Bitcoin and M-PESA are Quite Complementary, Mr Holmes

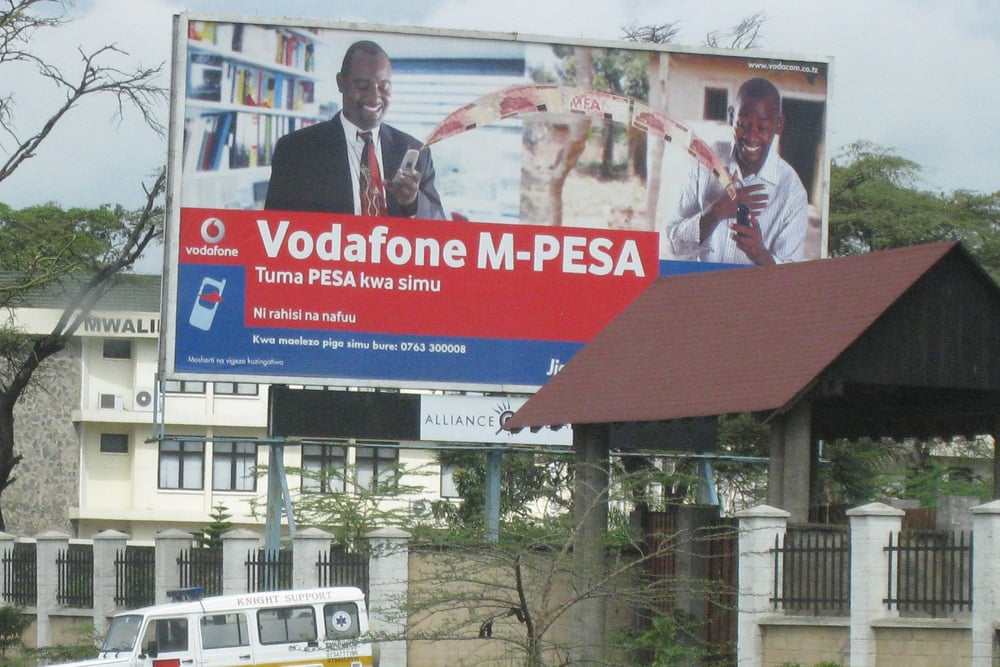

In a recent article appearing on SecurityWeek.com, the author David Holmes discussed virtual currency around the world in all its current forms. The article also discussed M-PESA, an SMS based system through which mobile subscribers in Kenya and a growing number of countries can send virtual money through a mobile operator’s phone number.

In a recent article appearing on SecurityWeek.com, the author David Holmes discussed virtual currency around the world in all its current forms. The article also discussed M-PESA, an SMS based system through which mobile subscribers in Kenya and a growing number of countries can send virtual money through a mobile operator’s phone number.

Either by circumstance or happenstance, I have been privileged to watch M-PESA grow from its soft launch at the Safari Park Hotel, Nairobi in late 2006 to what it has become right now. Though this can at times sound clichéd, M-PESA has revolutionized Africa, first in my native Kenya and then on to the rest of the continent. It gives me special pride that the product whose word pesa is Swahili for ‘money’ and derived from Portuguese peso has been able to continue the proud tradition of global circumnavigation since it first hit East African shores at the end of the 15th century.

I use M-PESA (almost) every day. I use it for a range of reasons including depositing funds into my Nairobi bank account, topping up my VISA-branded card, sending money to family and friends, paying for goods and services and so forth. Speaking for the million-strong Kenyan and African community in the diaspora like myself M-PESA has made a huge difference in our lives especially in remittance and investment back home.

But so has Bitcoin. For the work that I do for CCN.com, I am paid in bitcoins. The speed of transaction is instant, and within about 10 minutes, I’m able to get the money via M-PESA through a Nairobi-based Bitcoin exchange. I shudder to think how long the alternatives would take before I get funds into my account or into the physical wallet that I carry on my back pocket. In most African countries like Kenya and others in East Africa, authorities have been slow as far as cryptocurrency regulation is concerned. True, some noise, sometimes negative and sometimes positive, is being generated by innovation labs, a central bank, and one or two brave banks. However, the cryptocurrency landscape is still comparatively very dormant on the continent. In my experience, Bitcoin provides the ease at international level, while M-PESA provides the critical last mile.

It is from this personal experience that I would disagree with Mr. Holmes. In the last paragraph of his article he said that even if a currency revolution is happening globally, the winner would not be Bitcoin or any cryptocurrency, but might be an alternative currency M-PESA.

M-PESA’s Hurdles to Global Adoption

I differ from his perspective because as I see it, it would take a lot more time for M-PESA to attain the global ubiquity that Bitcoin inherently promises. Though he gives the example of South Africa, it is worthwhile to note that Africa’s largest economy Nigeria is yet to adopt M-PESA, mostly over fears of fraud and money-laundering. M-PESA has several other hurdles to overcome.

The biggest hurdle that M-PESA would have to overcome is interoperability. Each country uses M-PESA in its local currency. For M-PESA to truly go global, there will be a need for agreement on a common currency that could be used across countries and mobile network operators. For example, there is no product as yet that can enable M-PESA to be used across networks in East Africa itself let alone Africa or the world. Bitcoin notwithstanding, this is a product that is badly needed. I would bet that a product like that would unlock and unleash tremendous opportunity that is currently dominated by banks and money transfer services.

Bitcoin has already solved this problem. It is borderless, and transactions are instant. It also solves the problem of interoperability since as I write this, there are already plenty of Bitcoin mobile wallets and apps that can provide the needed interoperability across mobile networks. My personal favorite and one I see with the potential to merge M-PESA and Bitcoin is airbitz. In addition, Bitcoin is a currency whether governments and tax authorities view it as such or not.

The optimal solution will emerge by developing a product that merges the best of both Bitcoin and M-PESA. Already, apps are being developed that do what M-PESA does. My prediction is that in a few years, mobile payment solutions such as M-PESA will be plugged into cryptocurrency either natively through the blockchain or other means such as bitcoin exchanges. What remains for this to happen is for Bitcoin to achieve a greater degree of price stability, better optimization of Bitcoin apps for micropayments and regulation that will aid rather than hinder the use of Bitcoin.

Images from Wikimedia Commons.