How Apple Stock Reacts After Every Major iPhone Reveal

Apple CEO Tim Cook is expected to announce the hotly-anticipated iPhone 11 later today. | Source: Photo by Brittany Hosea-Small / AFP

It’s the biggest day of the year for Apple and Tim Cook. Yep, it’s the annual iPhone reveal, coming live from the Steve Jobs Theatre in Cupertino on Tuesday. Apple is expected to launch three new iPhones: the iPhone 11, 11 Pro, and 11 Pro Max. But how will Apple stock react?

Based on past performance, Apple investors tend to sell heavily immediately after the announcement. But the following 60 days usually yield returns. Let’s dive into the data.

Apple stock performance one day after iPhone launches

Investors often have a negative knee-jerk reaction to Apple stock after big iPhone events. As you can see below, the stock fell or remained flat in eight of the last 13 events in the 24 hours after the reveal.

- iPhone 1: 0%

- iPhone 3G: -2%

- iPhone 3GS: -1%

- iPhone 4: -1%

- iPhone 4S: +2%

- iPhone 5: +2%

- iPhone 5C: -5%

- iPhone 6: +3%

- iPhone 6S: -2%

- iPhone SE: +1%

- iPhone 7: -3%

- iPhone 8: -1%

- iPhone XS: +1%

This makes a lot of sense. Apple events are typically front-run by hype and rumors so there’s rarely much surprise when the event finally arrives. A classic ‘buy the rumor, sell the news’ event.

A better gauge of success is the longer-term horizon.

AAPL 60 days after iPhone event

The stock price in the two months after an iPhone launch is much more positive. Tracked 60 days after the launch, Apple stock has traded positive nine out of the last 13 launches.

- iPhone 1: +4%

- iPhone 3G: -11%

- iPhone 3GS: +15%

- iPhone 4: +4%

- iPhone 4S: +5%

- iPhone 5: -18%

- iPhone 5C: +6%

- iPhone 6: +12%

- iPhone 6S: +4%

- iPhone SE: -10%

- iPhone 7: +1%

- iPhone 8: +9%

- iPhone XS: -20%

What’s interesting about the numbers is how hard Apple falls when the iPhone launch disappoints. Last year, as iPhone sales tumbled, the stock fell 20% in the months following launch. The iPhone 5 event triggered an 18% loss.

In other words, expect a small rise if the event is successful but a big plunge if it’s poorly received.

Apple iPhone 11: what we know so far

The new iPhone 11 range is expected to be a minor refresh rather than a dramatic overhaul. Headline rumors include the introduction of a third camera for ultra-wide images and enhanced video editing software.

The phones are expected to come in new colors and the more expensive models will feature wireless AirPod charging.

Analyst Ming-Ch Kuo, who is renowned for accurately predicting Apple innovations, claims that Tim Cook is holding back for 2020 . Next year will usher in 5G and a complete design overhaul. In contrast, tonight’s event is likely to be a quieter affair.

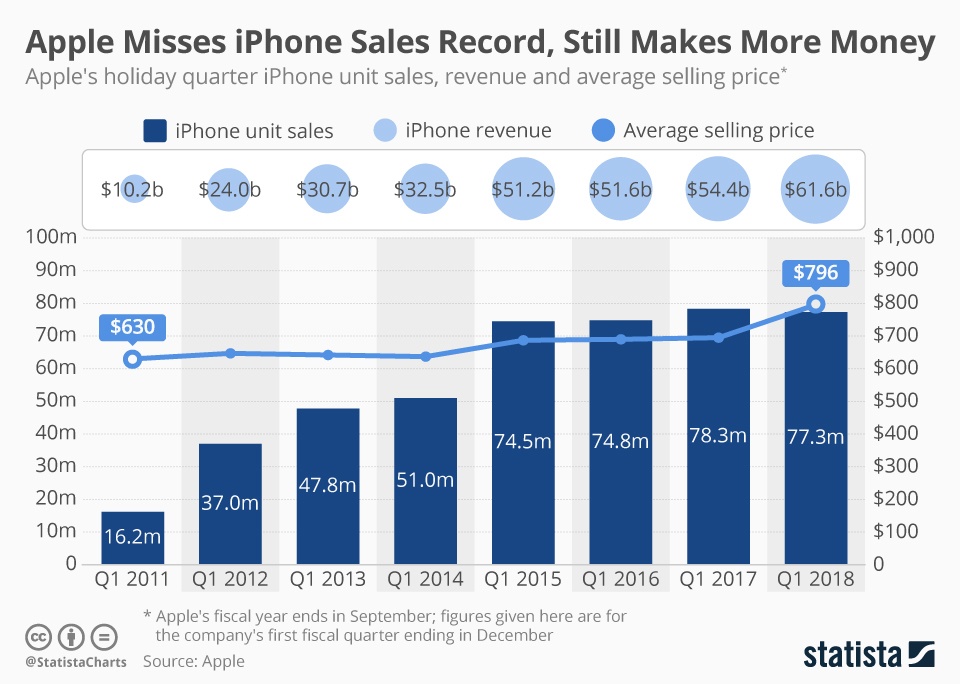

Tim Cook still reliant on iPhone

As CCN.com reported, Tim Cook has been busy expanding the Apple business to reduce its reliance on iPhone sales. New products and services include Apple Watch, Apple Music, Apple TV+, and the new Apple Card.

The move has supercharged Apple’s ‘services’ revenue. But the company still relies on iPhone for 55.6% of its business. After last year’s sales slump, tonight’s event is still the biggest moment of the year for Apple.

Impact of Trump tariffs?

There’s another factor looming over this September’s iPhone event: Trump’s China tariffs. On 15th December, the Trump administration will enact a new levy on Chinese exports; a move that will impact 92% of Apple’s hardware .

It means traders will have to navigate a complicated mix of iPhone unit sales, public response, and the over-arching global political backdrop.