Bitcoin Cash Pools: The Majority of Bitcoin SV Blocks Are Mined By ‘Unknown’ [Yes, Really]

According to data, a near 44% majority of mining pools in Bitcoin SV (BSV) are unknown. | Source: Shutterstock

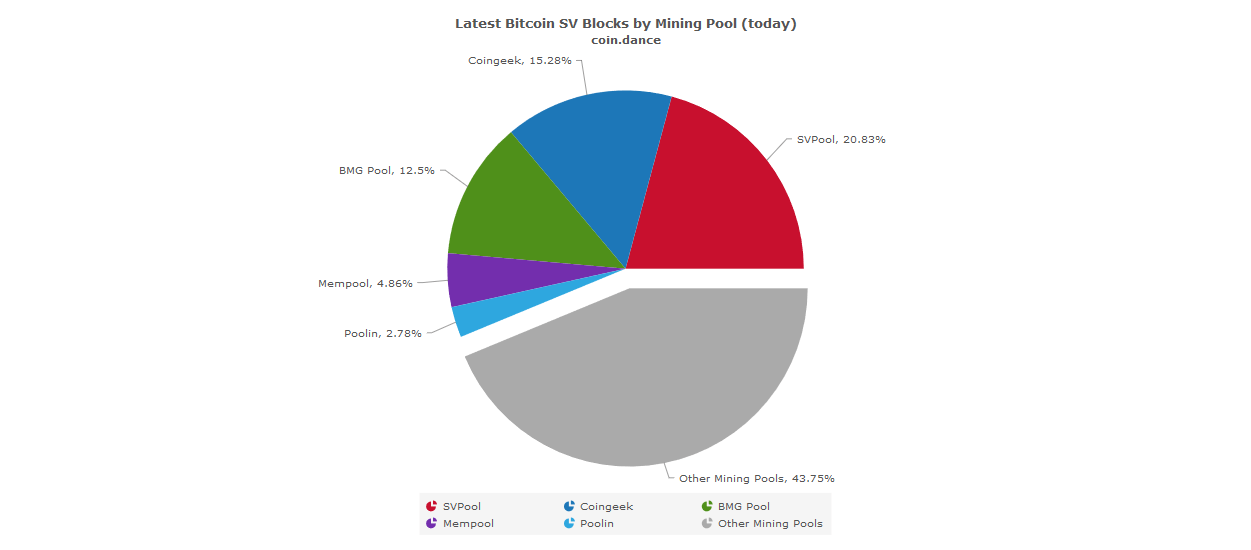

Like Bitcoin and Bitcoin Cash, Bitcoin SV has large mining pools, each with a significant share of its SHA-256 hashrate. However, unlike the others, BSV has a nearly 44% majority who are “unknown,” according to data published by Coin.Dance.

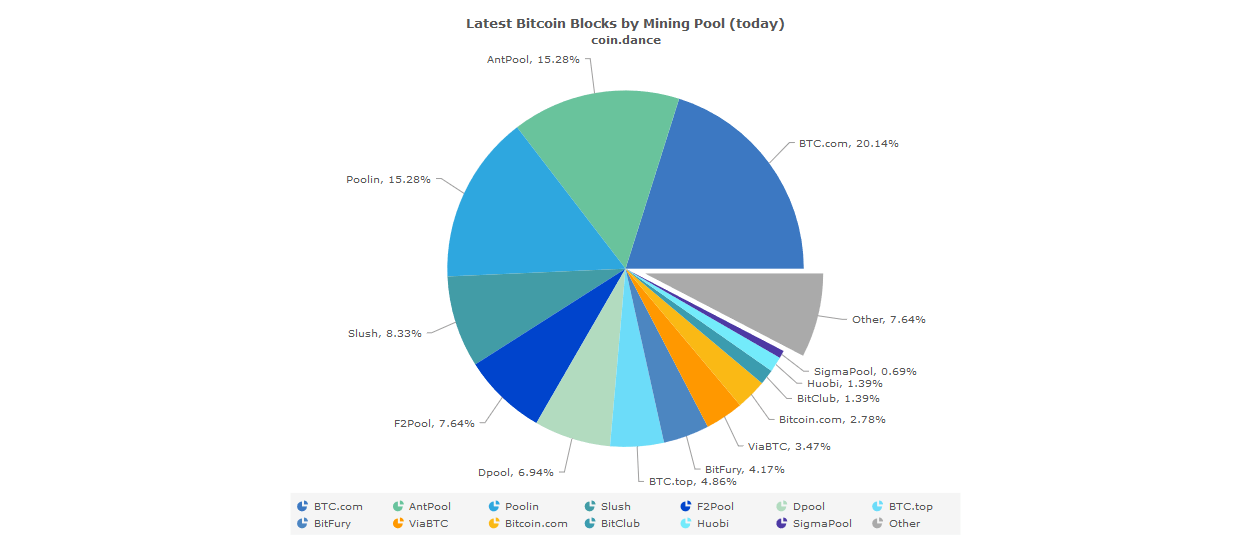

Comparing the above to Bitcoin’s same period chart, about 500% of the blocks in Bitcoin SV are mined by “unknown” compared to Bitcoin.

The situation led a Reddit user, who probably didn’t notice that the “unknown” miner doesn’t have to be a single outfit, to ask if an attack “is developing. ”

Three Pools Control Far More Than Anyone Else in Bitcoin SV

Perhaps more interesting than the high amount of “unknown” miners able to find blocks on the nearly 1 exahash chain is the massive power of a few pools. SV Pool, Coingeek, and BMG Pool control more than unknown miners. A slight increase in their power could lead to them collectively having the 51% majority needed.

Need for what? An attack, of course.

“Collusion” is yet another concern in scenarios like these.

SV Pool is owned by Craig Wright, while Coingeek is owned by Calvin Ayre, both wealthy backers of the Bitcoin SV fork away from Bitcoin Cash. This is the genesis of a comment by a Redditor:

[N]ah, it’s still calvin/craig who operate more than 95% of the hash. They just switch up the distribution every once in a while to make it appear as more mining entities.

Clearly the comment is hyperbolic, in that SV Pool and Coingeek control around 35% between them. The comment does seem to suggest that many of the “unknown” operators are also Wright and Ayre, which would be difficult to verify.

https://youtu.be/whbzIGML1qY

Centralization and 51% Attack Concerns Loom

If you’re still new to Bitcoin, a 51% attack, briefly, in part entails the power to “rewrite” the blockchain. This involves the right to not-include or include transactions. The potential for fraud is high in such situations. It is generally an expensive endeavor, especially in networks with a great deal of hashpower, like any of the three Bitcoins.

CCN.com recently reported that the Dash network was vulnerable to such an attack from a Nicehash miner. In the interim, the total network hashpower of Dash has gone up, while the power of Nicehash has gone down .

Centralization concerns are ever-present in the minds of cryptocurrency enthusiasts. Any time a situation arises wherein one entity seems to have too much power, someone raises an alarm. People have raised alarms about Bitcoin in the past.

Bitcoin SV has the lowest hashrate of the three Bitcoin forks. It, therefore, makes for a nice use case for older mining hardware. Retired from service as the difficulty on the Bitcoin and Bitcoin Cash networks has grown exponentially, SHA256 hardware gets a second life on Bitcoin SV.