Apple’s iPhone Woes are Over, But are AAPL Shares Really out of the Woods?

Apple and its suppliers may be in for a rough Q1 2019. | Source: Shutterstock

A top equities analyst, drawing on his knowledge of the company’s suppliers, predicts “limited downside risks” for Apple’s share price. He follows Morgan Stanley’s sentiment last week that the worst could now be over for the tech giant’s stock.

Ming-Chi Kuo Says Q2 iPhone Results Will Beat Expectations

Ming-Chi Kuo is an analyst with TF International Securities. According to CNBC , he says there are now:

Limited downside risks for Apple and iPhone suppliers’ share prices.

He added that iPhone shipments in the second quarter of 2019 will outperform market consensus, though Apple may still see a year-on-year fall in iPhone sales over the coming year. The severity of the fall should now start to slow.

Kuo has priced in weaker demand from China but is also counting on increases in sales outside of China, mainly in Europe. He also forecasts increased replacement demand as Apple offers trade-in opportunities and deals to its consumers. Kuo says:

If Apple continues the trade-in programs and the US-China trade war does not worsen further, we expect 2H19 iPhone shipments will be generally flat YoY.

Morgan Stanley Flags Recent Apple Sell-Off as Entry Point

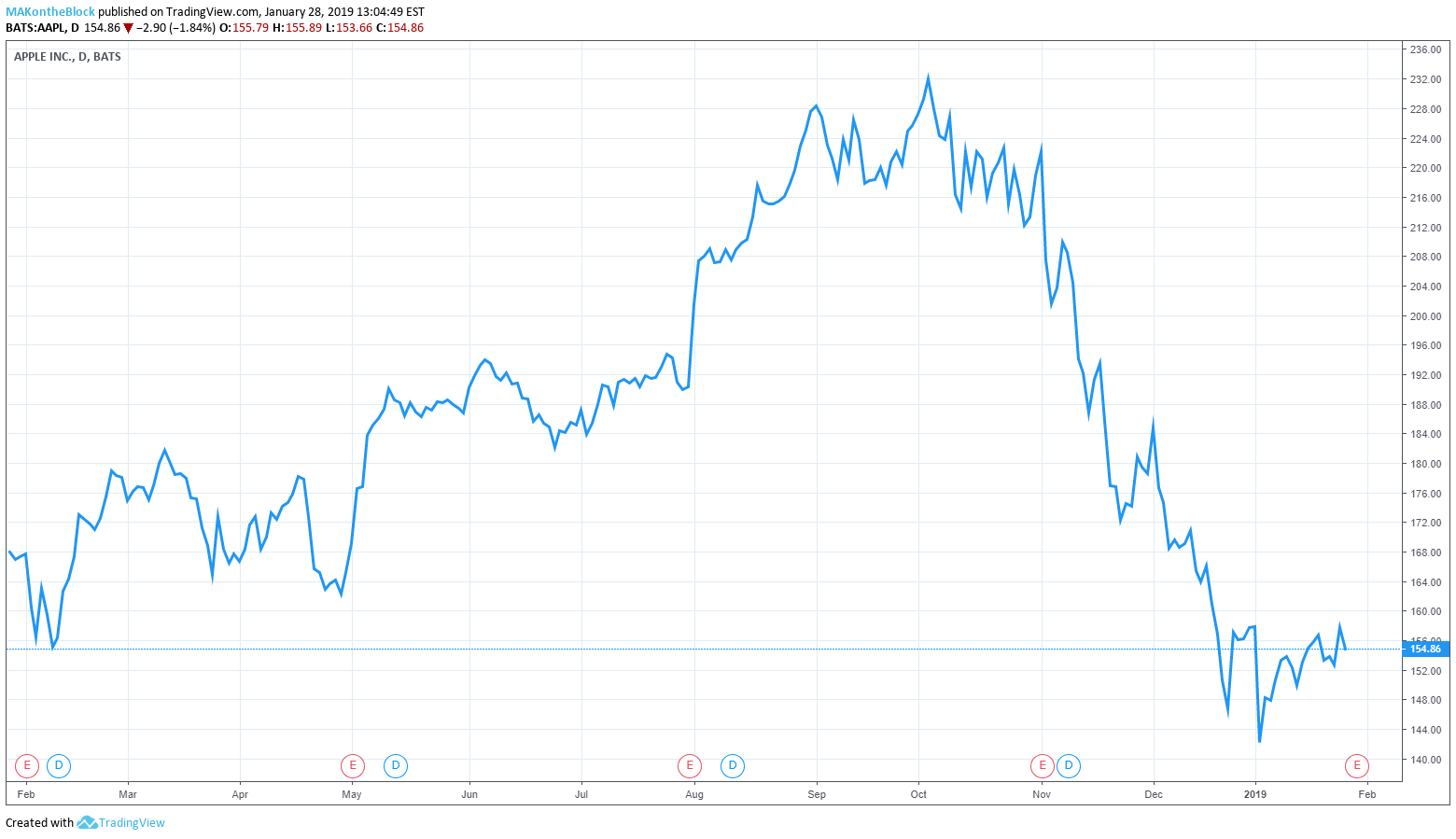

The company’s analysts now say investors should think about buying Apple shares before the iPhone maker releases its Q4 2018 results. Morgan Stanley says AAPL shares are not likely to fall further. Despite clawing back losses in 2019, Apple’s share price is still nearly a third below its value in October 2018. Morgan Stanley analyst Katy Huberty says:

We believe the recent pullback is an attractive entry point.

Huberty also pointed to positive sentiment based on new service launches and Apple shareholders “already pricing in extremely cautious iPhone replacement cycle and average selling price headwinds.”

Huberty believes that it’s time to buy Apple stock and that:

March quarter guidance will provide a base for forecasts during the remainder of the year.

However, for shares to recover further, the company does indeed need to deliver a revenue performance above consensus.

