Bitcoin Cash Price Drops Below $500 on Chinese Exchanges

The bitcoin cash price dropped below $500 on Chinese exchanges on Tuesday following investor panic about the Chinese ban of initial coin offerings (ICOs).

The ban, which was announced by the People’s Bank of China (PBoC) earlier this week, bars Chinese citizens and residents from hosting or participating in ICOs. The ruling further ordered groups that have already completed ICOs to return the funds to investors. Panic ensued, and traders initiated a massive sell-off that extended far beyond the cryptocurrencies directly affected by the PBoC ruling, including bitcoin cash.

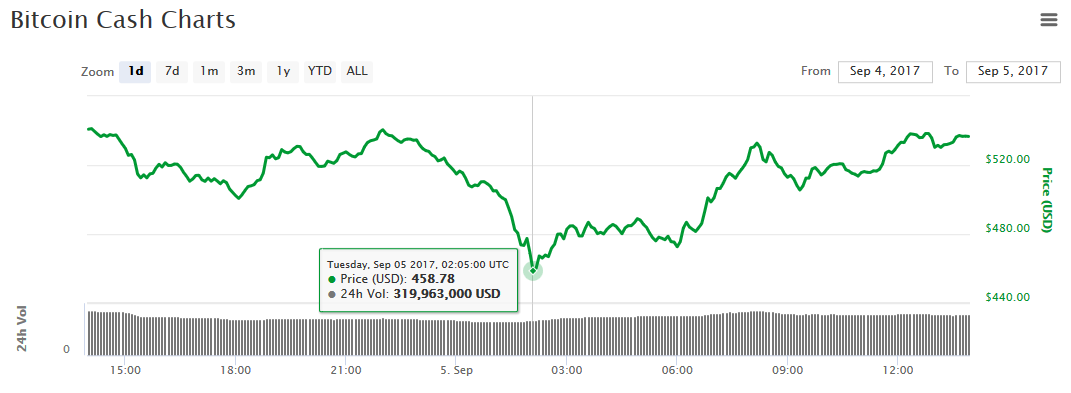

The bitcoin cash price entered September on a moderate incline, rising back to $600 after dipping below $550 earlier in the week. This week’s sell-off reversed that trajectory, sending the bitcoin cash price back into decline. On September 5, the global average bitcoin cash price tumbled as low as $459, although it has since recovered to $537 at present. This represents a weekly decline of about 8%.

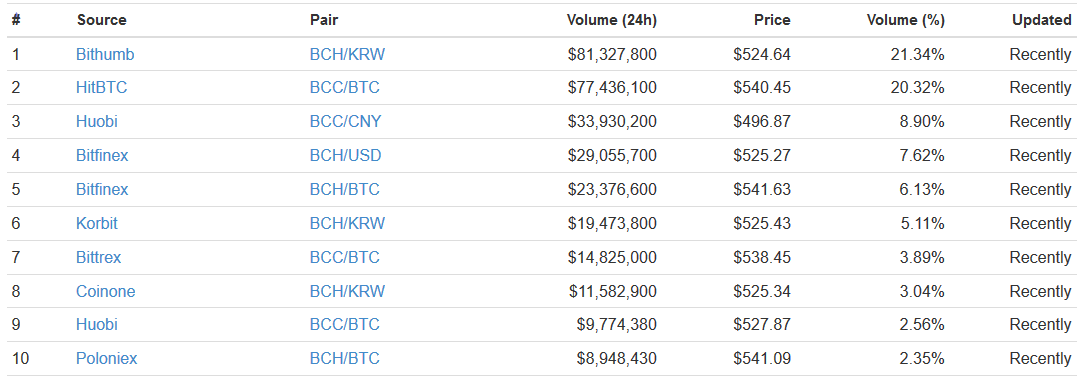

Nevertheless, Chinese traders continue to put intense downward pressure on the bitcoin cash price. On Huobi, for instance, BCC/CNY is trading at just $497. At present, bitcoin cash’s largest exchange pair remains BCH/KRW on Bithumb. Since South Korean regulators are considering tightening their digital currency regulations, BCH/KRW support levels could falter if regulators take a heavy-handed approach to the new rules.

