Bitcoin Beats the Dow, Outperforming Every Single Stock, in 2019

Bitcoin is outperforming every single stock in the Dow Industrial Average this year. | Source: Shutterstock

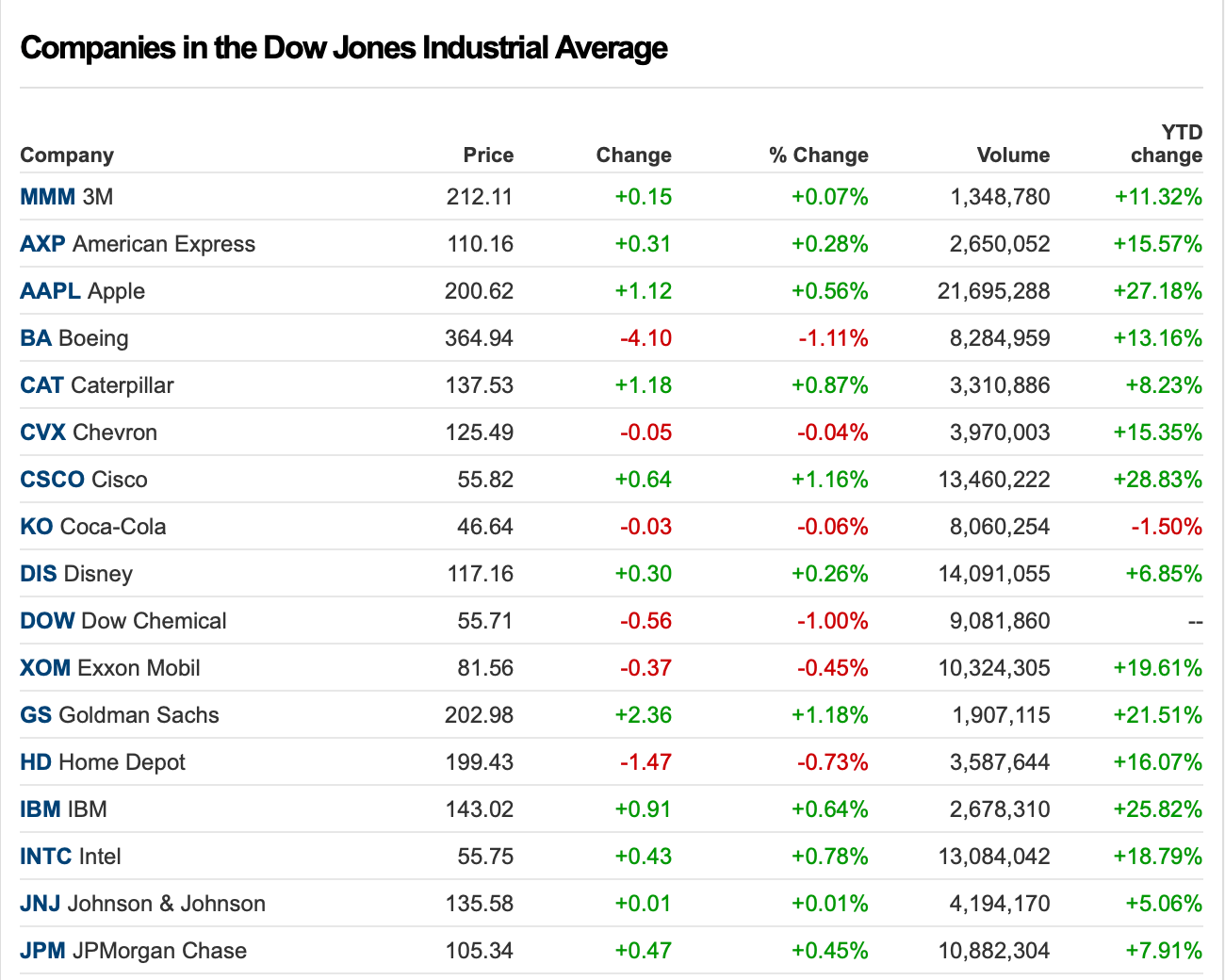

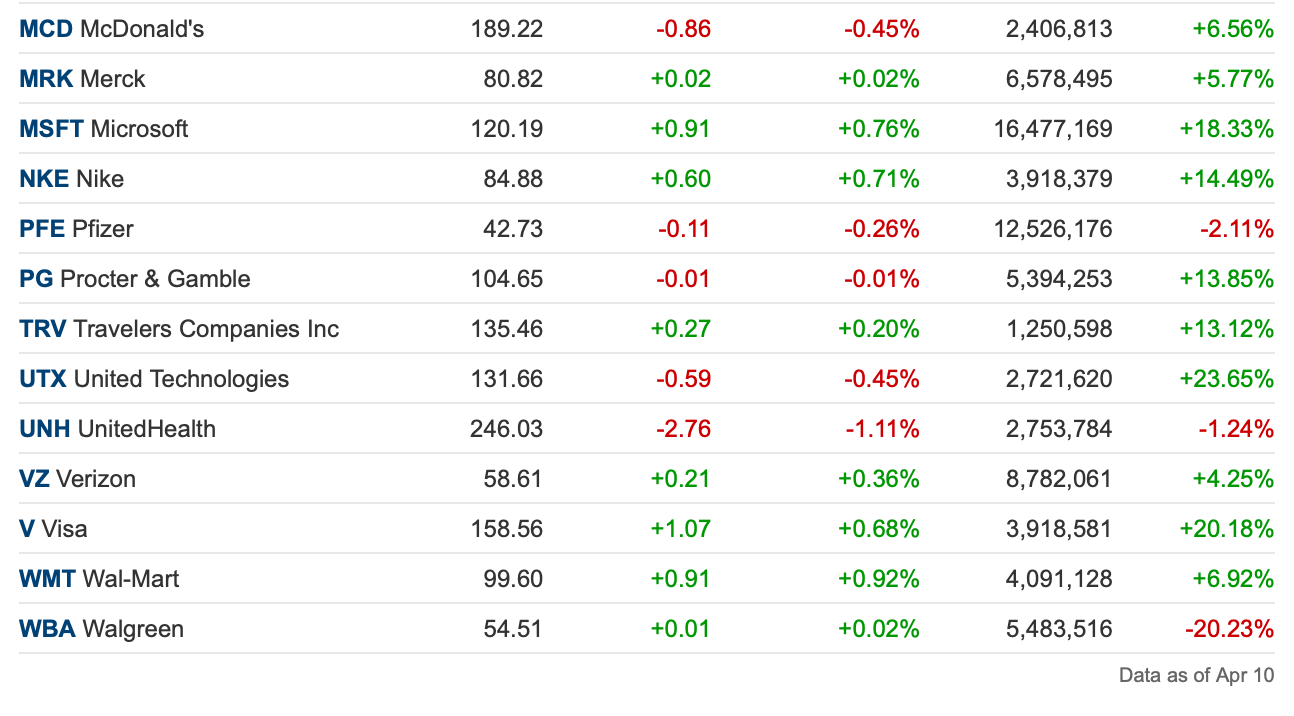

Traders and analysts are screaming about the stock market’s “historic ” first quarter. The Dow Jones Industrial Average (DJIA) – which tracks 30 of the largest American companies – has staged an epic rally since the start of the year, chalking up 12 percent.

But forget stocks. Bitcoin is outperforming the broader stock market by a huge margin. In fact, bitcoin is outperforming every stock on the Dow Jones Industrial Average.

Bitcoin Gains Leave Dow in the Dust

As you can see in the chart above, bitcoin has gained 44 percent since the start of the year. In contrast, the Dow has etched out 12 percent.

It’s still an impressive rise for stocks. Just three months into the year and the Dow has already surpassed the annual average stock market return of 10 percent .

Bitcoin’s rise in the same time period, however, makes the stock market rally look weak. On Wednesday, bitcoin carved out a new 2019 high, coming within touching distance of $5,500 on the Bitstamp exchange. It marks the peak of 44 percent bull run since the start of the year.

Bitcoin Beats Apple, IBM, and Microsoft

To put bitcoin’s rally into perspective, let’s dive into the Dow itself. The DJIA is compromised of 30 giant US companies including Apple, McDonald’s, Goldman Sachs, and Disney.