Apple analyst Kuo forecasts first-quarter 2019 iPhone shipments of 36 million to 38 million, though actual iPhone units sold will not be announced. Huberty and Morgan Stanley think Apple stock could:

Trade up on revenue and gross margin guidance range of $58 billion and 38 percent at the mid-point respectively, guidance meaningfully below these levels would fuel the bear case.

https://twitter.com/wjboynton/status/1088846460282720256

Are Apple’s Share Price Woes Really Over?

Morgan Stanley also draws attention to Apple’s revision of its services revenue growth down from 25% in the third-quarter of 2018 to a new figure for 2019 of 18%. The analysts expect further details in Apple’s upcoming earnings call but believe the company could be purposely setting the bar low.

News is currently breaking that, according to anonymous sources, Apple is planning a subscription service for games. Discussions may have begun with game developers as early as the second half of 2018. Such a service could be a game-changer for Apple. Analyst Gene Munster of Loup Ventures says:

It’s a big enough market to move the needle for Apple

The development may not be in time to save services revenue growth for the first two quarters of 2019. Two other analyst surveys, according to 9TO5Mac , predict that services growth could slow to between 18% and 21% in the second quarter of 2019. Services revenue growth was 31% in the same period of 2018.

Furthermore, a change to the way the company accounts for its services revenue would mean the 21% figure from a PED 3.0 survey would really be closer to 14%. A Wall Street Journal report says:

Analysts now expect Apple’s service revenue to average 15% annual growth over the next four quarters. Under the old revenue numbers, that average would have been 22%.

Apple’s earnings call may or may not reveal further information on the company’s service plans, now a key driver of the firm’s revenue as iPhone sales sputter. The company’s performance will also be closely linked to the performance of China’s economy and a resolution of the US-China trade war.

Last Friday, a 3.31% rally thrust Apple shares into positive territory for the year, albeit to the tune of just 0.1%. However, AAPL fell 0.93% on Monday despite the more positive dialogue from analysts.

Featured Image from Shutterstock