Binance CEO Debunks Crypto Twitter Hysteria Over US Geoblock

Speaking exclusively with CCN.com, Binance CEO Changpeng Zhao debunked Crypto Twitter's hysteria about the firm's supposed US geoblock. | Source: REUTERS / Darrin Zammit Lupi

By CCN.com: A rumor that crypto exchange giant Binance had barred users from the United States and 28 other countries from accessing its decentralized exchange (DEX) has had Crypto Twitter in a tizzy. As is often the case with rumors, the truth is a bit more complicated – and a lot less tantalizing.

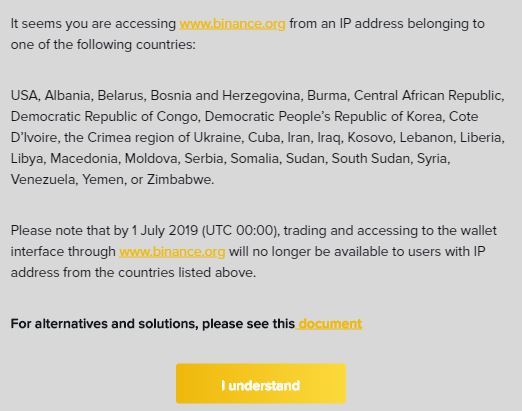

Speaking to CCN.com, Binance CEO Changpeng Zhao debunked the hysteria. He explained that the geoblock of users from 29 countries including the U.S. and Venezuela only applies to a single website in www.binance.org , and he also clarified that Binance DEX itself is not blocking users based on their location.

Changpeng Zhao: Binance DEX Doesn’t Block US Crypto Traders

Zhao stated that Binance DEX, as a blockchain protocol, does not and cannot enforce a regional ban on users, emphasizing that it is up to providers that operate on Binance DEX to make independent decisions about who they allow to access their services.

“Today, there are at least a dozen mature wallets supporting Binance DEX already. The geoblock is not for Binance DEX, which is maintained by a number of nodes operated by independent parties. The geoblock is only for one website (www.binance.org), operated by one of our affiliates. Whether a centralized party decides to geoblock a region depends on their compliance policies I guess,” said Zhao.

Outside of binance.org, users are able to use other platforms like Trust Wallet to trade crypto assets using the native coin swap feature, as noted by the Trust Wallet team .

https://twitter.com/cz_binance/status/1135432360164450304

As more crypto wallets and platforms launch on the DEX blockchain, users should see a wider range of options beyond binance.org.

CZ Dishes on Binance Roadmap, Benefits of Non-Custodial Exchanges

Zhao further told CCN.com that since its inception in April, the Binance DEX’s community has strategized to move the entire protocol to open-source and fully decentralized development as it matures and improves.

“Back to the roadmap, eventually, everything will be open-sourced and fully decentralized, meaning anyone can clone a website exactly the same as binance.org, or fork the code of Binance DEX and run a version (hopefully improved) themselves. We look forward to that future,” he said.

The initial launch period, on the other hand, enabled developers to establish a foundation that is necessary to kickstart the development of a decentralized crypto exchange-focused blockchain protocol.

As the project evolves into an open-source project maintained by a decentralized developer base and the number of non-custodial exchanges on Binance DEX competing to provide liquidity increases, investors should be able to trade in an environment that is immune to hacking attacks and security breaches.

However, it would also mean that investors are not exposed to insurance and other protective measures provided by major centralized exchanges.

For instance, in an event of a hacking attack or misdistribution of funds, a centralized exchange is able to help users recover their lost crypto. In a peer-to-peer environment, misplaced transactions would lead to a permanent loss of funds.

Zhao said:

“One of the key design goals of Binance DEX (for the lack of another word) is to address the issue of ‘not your keys, not your fund,’ i.e., the Binance DEX does not hold your funds at any time. You trade directly from your wallet. This does address one of the news headline risks for centralized exchanges, exit scams, or being hacked and not able to cover for it.”

As such, a decentralized exchange, despite the merit of non-custodial trading, is not an answer to all problems, said Zhao, especially for casual users who are new to cryptocurrencies as an asset class.

DEX – Less Secure Than Centralized Crypto Exchanges?

According to Zhao, depending on the user base, a centralized crypto exchange could actually be more secure and efficient than a DEX.

On a decentralized exchange like Binance DEX, every trade, transaction, and piece of data is recorded on the blockchain as permanently embedded information that cannot be altered. Hence, mistakes cannot be rolled back, and crypto users have to manage their own security independently.

“However, a DEX is not a ‘solve all problems’ solution. A user now has to secure their own wallets, computers, etc. Many users are much less capable of doing digital security than big exchanges. An unpopular opinion here, for many users, a DEX will be less secure than a centralized exchange. We see many people on Twitter complaining they lost their funds stored in a Ledger hardware wallet, most likely because someone got their seed. Regardless, we offer both choices to our users now, and it’s up to them to decide. We do think most people choosing DEX will be advanced users,” said Zhao.