Bitcoin Price Resurgence Is a ‘Self-Fulfilling Prophecy’: Analyst

The bitcoin price is surging, and one analysts says the spike is a "self-fulfilling prophecy" - which isn't necessarily a bad thing. | Source: Shutterstock

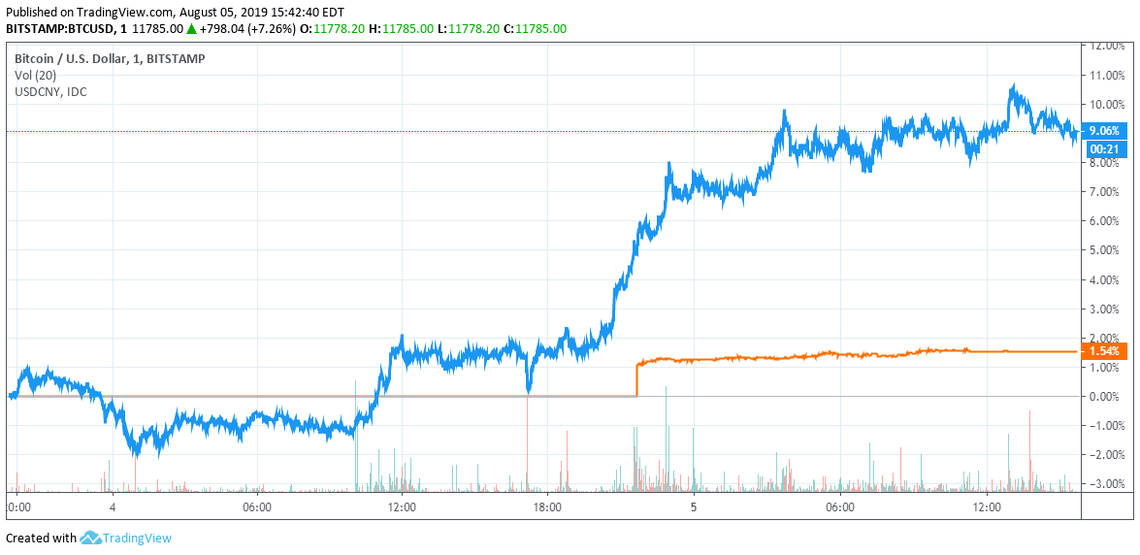

When the bitcoin price smashed through $11,000 overnight and set its sights firmly on the $12,000 mark, analysts almost uniformly pointed to China’s stunning decision to defy the Trump administration and devalue the yuan as the catalyst.

However, cryptocurrency bulls who proclaimed that bitcoin had demonstrably proven its worth as a safe-haven asset might have spoken too soon.

China’s Shock Yuan Devaluation Bolstered Bitcoin – But Why?

It’s not that the safe-haven argument doesn’t make sense.

The People’s Bank of China’s decision to allow the yuan to slide below a 7:1 ratio against the US dollar thrust the CNY to its lowest level in more than a decade and marked a brazen escalation in US-China tensions.

Consequently, it’s unsurprising that Chinese investors would search for safe-haven assets, and borderless cryptocurrencies like bitcoin represent a fairly convenient way to park their cash offshore.

Simon Peters, an analyst at eToro, suggested in market commentary shared with CCN.com that Chinese crypto investors might be doubling down on BTC.

“It’s no coincidence Bitcoin’s surge over the weekend has coincided with Donald Trump’s announcement of tariffs on $300bn worth of Chinese goods. The yuan has fallen against the dollar to levels not seen since the 2008 financial crisis, and Chinese investors are casting around for alternative assets for their wealth,” Peters said. “Gold, the traditional haven asset, has been a beneficiary of some of this investor uncertainty. Yet Bitcoin also seems to have served a similar purpose. Given that Chinese investors make up a large proportion of crypto investors, there’s a strong possibility some are backing Bitcoin’s chances against the yuan.”

Other pundits went even further, alleging that capital was using bitcoin to evade China’s Great Firewall.

It’s a compelling argument, and it makes for a nice tweet.

But it’s unlikely to survive closer scrutiny.

Krüger: Crypto Boom Is a Speculative Self-Fulfilling Prophecy

There’s precious little evidence that Chinese investors have begun to pile into bitcoin, save for the cryptocurrency’s bullish Monday pivot, which saw the BTC price surge as high as $11,959 on Bitstamp.

Bitcoin has now climbed about 20% since the beginning of August, when it traded below the $10,000 mark. The recovery had correlated with unexpected escalations in the trade war, and there’s a case to be made that the correlation extends into causation.

However, none of this means that Chinese investors – or investors anywhere, for that matter – are actually using bitcoin as a safe-haven asset or a hedge against stock market uncertainty.

To put it simply: While holding a depreciating currency like the yuan might not be ideal, one doesn’t flee to “safety” in an asset that’s exponentially more volatile.

Rather, as crypto analyst Alex Krüger explained in a series of tweets on Monday , the rally isn’t fundamental. This upswing, like every single one before it, is speculative.

However, that doesn’t mean it isn’t sustainable.

According to Krüger, bitcoin price moves are “entirely behavioral…self-fulfilling prophecies.”

“When most pundits, even those outside crypto, start saying $BTC is pumping because of X, $BTC will pump because of X, as it is an entirely behavioral asset. That’s how self-fulfilling prophecies work. Speculation is the driver, not hedging. Some may want to call it wealth hedging,” Krüger said.

“Fake narratives can become self-fulfilling prophecies,” he added. “This is a huge win for bitcoin.”

So it’s entirely possible that rising volatility in stock and currency markets will tilt the risk calculus enough that bitcoin begins to look like a more attractive gamble.

Just don’t call it hedging.

Click here for a real-time bitcoin price chart.