There is not a single company in the list that comes close to bitcoin’s gains this year.

The biggest riser in the Dow is Cisco, chalking up 28 percent year-to-date. Apple is a close second with 27 percent, followed by IBM (25 percent) and United Technologies (32 percent).

Even in a record-breaking bull run, strong blue-chip stocks like Visa, Nike, and Intel can’t match crypto’s rise.

Bitcoin and Dow Correlated?

Bitcoin has long been considered a non-correlated asset compared to stocks. The theory goes that bitcoin is a means to diversify out of stocks when volatility hits.

But as more institutional money creeps into bitcoin, that could change. As CCN.com reported this week, Wall Street investors might be more inclined to treat cryptocurrencies as a “risk-on” asset, similar to stocks. Economist Alex Kruger explains:

“IMO crypto will behave like a highly correlated high-beta asset class. Not where you go to for diversification purposes.”

We’re beginning to see the first signs of that as bitcoin and the Dow both record huge, roughly correlated gains at the start of 2019.

Bitcoin Rally to Continue?

Analysts are divided over whether bitcoin’s 44 percent surge indicates a long-term bull trend.

Bullish analysts point to record volumes on bitcoin futures markets and the imminent break of bitcoin’s 200-day simple moving average (SMA).

But not everyone is convinced. One Bloomberg analyst claims bitcoin traders are “grasping at straws” and warned of a possible 65 percent correction.