Bitcoin Hits Highest Volume in 9 Months: Is Crypto Ready to Take Off After Massive Gains?

Bitcoin trading on Monday reached its highest volume since the beginning of the bear market in mid-2018. | Source: Shutterstock

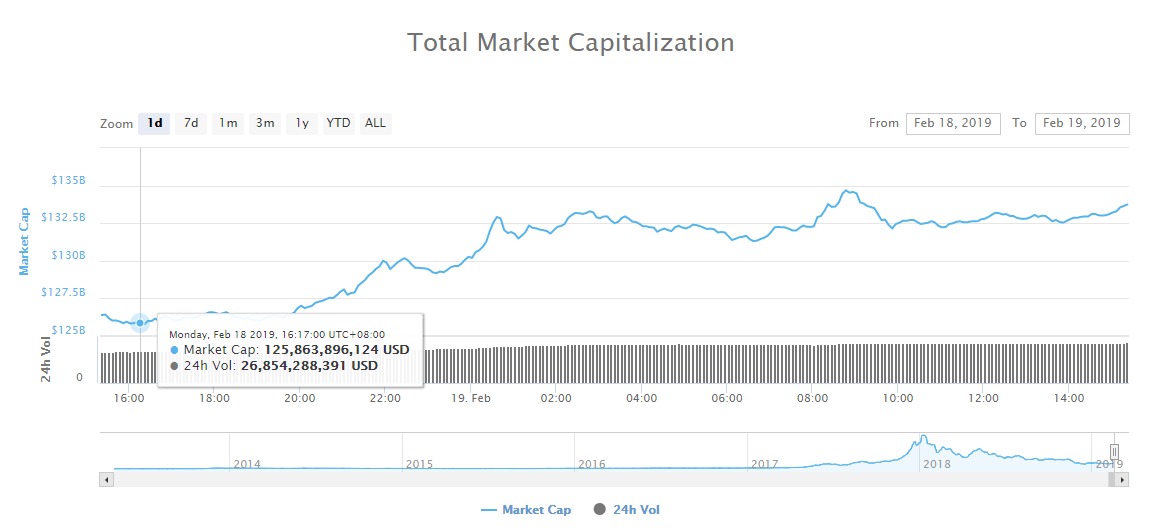

In the last 24 hours, the valuation of the crypto market increased by $8 billion as the Bitcoin price neared the crucial $4,000 resistance level.

Major crypto assets in the likes of EOS, Ethereum, and Bitcoin Cash recorded gains in the range of 10 to 30 percent.

Most cryptocurrencies have started to see record high volumes across leading cryptocurrency exchanges, demonstrating an increase in demand for digital assets.

What is Causing the Rally and Can Bitcoin Sustain its Momentum?

Prior to the rapid price movement of Bitcoin from the mid-$3,000 range to $3,995, one cryptocurrency trader said that the volume of the dominant cryptocurrency is at a 9-month high.

“Volume precedes price. We’re on our way to the highest crypto volume day since the beginning of the bear market. It’s already the highest volume day since May 2018. Oh, and BTC transactions are almost back to ATH as well,” the trader said .

Throughout the past six months, the core concern of analysts regarding the mid-term trend of crypto assets has been the lack of volume and trading activity in the digital asset market.

The low volume of major digital assets allowed minor downside movements to lead the market into large-scale sell-offs with relatively low sell-pressure.

As the market continued to demonstrate vulnerability to small downside movements, bears had an edge over bulls since mid-2018.

However, as the volume of Bitcoin and the rest of the cryptocurrency exchange market started to pick up, it eliminated most of the sell-pressure from crypto assets, allowing the market to initiate a recovery.

https://twitter.com/TheCryptoDog/status/1097617160048963585

Positive technical indicators supported by fundamental factors such as the growing usage of the Bitcoin blockchain network and rising transaction volume have improved the sentiment of investors in the cryptocurrency market.

Ethereum, which recorded a 10 percent increase in value on the day following a strong day on February 18, also reached record high volumes across major exchanges such as BitMEX.

Although the price movements of both Bitcoin and Ethereum have fueled the momentum of the two assets, Alex Krüger, an economist and a cryptocurrency analyst, said that it is too early to expect FOMO in the market.

The analyst explained:

Two signs of longer trend change (backwards looking by definition). Issuance has been dropping since Dec and will stabilize at lower levels with the fork. And we have the fork’s bullish narrative kicking in (just a narrative, but narratives matter). The fork is set for Feb/27.

For what it’s worth, for short term trading and those of us attempting to time the market, both BTC and ETH are at take profit levels now. In my opinion, nothing to FOMO into.

How Far is the Market From a Full-Fledged Trend Reversal?

In financial markets, an asset is considered to be in a bear market when it is down 20 percent from its all-time high.

Bitcoin is still down 80 percent from its all-time high at $20,000 and most crypto assets have fallen by around 90 to 95 percent.

But, the $20 billion increase in the valuation of the crypto market in the past 30 days has alleviated significant pressure from cryptocurrencies and it could lead to an extended period of accumulation.

Previously, analysts stated that it is difficult to suggest an accumulation phase is being initiated if the on-chain transaction volume of public blockchain networks remains low.

In the past three months, the on-chain transaction volume of Bitcoin has increased to around 350,000 transactions per day, moving closer to its all-time high at 400,000.

If fundamentals of major cryptocurrencies can hold up in the near-term, technical factors could push the market to new resistance levels.

Click here for a real-time bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView .