wave of Bitcoin Hodlers?

These aren’t small, retail buys. These are massive, fund-sized buys.

In this case, the coins will be held.

Which means the coins actively trading and determining the price will be increasingly limited.

It doesn’t take a calculator to figure out what happens next. Supply and demand come into play. The market undergoes a steep rise as people are willing to pay more for less, and less becomes available.

The more people that wield the “buy and hodl” strategy, the higher the price can theoretically go. The only question that remains once it reaches certain historical levels is – where’s the liquidity? Is there cash available for a sizable amount of Bitcoin at that level?

The answer is often no, which leads to a cascading price fall. These periods can shake on for months.

SFOX believes that institutions are currently buying with the expectation, based on fundamentals, that a bull return soon is pretty inevitable. They write:

“In sum, while both the 2017 and 2019 crypto rallies were swift and no doubt influenced by trading psychology factors like FOMO, the data indicate that crypto is markedly more mature now than it was a year and a half ago — and that maturity may suggest that this rally is more fundamentals-driven than the last one was.”

Indeed, FOMO buying will be when Bitcoin’s seeing $1 trillion a day in retail purchases above $30,000. From the same people who wouldn’t buy at $3,000.

Click here for a real-time Bitcoin price (BTC/USD) chart.