Asian Stocks See Mixed Results Following Fed’s Unusual Repo Operation

Asian markets await the outcome of the Federal Reserve's policy meeting scheduled to conclude Wednesday afternoon. | Image: AP Photo/Eugene Hoshiko

Stocks in the Asia Pacific region traded mixed on Wednesday, as investors gauged prospects for monetary policy after the Federal Reserve took action in re-balancing the money markets.

Asian Markets Mixed

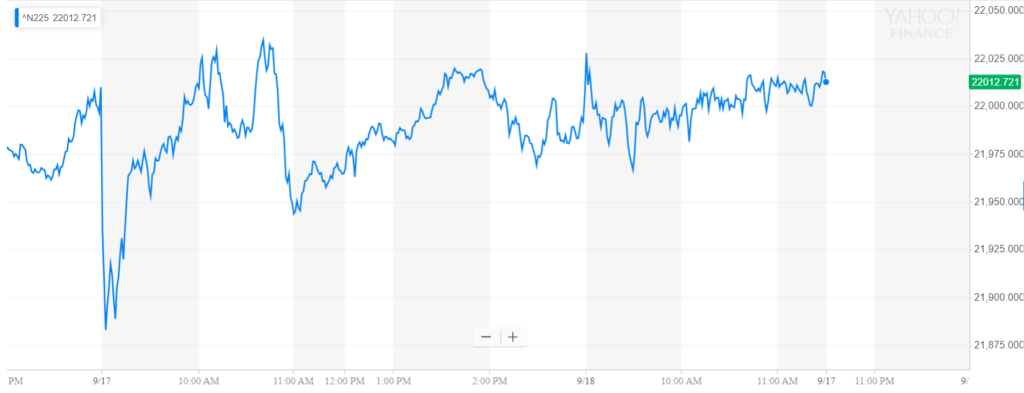

There was no clear-cut direction in Asian equities on Tuesday. Japan’s benchmark Nikkei 225 index edged up 0.1% to 22,012.72.

The Topix index, which also trades in Tokyo, fell 0.4% to 1,608.08.

Mainland China’s CSI 300 Index jumped 0.8% to 3,922.80 and was on track to snap a two-day skid. Hong Kong’s benchmark Hang Seng index traded 0.1% higher at 26,813.89.

Fed Injects Billions into Financial System

For the first time since the financial crisis, the Federal Reserve moved on Tuesday to shore up liquidity constraints by conducting a repurchase operation that injected billions into the financial system.

Basically, the U.S. central bank bought $53.2 billion worth of securities and vowed to purchase another $75 billion through another overnight repo operation. The move is designed to put a limit on short-term interest rates, which rose more than fourfold to a high of 10%.

Short-term interest rates are sensitive to funding shortages. The Fed acted because there seems to be a sizable gap between the funding needs of the market and what’s currently available. Banks get the overnight capital they need by pledging collateral, usually Treasury bonds, in exchange for cash. When the Fed provides the cash, they basically print the money in exchange for the securities.

U.S. Stock Futures Market Remains Calm

Futures on U.S. stocks traded slightly lower on Wednesday, as traders looked ahead to the Federal Reserve’s forthcoming interest-rate verdict. Dow Jones Industrial Average (DJIA) futures were down 17 points, or 0.1%, to 27,093.00. S&P 500 futures declined 0.1% to 3,005.75. The Nasdaq 100 mini futures contract was also down 0.1% at 7,907.00.