Big Tesla Bull Just Downgraded TSLA Stock. Here’s Why

Tesla bulls may have bitten off more than they could chew with the yearlong rally. | Image: AP Photo/Ben Margot, File

- JMP Securities views Tesla’s current stock price as being too high.

- In July, the electric carmaker’s stock has surged over 50%.

- After beating delivery estimates for the quarter ending June, Tesla reports Q2 earnings this week.

Tesla (NASDAQ:TSLA) bull JMP Securities has downgraded the stock from “Market Outperform to Market Perform.”

Earlier this month, JMP raised the electric vehicle (EV) maker’s price target to $1,500 , terming the stock a “category killer.” Tesla is currently trading above $1,600. The price target was based on expectations that Tesla could hit $100 billion in revenue in half a decade.

TSLA not worth $1,600

Now the analyst says there is no compelling argument for Tesla’s current stock price:

We continue to believe that TSLA can become a $100 billion car company by 2025, but we cannot arrive at a reasonable basis for arguing that the stock should be valued above current levels, even considering our fundamental outlook.

At a price of nearly $1,650 per share, Tesla’s market cap is around $305 billion, making it the most valuable carmaker in the world. The stock surge has made Elon Musk the world’s 6th richest person .

Not all analysts agree

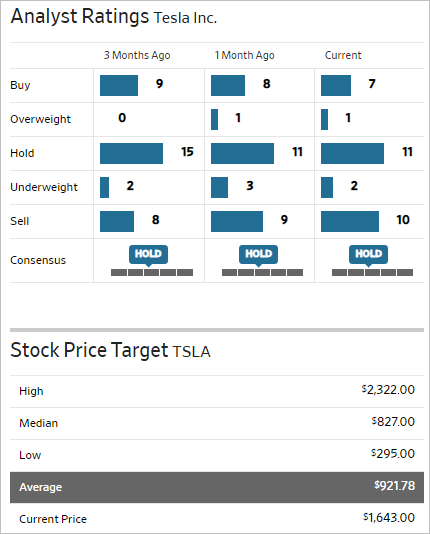

JMP’s downgrade contrasted with Piper Sandler’s sentiments several days ago. The Wall Street firm raised TSLA’s price target from $939 to $2,322 per share. TSLA would have to rise another 40% to reach this target.

The JMP downgrade is now closer to Wall Street’s consensus rating of ‘hold.’ The average price target for the stock is a little over $920.

Tesla’s moment of truth

Just this month, Tesla’s stock has appreciated by over 50% after the EV maker reported that it delivered 90,650 vehicles.

The expectation that Tesla could join the S&P 500 Index if it reports its first annual profit is a factor, too.

Tesla has reported profits consistently in the last three quarters. Joining the S&P 500 Index could give the stock more upside potential.

Consensus estimates lean on the electric vehicle maker reporting a loss, though. Thirty-three analysts polled by FactSet expect a GAAP loss of $1.02 per share and an adjusted loss of $0.14 per share.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.