Billionaires Have Trump to Thank: How the Mega-Rich Raked In $500 Billion in 2019

President Trump has been very good for billionaires. America's elite raked in a whopping $500 billion in 2019 thanks to stock and asset appreciation. | Image: AP Photo/Andrew Harnik

- The mega-rich saw their net worth spike to $5.9 trillion in 2019 as the Trump economy continued to expand.

- Strong fundamentals are expected to push the stock market further up in 2020.

- Top billionaires saw big gains through stocks and emerging assets.

The Trump economy is continuing to march forward , and the rich are now collectively worth $5.9 trillion. Heading into 2020, billionaires are likely to get even richer.

A rise in market liquidity , a low benchmark interest rate, and the strong upsurge in U.S. stocks will further boost the mega-wealthy over the next 12 months.

How the billionaires did it

According to Bloomberg, 172 billionaires in the U.S. raked in $500 billion in 2019, with Facebook CEO Mark Zuckerberg and Microsoft co-founder Bill Gates earning $27.3 billion and $22.7 billion respectively.

Most of the ultra high net worth individuals saw large gains in their wealth due to the recovery of the stock market and emerging assets.

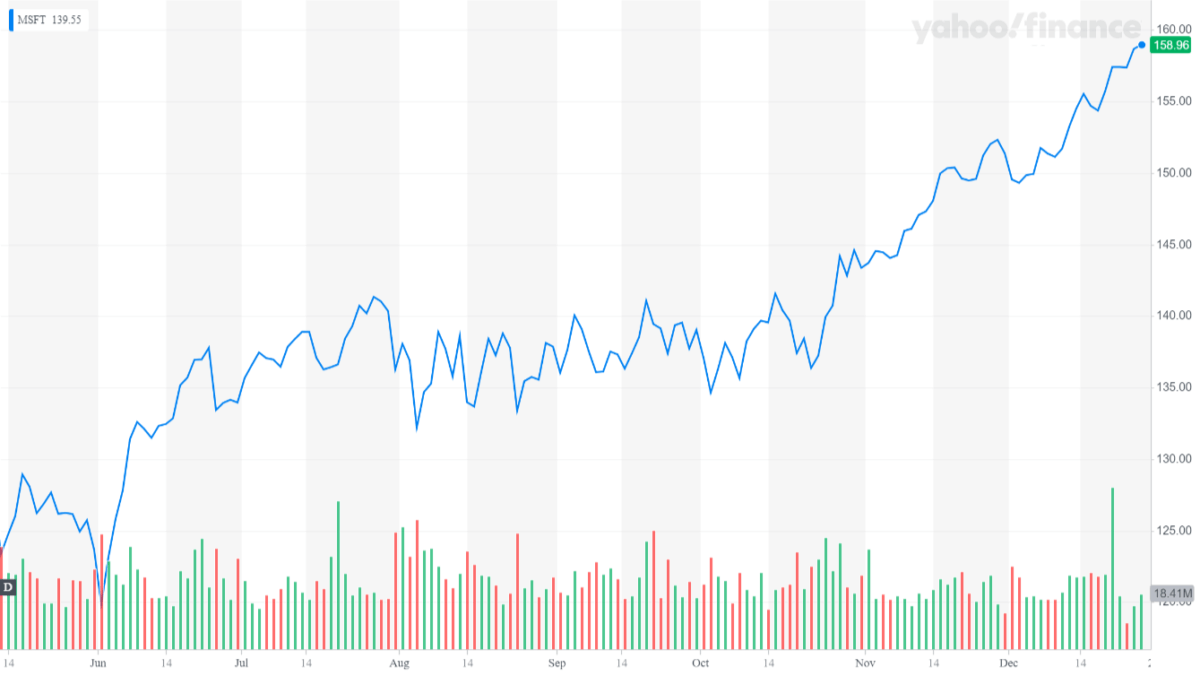

Bill Gates, for instance, briefly overtook Amazon CEO Jeff Bezos with a net worth of over $110 billion. The strong performance of Microsoft and its cloud computing department, which won a $10 billion contract from the Pentagon, pushed Gates’ fortune further up.

Bernard Alnaut, the CEO of LVMH Moët Hennessy, best known for being the parent company of Louis Vuitton, earned a staggering $39 billion in 2019 alone through high profile acquisitions.

The market capitalization of LVMH spiked by more than $82 billion following its acquisition of Tiffany & Co for $16.2 billion in November.

Regarding the acquisition, LVMH said:

The acquisition of Tiffany will strengthen LVMH’s position in jewelry and further increase its presence in the United States. The addition of Tiffany will transform LVMH’s Watches & Jewelry division and complement LVMH’s 75 distinguished Houses.

Warren Buffett, chairman of Berkshire Hathaway, made over a billion dollars from his stake in Apple that he purchased in 2016. In less than three years, his 9,811,747 shares of Apple are up 156.77%.

Taking advantage of relaxed financial conditions, high net worth CEOs pushed for large acquisitions and high profile product launches heading into 2020.

Companies that expanded in 2019 with strong sales such as Microsoft, Apple, LVMH, Amazon, and Tesla saw handsome gains to end the year with a positive note. That boosted the net worth of CEOs and major stakeholders.

Trump will make it even better

The Dow Jones is up 22.8% year-to-date and as CCN.com reported, U.S. President Donald Trump is likely to keep the markets elevated heading into the 2020 re-election.

President Trump can control the main factors that have pushed equities higher throughout 2019. He can complete minor trade deals and continue to apply pressure on the Fed to maintain flexibility in the financial markets.

With no interest rate adjustments planned until 2021, the U.S. stock market is set to maintain its momentum through next year, which has been the biggest catalyst for the mega-rich.