Bitcoin Price Has Just a 5% Chance to Hit $10,000 in Next 6 Months

There's less than a 5 percent chance that the bitcoin price hits $10,000 by September, according to the options market. | Source: Shutterstock

The chances of the bitcoin price reaching five figures within the next six months are growing slimmer by the day. Based on the current value of BTC options, cryptocurrency analysis firm Skew Markets has disclosed that the odds of bitcoin exceeding the $10,000 mark by September are now just 4.6 percent.

Additionally, the probability of bitcoin reaching slightly lower price targets are not that great either. For instance, the probability of bitcoin reaching $8,000 by September is slightly under 10 percent.

The odds, however, more than double with regards to bitcoin reaching $6,000 by September, though that also means there’s an 80 percent chance bitcoin won’t hit that target.

Bitcoin Price Struggles to Clear $4,000

Currently, bitcoin is trading in the $3,950 – $4,000 range after having briefly broken the $4,000 resistance level over the weekend.

The cryptocurrency’s breaking of the resistance level came amidst rising volumes. This month saw five days record daily volumes of more than $10 billion according to analyst Kevin Rooke:

“Bitcoin’s daily exchange volume is booming. Volume has increased by ~150% in the last 5 months. Average daily volume hasn’t been this high since Jan 2018. Only 9 days in the last 12 months had $10B+ in volume. 5 of those days have been in March 2019.”

https://twitter.com/kerooke/status/1106974342175297536

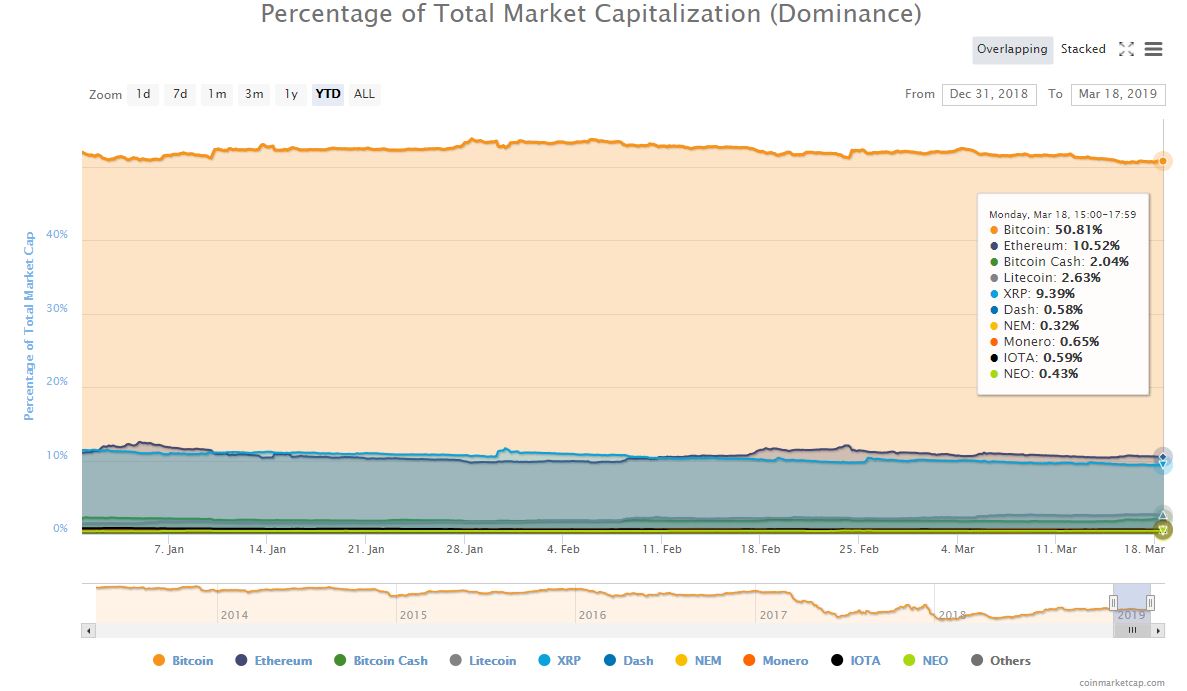

Bitcoin Dominance Falls as Altcoins Regain Allure

Interestingly, it also comes at a time when bitcoin’s dominance in the market is falling. According to CoinMarketCap, the dominance of bitcoin is now 50.8 percent. For most of the past year and a significant part of this year so far this figure was over 53 percent.

Given the bearish conditions which have prevailed in the cryptocurrency markets for over a year now, the low odds of bitcoin suddenly recovering to late 2017 prices are understandable. This has, however, not prevented renowned crypto bulls from making bold predictions.

Fundstrat’s Tom Lee, for instance, recently suggested that bitcoin’s fair price should be between $15,000 and $20,000.

Bitcoin Will Go to $250,000 by Gobbling Fiat’s Market Share: Tim Draper

https://youtube.com/watch?v=_B-8r8fhHHY

A few months ago, another notable bitcoin bull – Tim Draper – also reaffirmed an earlier prediction that the cryptocurrency would go to $250,000 by 2022. According to Draper, this would be achieved by cryptocurrencies eating into traditional money’s market share, per Fortune :

“Because there is $86 trillion worth of [fiat] currency out there in the world. We’re talking about getting to about 5% market share to get to $250,000 [per Bitcoin], and that seems like a drop in the bucket. And all we need to really do is make it so Bitcoin can be used to buy Starbucks coffee, and all of a sudden the world just opens up.”

Earlier this year, Draper predicted that cryptocurrency adoption is set to grow rapidly with everyday retailers such as Starbucks accepting them.

Chinese billionaire and over-the-counter bitcoin trader Zhao Dong has also been one of the prominent bulls. He expects the cryptocurrency to reach $50,000 by 2021.

Short-term Risks Still Remain

While only time will prove the medium-term to long-term predictions either wrong or accurate, in the short term, however, some analysts have warned that there are risks to the downside. This includes Mike McGlone, a Bloomberg Intelligence analyst:

“The entire industry is ripe to resume a path to lower prices. Conditions are akin to November, just prior to the collapse. Prices are consolidating within narrowing ranges, with a few sharp bear-market rallies that appear fleeting.”