Newsflash: Bitcoin Price Crashes Below $11,000 to Cap 20% Plunge

The bitcoin price crashed below $11,000 on Thursday. It has lost more than $3,000 - or 20% - since peaking near $14,000 less than 24 hours ago. | Source: Shutterstock

The bitcoin price crashed below the $11,000 mark on Thursday, extending the vicious sell-off that began the previous day.

Bitcoin Price Careens Down to $10,800

A suddenly-heavy BTC had struggled to defend the $12,000 mark for much of the morning, and around 12:00 pm ET traders capitulated to the stifling downward pressure.

In just 25 minutes, the bitcoin price careened from $11,751 all the way down to $10,800 on Bitstamp, setting a new intraday low and putting the flagship cryptocurrency dangerously close to the psychologically-significant $10,000 level.

BTC Has Crashed More Than $3,000 in Less Than 24 Hours

The 8% slide added to yesterday’s mid-day bloodbath, which served as a painful reminder that parabolic price rallies are often followed by sell-offs that are equally as swift.

On Wednesday, a red-hot BTC soared as high as $13,880, leading bulls to hike their year-end price targets and proclaim that the market would reach a new all-time high sooner rather than later.

Mati Greenspan, a senior market analyst at eToro, had warned euphoric investors to prepare themselves for a 20% bitcoin price crash, the inevitable result of the market’s feverish rally.

Little could he have known how quickly that sell-off would materialize. Just hours later, BTC plunged more than $1,500 in a matter of minutes, and the frenzy proved too much for major crypto exchange Coinbase’s servers to handle the load.

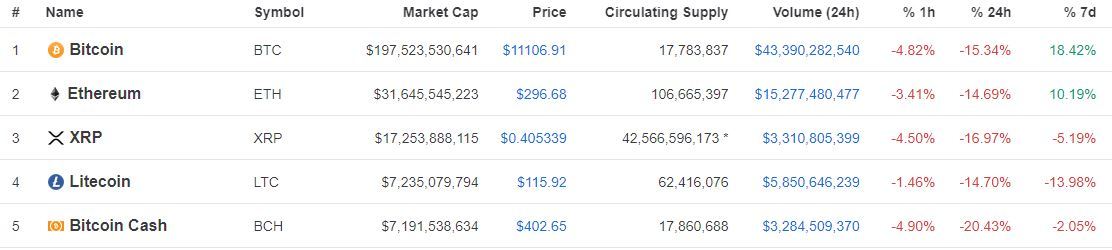

In less than 24 hours, the bitcoin price shaved more than $3,000 off its meteoric 2019 ascent, though it has since experienced a minor recovery. The cryptocurrency last traded at $11,149, dropping its market cap slightly below the $200 billion threshold.

Notably, the pullback occurred just before what is expected to be the “largest [cryptocurrency] derivatives expiry on record,” which is scheduled to take place on Friday.

Remarkably, bitcoin continues to post enormous weekly gains, having climbed more than 18% over the past seven days. Ethereum has also gained more than 10% for the period, while virtually every other major cryptocurrency has suffered significant losses.

Click here for a real-time bitcoin price chart.