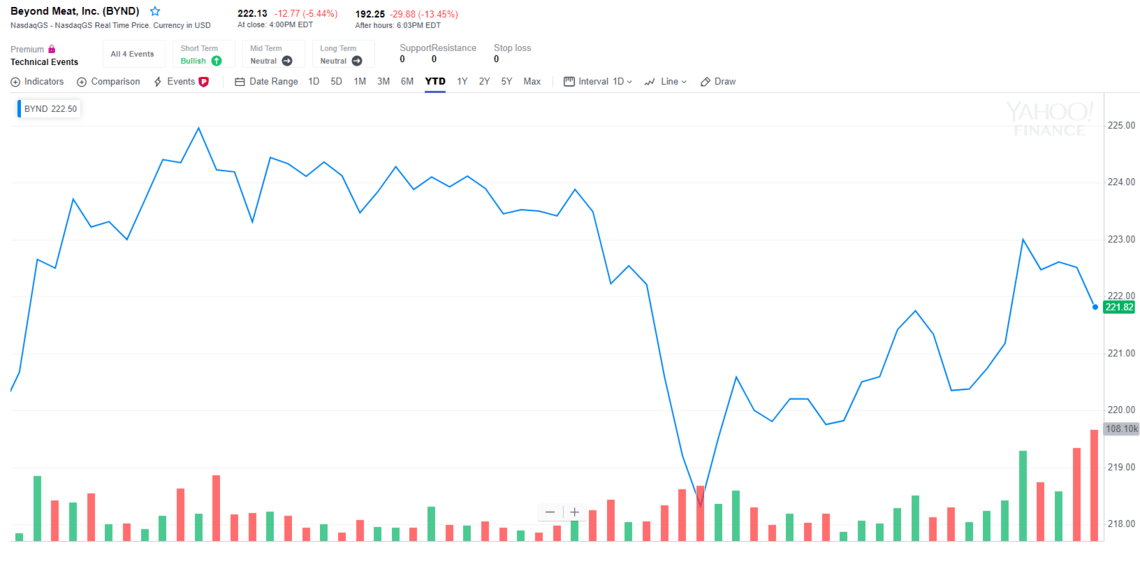

Beyond Meat Tanks 13 Percent After-Hours Because of This Terrible News

Beyond Meat reported a huge surge in revenue, but its valuation is ridiculous. That's why it's also having a secondary offering. | Source: Shutterstock

Beyond Meat reported its quarterly earnings on Monday. The numbers are not terribly impressive and hardly justify Beyond Meat’s stock valuation. Yet the company made a separate announcement that tanked the stock and will continue to tank the stock going forward.

First, though, here are the important numbers and how to interpret them.

Beyond Meat Still Makes No Money

Revenues were $67.3 million, an increase of 287% over last year. One would think that 287 percent revenue growth would be amazing – and it is, in the absolute.

Yet for a company valued at $11.6 billion, it is now trading at 160x revenue, which is absurd in the extreme. Even Amazon only trades at 4x revenues, and Uber trades at 6.5x revenues.

Gross profit came in at $22.7 million, or 34 percent as a percentage of sales, compared to gross profit of $2.6 million, or 15 percent as a percentage of sales last year.

This is good news. It demonstrates that Beyond Meat is becoming more efficient at keeping a lid on its cost of sales.

Beyond Meat had a net loss of $9.4 million, or $0.24 per share, compared to a net loss of $7.4 million, or a loss of $1.22 per share last year.

Judging a relatively new company based on its bottom line isn’t a very reliable method of valuation. What is significant, however, is the absurd valuation the stock market gives Beyond Meat considering the company is not even profitable.

Cash and Cash Flow Are Doing Just Fine

Adjusted EBITDA, which is cash flow adjusted for certain one-time items, came in at $6.9 million compared to an adjusted EBITDA loss of $5.6 million.

On an operational basis, it is good to see Beyond Meat’s cash flow is now positive, yet the stock remains unjustifiably high based on this metric.

Beyond Meat has $277 million in cash with only $30.5 million in debt. Thus, Beyond Meat has plenty of cash on hand, and thus the cash used in operating activities of $22.4 million for the past six months (compared to $12.7 million last year) does not raise liquidity concerns.

For the 2019 fiscal year, management said to expect 170 percent revenue growth to $240 million, and adjusted EBITDA will be positive instead of the previous expectation of breakeven.

The Terrible News Is Revealed

However, Beyond Meat is doing a very smart thing in making a secondary equity offering with its stock at these absurd prices. It plans to offer 3.25 million additional shares. This will likely raise an enormous amount of capital – possibly in excess of $450 million.

Yet there are two disconcerting matters concerning this equity offering.

The first is that 3 million shares will be sold by current shareholders of Beyond Meat.

That means these shareholders are getting out of Dodge while the share price is absurdly high, which may show prudence as far as covering their respective behinds from a wealth standpoint. But it also shows skepticism about the company’s long-term prospects.

Not only did this news send Beyond Meat stock down 13 percent in after-hours trading, but the share float will increase by 10 percent. This will make it easier to short the stock but not quite as easy to cause a short squeeze.

It has been hype, combined with a scarcity of shares, that has driven the stock to these levels. You should avoid Beyond Meat stock.