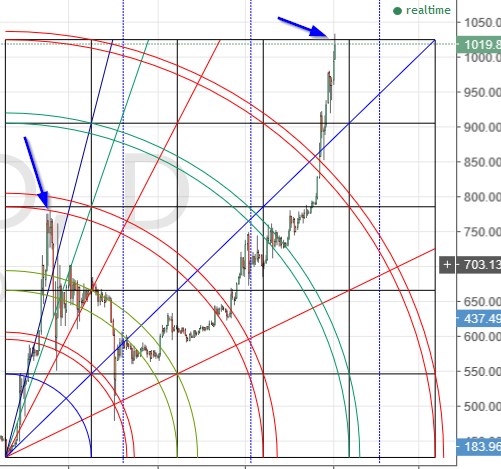

Bitcoin Has Hit a Price Target

As regular readers of this column will realize, we have been discussing the $1020-1030 area for several weeks as a likely place to see a possible trading opportunity on the short side. Well, we are now there. Bitcoin price hit the top of the 5th square on a shorter-term setup on the daily chart. There are many reasons to justify going short here, but I tell you honestly, I just can’t bring myself to do it yet. For reasons visible on a 2-hour chart (not shown) I will consider shorting when/if we get a close below $1000.

There are many reasons to justify going short here, but I tell you honestly, I just can’t bring myself to do it yet. For reasons visible on a 2-hour chart (not shown) I will consider shorting when/if we get a close below $1000.

In the meantime, I closed my long position already. If we get a convincing close above the swing high of $1033 I will re-enter on the long side.

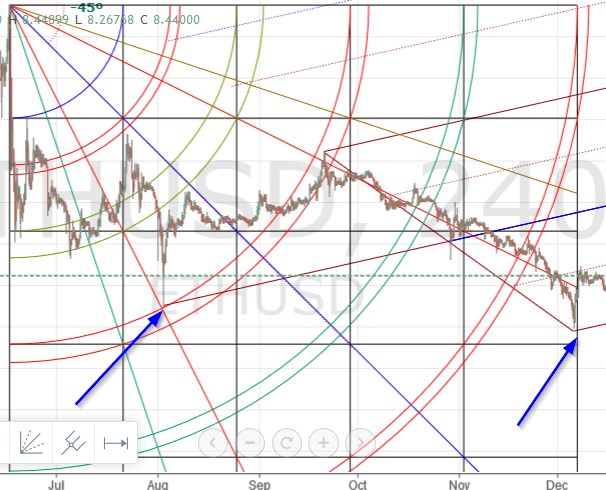

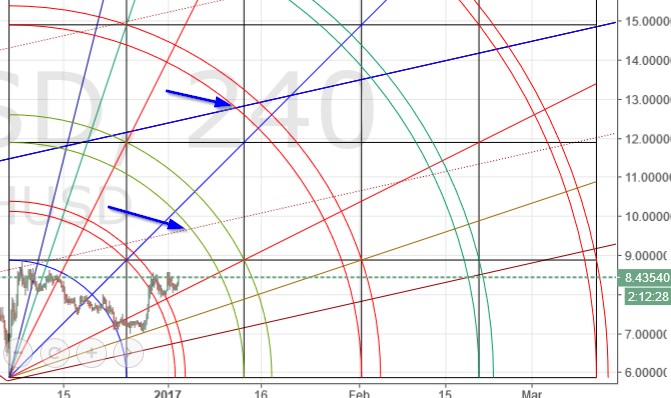

Ethereum

Ethereum is showing signs of life, as is eth/xbt. Here we see a 4-hour chart of ethusd. While overall the chart does respect the setup very well, I note that the July panic low was stopped by the 3rd arc pair and the more recent swing low happened right at the end of the 5th square.

Here we see a 4-hour chart of ethusd. While overall the chart does respect the setup very well, I note that the July panic low was stopped by the 3rd arc pair and the more recent swing low happened right at the end of the 5th square.

Believing there is a “reasonable” possibility that the long correction from the mid-year high might be over, I have plotted a bull setup on this chart:

It seems that there are targets at the 2nd and 3rd arcs, at ~ $9.70 and 12.70, respectively.

It seems that there are targets at the 2nd and 3rd arcs, at ~ $9.70 and 12.70, respectively.

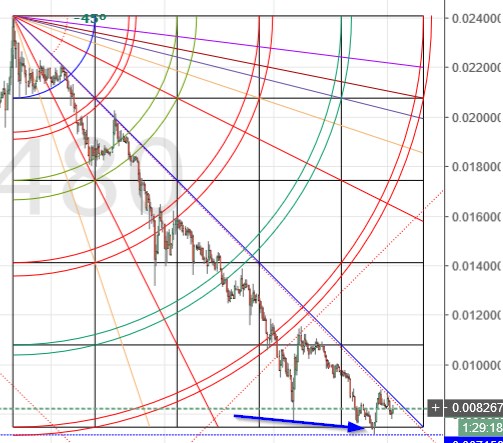

ETH/XBT

ETH/XBT has completed a long trek to the bottom of the 5th square on a shorter-term bear setup on the 8-hour chart: I am cautiously bullish this chart, for now, though a close above the 1×1 gann angle (45 degrees) would give me a bit more confidence.

I am cautiously bullish this chart, for now, though a close above the 1×1 gann angle (45 degrees) would give me a bit more confidence.

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.

Image from Shutterstock.