Bitcoin Price Smashes Past $11,000 – Should Traders Fear a Dump?

The bitcoin price just smashed through $11,000 for the first time since March 2018. | Source: Shutterstock

By CCN.com: The bitcoin price rally refuses to let up, and the dominant cryptocurrency just soared above $11,000 for the first time since March 2018.

Bitcoin Price Rushes to 15-Month High

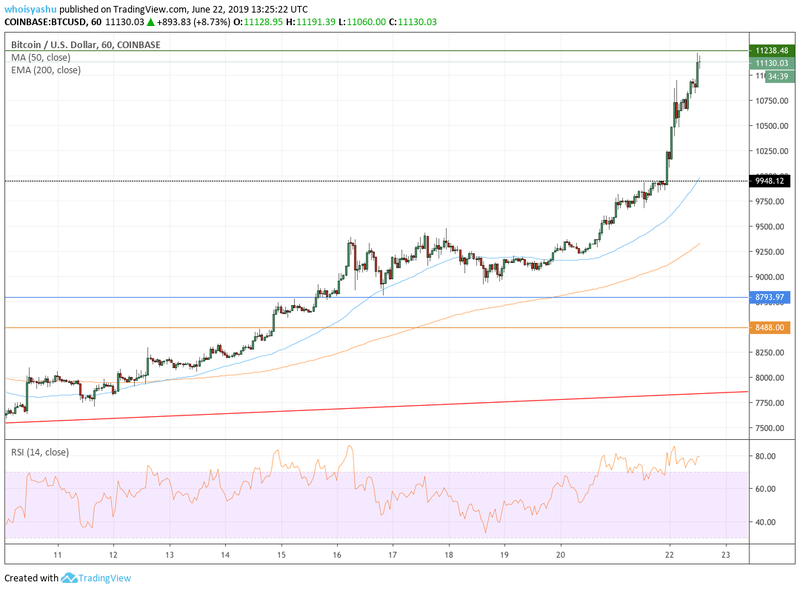

Around 12:00 UTC, investors bid the bitcoin price up to $11,215.89 on US cryptocurrency exchange Coinbase. The move pushed the asset up by 13 percent for the day, launching its month-to-date gains above 30 percent. The past 24 hours also saw bitcoin’s “real 10” volume, which eliminates suspicious trades, swell to $2.58 billion.

Following the upside move, the bitcoin price is now trading just 45 percent lower than its all-time high near $20,000, established in December 2017. Furthermore, the cryptocurrency has recovered by 260 percent from its 2018 low of $3,126, including a year-to-date return of more than 200 percent.

Libra, Fed Rate Cut, & US-China Trade War Pump BTC

The bitcoin price started climbing higher on Wednesday soon after the Federal Reserve announced its plans to cut interest rates in July. As CCN.com reported, the Fed’s move left the US dollar in a weaker spot, sending the benchmark S&P 500 Index and especially the haven asset higher in the coming sessions.

Cryptocurrency analysts speculate that investors are looking at bitcoin as an alternative hedge, owing to the uncertainty over a trade dispute between the US and China. Grayscale Investments stated in its new report that the ongoing tensions between the two economic superpowers left investors in China stranded with a weaker Chinese Yuan. In response, investors allegedly started hedging their capital into bitcoin. The report read:

“While it is still very early in Bitcoin’s life cycle as an investable asset, we have identified evidence supporting the notion that it can serve as a hedge in a global liquidity crisis, particularly those that result in subsequent currency devaluations.”

A part of bitcoin’s bullish sentiment also came in the form of Libra, better known as the Facebook cryptocurrency. Jasper Lawler of London Capital Group told CNN that the Facebook token would act as a gateway to the crypto market for its 2 billion users. The head of research added:

“Libra will expose 2 billion Facebook users to crypto. Because of its huge network of over 2 billion users, Facebook products cast a wide net. Libra will breed familiarity of cryptos to a much wider audience. Two billion people will now be much more open to Bitcoin and other altcoins.”

BTC at Risk of Reversal

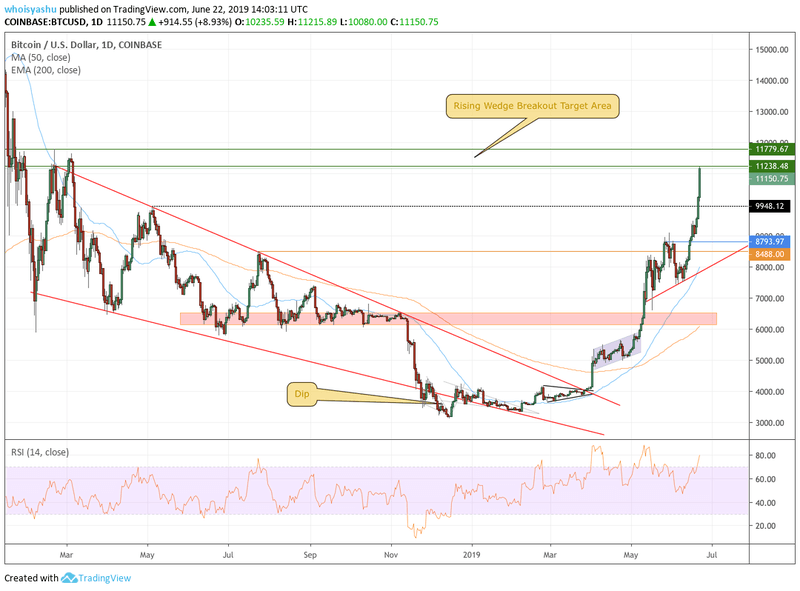

BTC’s latest push to the upside has brought it closer to the wedge breakout area, as CCN.com discussed in previous analysis.

There is a significant possibility of a reversal once bitcoin tests the $11,238-$11,779 area, the top of the falling wedge depicted in red, according to the daily RSI indicator, which is overbought.

A pullback, therefore, could push bitcoin towards the support area above $9,948. On the other hand, a break above the $11,238-$11,779 area could have bitcoin test $12,972 as interim upside target.