Bakkt CEO Kelly Loeffler Targets July for Thrilling Bitcoin Futures Launch

After a series of delays, Bakkt CEO Kelly Loeffler expects regulators to give the green light for bitcoin futures contracts. | Source: Shutterstock

By CCN.com: It’s finally happening. The Intercontinental Exchange (ICE), the parent company of Bakkt, has officially filed for bitcoin futures approval with the U.S. Commodity Futures Trading Commission (CFTC), according to a blog post this morning by Bakkt CEO Kelly Loeffler. Although the CFTC hasn’t approved the new platform yet, Loeffler seems confident it will, stating:

“…bitcoin futures will be listed on a federally regulated futures exchange in the coming months.”

What We Know About the Platform

Loeffler sheds some light on the upcoming platform launch in her post. Here’s what we know:

- Bakkt will list two futures platforms – one for daily settlements and another with a month-long timeframe.

- The platform has tools in place to detect wash trading and exclude it (as well as other deceptive practices) from its price discovery.

- ICE Clear U.S. will margin the bitcoin futures, but Bakkt is still contributing $35 million toward clearinghouse risk.

- The company still plans to settle the futures contracts with physical bitcoin, differing from futures competitors the CME and Cboe which only settle in cash.

Bakkt Has Had a Long Road to Regulation

Since announcing the platform in August 2018, Bakkt has pushed back its launch date on several occasions. Originally, Bakkt executives planned to launch the first futures contract on December 12. Shortly after the announcement, though, the team pushed that date back to Jan. 24, 2019. A government shutdown and several regulatory hurdles now place the launch in July this year.

Bakkt is also working with the New York State Department of Financial Services to become a qualified custodian for customers’ digital assets. Because the platform settles contracts in bitcoin, this approval is almost a necessity for its success.

Will Bakkt Cause the Next Bitcoin Bull Run?

Several analysts believe that Bakkt is going to spur a new wave of bitcoin institutional investments. The backing of ICE, which also owns the New York Stock Exchange, brings a level of credibility to the platform that we haven’t previously seen.

Equally as exciting are the company’s partnerships with Starbucks and Microsoft. The details of the deals are still murky, but according to an August 2018 press release, Bakkt will

“…leverage Microsoft cloud solutions to create an open and regulated, global ecosystem for digital assets.”

And,

“Starbucks will play a pivotal role in developing practical, trusted, and regulated applications for consumers to convert their digital assets into U.S. dollars for use at Starbucks.”

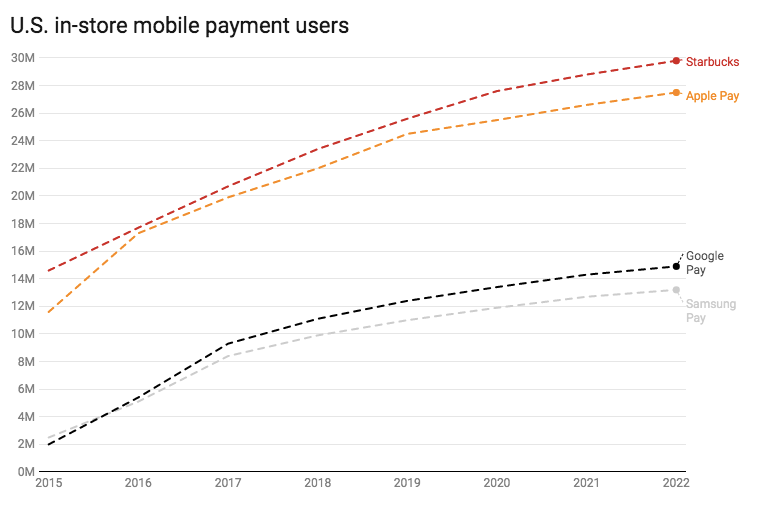

With more than 20 million users in the U.S. on its Mobile Pay app, Starbucks tops Apple, Google, and Samsung Pay. So, the implementation of bitcoin payments could easily give the market a boost.

Through these partnerships, Bakkt is opening up the cryptocurrency process (from acquisition to spending) to a whole new class of people who otherwise would remain sidelined. A successful futures launch in July should bring in a large crop of new institutional investors while the Starbucks implementation shortly after will draw in those on the retail side.