Bitcoin Price Escaped Bear Market 3 Months Ago: Analyst

A key bitcoin metric just surged to its highest level since December 2017 when the bitcoin price traded near its all-time high at $20,000. | Source: Shutterstock

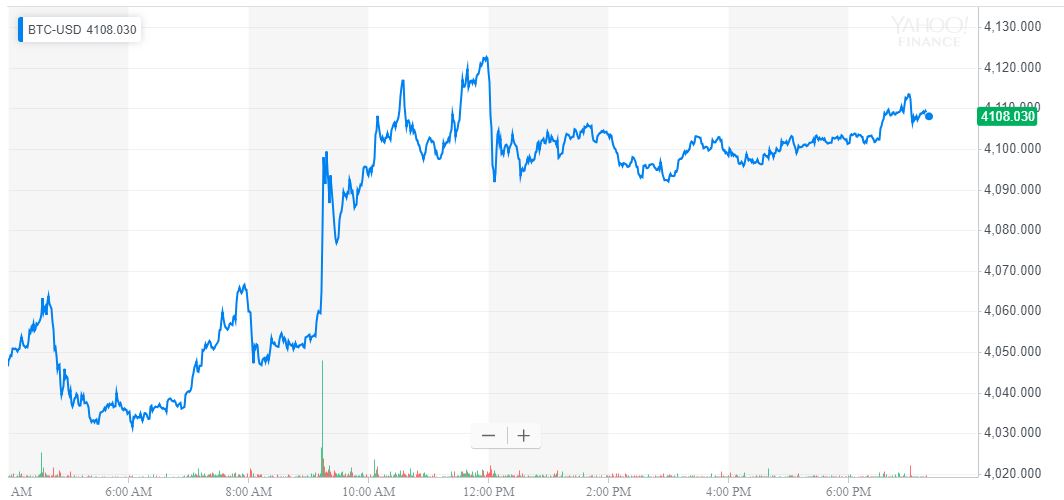

By CCN.com: After a long and bitter winter, the crypto thaw has arrived and bears have lost their grip on the market. One economist says the bears were sent packing into hibernation as many as three months ago from a technical standpoint, though you wouldn’t know it from March’s narrow bitcoin trading range.

Alex Kruger: Bitcoin Has Vanquished Bear Market – That’s a Fact

Believe it or not, with the bitcoin price hovering near $4,100, the bulls have finally wrestled back control. Investors failed to commemorate the occasion with a party, which could just be a symptom of frostbite from the prolonged winter.

Economist and trader Alex Kruger tweeted the official end of the bear market, saying:

“BTC breaking above $4,200 will mark the end of the bear trend that started in January 2018. Going to miss this big fellow.”

He was quick to clarify that his announcement isn’t a prediction, saying:

“This is not a call. Not a matter of aging well or not. A break above $4,200 technically ends the bear trend that started January 2018. Facts don’t care about opinions.”

That said, if he had to issue a forecast, he could see a:

“strong run above $4,200 (say to $5,000), crash back to $4,000 or upper $3,000s, then chop, then bull trend resumption.”

For now, the bitcoin price is up nearly 7% year-to-date, which compared to last year’s first quarter in which it was sliced in half isn’t bad.

Based on the trader’s analysis, $4,200 is a key level that once surpassed could lead to a fast-moving breakout. The possibility of a crash still exists but that doesn’t cancel out the fact that the bitcoin price is in bullish territory for now.

Tom Lee: Crypto Market Seeing Major Tailwinds

It’s not just the traders saying so. Fundstrat’s Tom Lee is similarly sanguine, saying that the macro headwinds of 2018 have turned into tailwinds in 2019. Lee was responding to a tweet by Brendan Bernstein, who has nearly 15,000 Twitter followers. Bernstein described a perfect storm for bitcoin, one in which events ranging from democratic socialism to the 2020 election to BTC halving in 2020 translate to him being more bullish than ever.