Attn: Robinhood Traders. Apple Just Made a Massive iPhone Order

Apple's suppliers are reportedly manufacturing 75 million 5G iPhones this year - and that bodes well for Apple stock in Q4. | Source: Shutterstock.com

- Apple has asked its suppliers to manufacture 75 million 5G iPhones in 2020.

- Analysts expect Apple to ship over 80 million iPhone models this year, despite the pandemic and global recession.

- The dominance of the firm in the wearables market in Q1 2020 raises the chances for a blockbuster Q4 performance.

While the smartphone sector plummets after the pandemic, Apple is thriving. The demand for the firm’s flagship product iPhone is rising, signaling a strong fourth-quarter performance.

Apple reportedly requested its suppliers to produce 75 million 5G iPhones . It is roughly the same number of phones as in 2019, showing Apple’s resilience amid a worldwide recession.

Reports Say 80 Million iPhone Shipments Expected in 2020

Apple has outperformed all smartphone manufacturers throughout the past nine months.

As CCN.com previously reported, top smartphone firms, including Samsung and Huawei, saw sales decline by 5.8% to 27.1%. Apple managed to minimize the drop in iPhone sales by 0.4%, buoying its second-quarter performance.

The confluence of a relatively minor drop in Q2 sales and the growing iPhone 12 hype is catalyzing sales expectations.

According to Bloomberg, sources familiar with the matter said iPhone sales could reach 80 million units this year.

Apple’s plans to build four new products in October and the excitement around iPhone SE caused analyst confidence to improve.

Analysts expect Apple to release more affordable versions of the new iPhone model first. The company said the iPhone 12 launch would come a few weeks later than last year’s release.

Two Factors Supplement Apple’s Strengthening Momentum

Heading into the last quarter of 2020, Apple has two key fundamental factors complementing the rising demand for new products.

First, the firm’s main supplier is TSMC, the world’s largest semi-conductor conglomerate based in Taiwan.

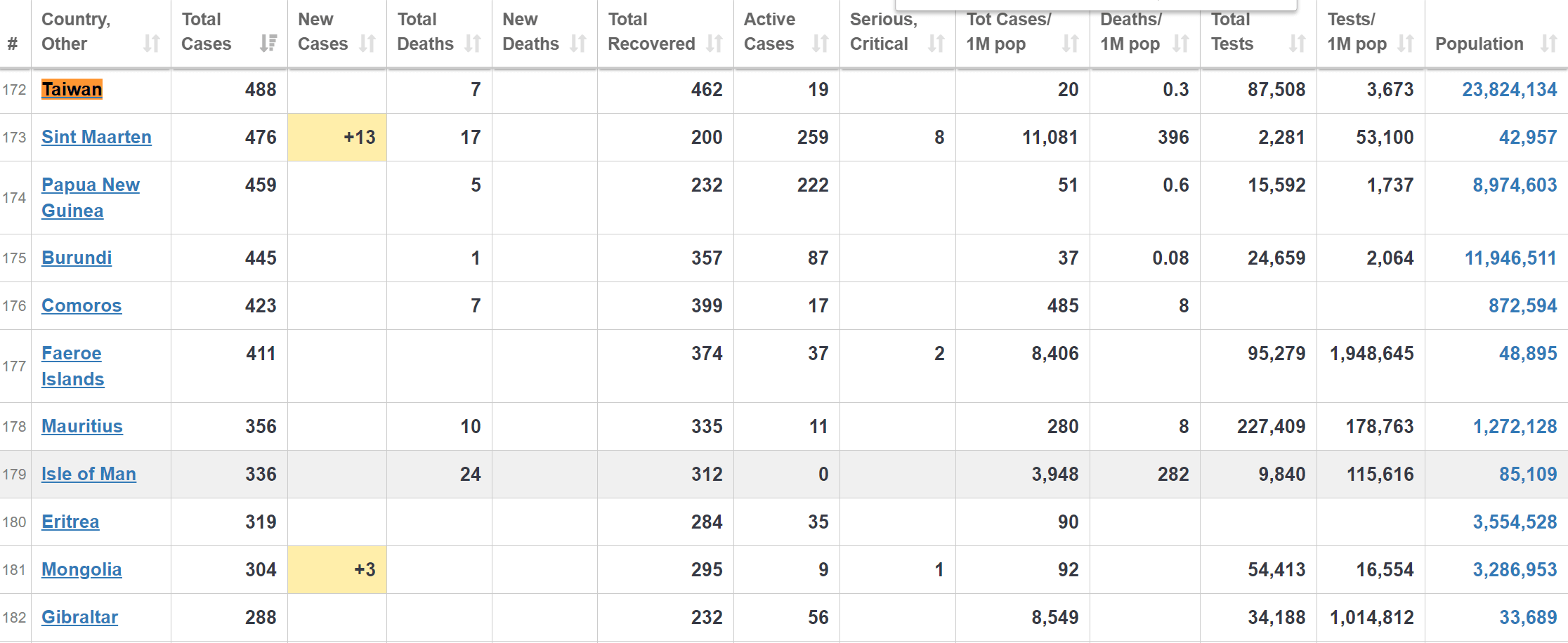

Relative to most countries, Taiwan remains one of the few countries that have controlled the pandemic. Data shows Taiwan has recorded 488 total COVID-19 cases to date.

The smooth reopening of Taiwan’s economy and factories would reduce potential disruptions in manufacturing new iPhone models.

Second, Wedbush analyst Daniel Ives has consistently emphasized throughout August that Apple is nearing a “supercycle.”

Many users, especially in China, are holding Apple products that are two to three years old. Millions of users are likely looking to replace their old models, which coincides with the release of the iPhone 12.

Ives said 350 million iPhones are facing an upgrade period. He described the launch of the iPhone 12 as a “once-in-a-generation opportunity,” calling it a supercycle.

Other Products Expected to See High Demand

Atop the highly-anticipated new iPhones, Apple is preparing to release the new iPad Air, two new Apple Watch models, and a new headphone.

The headphone would be released separately from the Beats brand, further strengthening Apple’s presence in the wearables market.

In Q1, IDC reported that Apple’s wearables market share rose by 23% . Throughout late 2019, the firm had continued to dominate the wearables sector with the AirPods.

Apple sold 21.2 million wearable units, which include the AirPods and the Apple Watch. IDC’s report reads:

“While Apple Watch shipments declined due to difficulties in the supply chain, the strength of the Beats and Airpods lineup was more than enough to offset the negative growth.”

Apple’s continuous dominance in the wearables market, combined with the predicted massive shipments of new iPhone models, set the firm strongly for another blockbuster Q4 performance.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.