OKCupid, Overstock, DISH network, Expedia, Kings College New York. The list of merchants accepting Bitcoin is growing. Every time a new business accepts Bitcoin, the community cheers. But they could be more sober. Because all those Bitcoins are converted straight into dollars, driving the Bitcoin value down.

To understand why, imagine Mr. John Public buying a new laptop. He heads over to Overstock.com, finds a nice white shiny laptop that makes him feel worthy, and proceeds to checkout. He is told he can pay with Visa, Paypal and Bitcoin. He heard something on the evening news about Bitcoin but he has never purchased one. Do you think John Public will go over to the Bitstamp exchange to register, buy Bitcoin, and then pay?

My bets are off. John Public has nothing to gain from Bitcoin. It doesn’t make the goods cheaper and it doesn’t give him anonymity when buying. It is neither any faster. For John, it’s just more work for the same result. My bet is that John will buy absolutely nothing with Bitcoin — ever, unless he already owns bitcoins.

One person who does own Bitcoin, is Leon Libertaris. Leon is on top of the latest technology trends. He has a healthy dislike of the status quo and central banking, and bought about twenty bitcoins two years ago. They are now worth more than 10,000 dollars. He’s a rich kid. Leon also decides to buy a laptop, and pays in Bitcoin. Overstock immediately exchanges the Bitcoin for dollar. Since nobody is buying Bitcoin for merchandise and Overstock immediately sells the bitcoins they receive, what Overstock ends up with is not more buying of Bitcoin, but more selling of Bitcoin. And selling pressure drives the price down.

RelatedNews

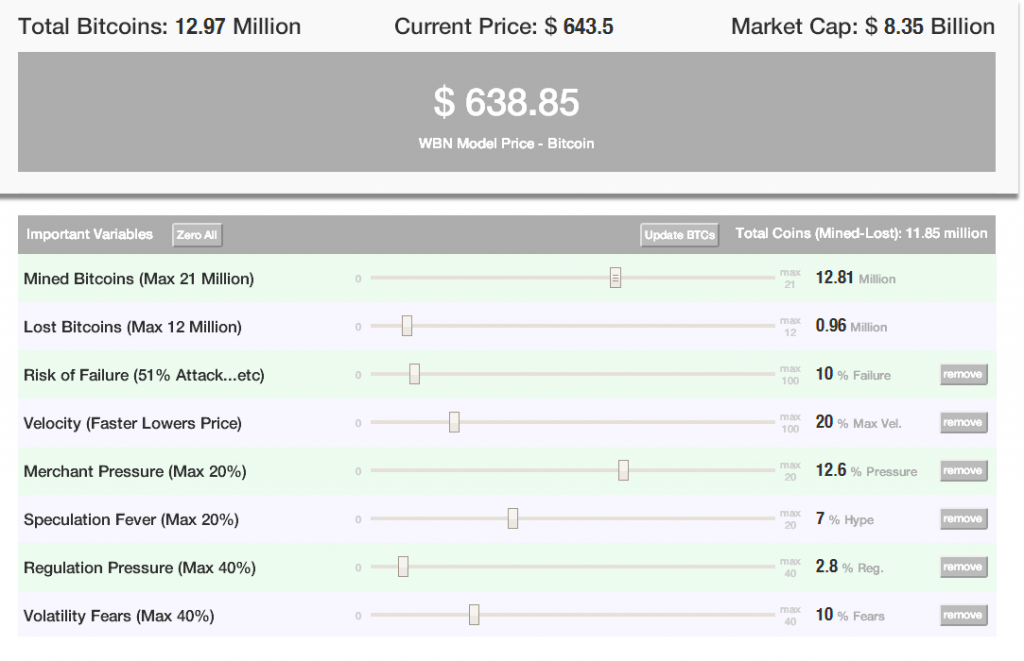

This effect is confirmed by a price model from the makers of the Bitcoin 101 Blackboard series . A variable dubbed “merchant pressure” represents the sell pressure of merchants selling Bitcoin for U.S. dollars.

In their tutorial Modelling the Price of Bitcoin they explain the model in full, including the effect the number of lost Bitcoins and mined Bitcoins have on the price. It shows, for example, that if Bitcoin only manages to take hold of 2% of the store of wealth in gold market, a price of 10,000 USD per Bitcoin is possible. So big is the size of the gold market, and so small is the current size of the Bitcoin market.

But as much as we like the Bitcoin price going up, for consumers and merchants, a high exchange rate is not necessarily good. They are most happy with a stable currency. Merchants operate on a tight margin and don’t like volatiliy in price.

The exchange rate going up is encouraging for the general public’s confidence in Bitcoin however, which is enormously important for a developing currency. So the argument can be made that Bitcoin merchants are actually hurting Bitcoin by converting them straight into USD.

Sources:

Disclaimer: The author owns 5 bitcoins. He has no affiliation with the blackboard tutorials series.