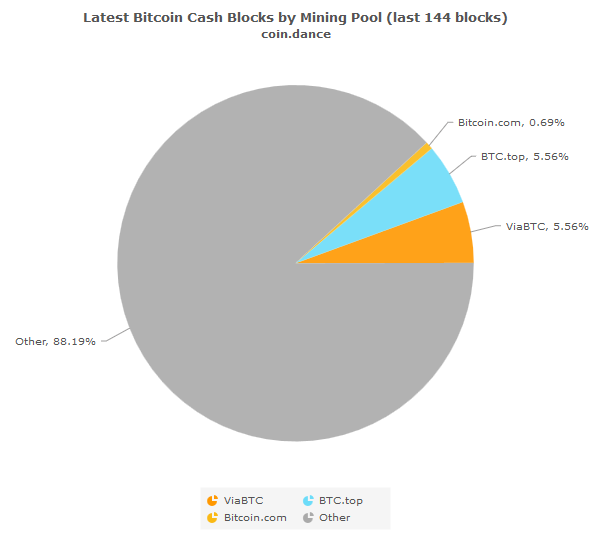

The bitcoin cash price dip comes at a time when the coin is struggling with a waning hashrate and increasing miner centralization. At present, the bitcoin cash hashrate is just 584 PH/s. While this is an improvement over last week’s hashpower, it is still far below that of the main bitcoin blockchain. At present, bitcoin cash accounts for less than 5% of the combined BCH/BTC hashrate.

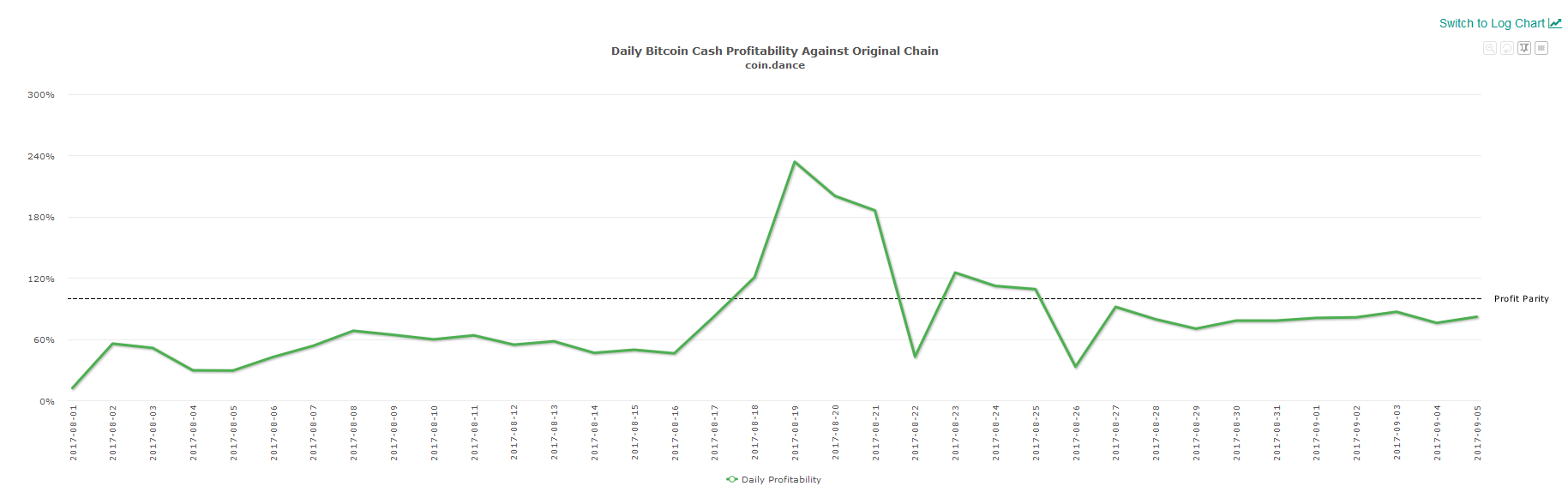

The reason for the waning hashrate is the decline in BCH mining profitability. Bitcoin remains about 20% more profitable to mine, leading non-committal miners–including AntPool–to gravitate back to the main blockchain.

The hashpower that remains on the bitcoin cash network has become increasingly centralized. As of writing, more than 88% of the last 144 bitcoin cash blocks had been mined by a mystery miner or miners.

To some, that figure is alarming, since it theoretically makes the network vulnerable to a 51% attack. Others, however, remain unconcerned. Bitcoin cash proponent Olivier Janssens, for instance, recently called concern over miner centralization “small block propaganda”. He argued that miners will not destroy their multi-million dollar investments by attempting to deploy an attack against the network.

Featured image from Shutterstock.