Apple Stock a Screaming Buy, Will Surge 21% Despite ‘Underwhelming’ Apple TV+ Launch: Analysts

Apple's 'subtle' approach to its pivot as a services company is a good thing, analysts say. | Source: Apple

Apple stock bled out on Monday afternoon as Tim Cook revealed his long-awaited Netflix rival, Apple TV+.

Traders were immediately underwhelmed by the lack of details and the stock ended the day 1.2 percent lower.

But don’t believe the hype. Wall Street analysts have weighed in since the announcement and most still think Apple stock is a screaming buy.

Apple stock has 21% upside

At least seven analysts re-affirmed their “buy rating” on Apple shares after the big reveal. The most optimistic of which (Samik Chatterjee at JP Morgan) put a $228 price target on the stock – a 21 percent upside from yesterday’s closing price.

The $228 price target would take Apple stock within touching distance of its all-time high. Chatterjee did show concern for Apple’s lack of clarity on its streaming service. But said Apple’s new credit card and its “Arcade” gaming service gives it a new edge.

Netflix has an “Inferior Position” to Apple

One of the most damning assessments for Netflix came from analysts at Needham. Laura Martin said :

“NFLX has an inferior competitive position to AAPL over time.”

She says Apple will have an easy time converting users while Netflix is left spending a fortune on customer acquisition:

“AAPL has zero consumer acquisition costs since it will first target its captive 900mm global unique users, which are the wealthiest consumers in the world.”

Further reading: 5 Reasons Apple’s Streaming Service Will Destroy Netflix in Five Years

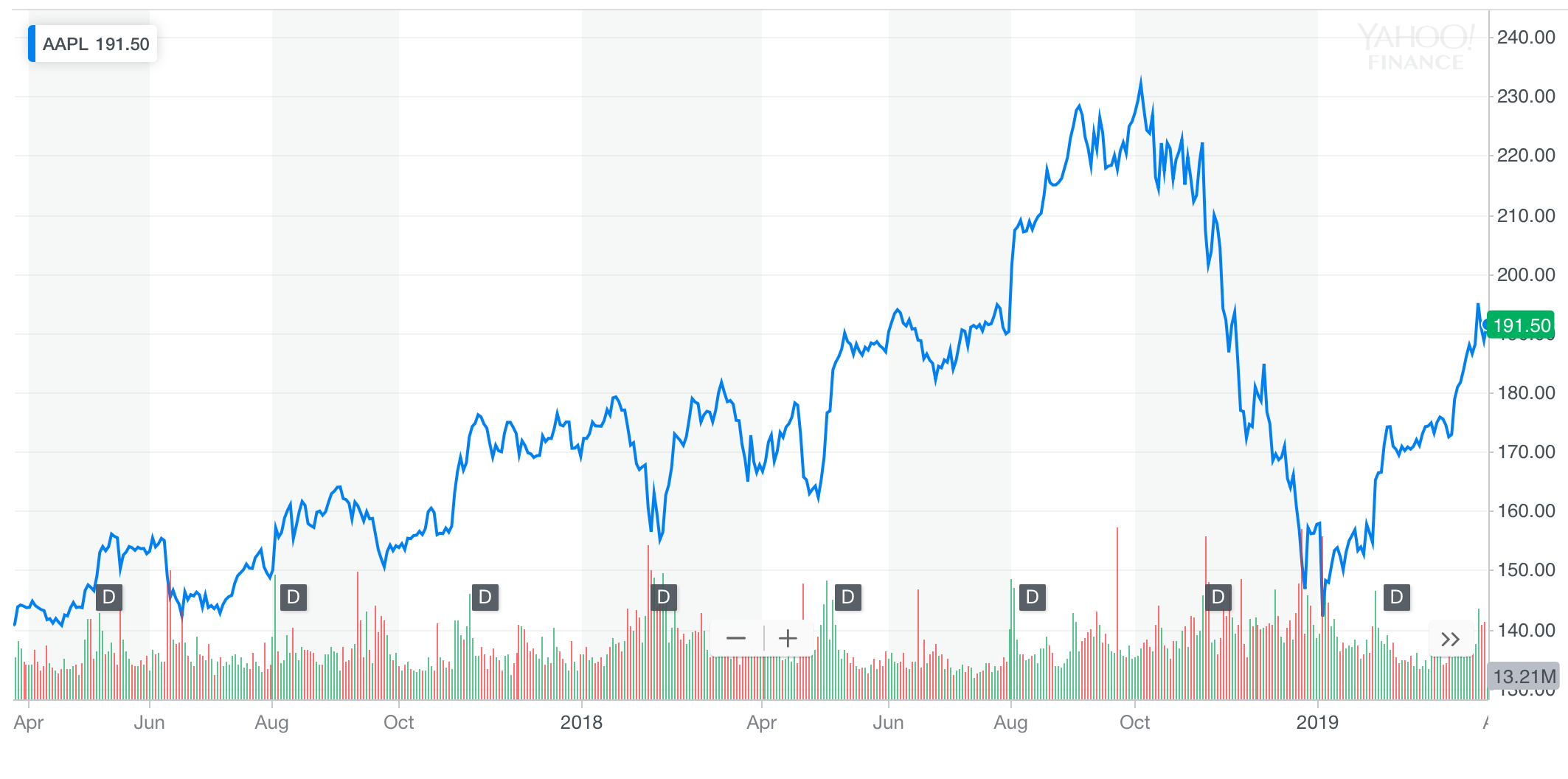

Apple stock always plunges on big announcements

If you look back at previous launch events, you’ll see a pattern in Apple stock. It almost always falls on the day of the announcement and for the following week. But in the medium-term, there’s a strong recovery.

On average, Apple stock rebounds 10.7 percent in the three months following major product launches.

Why did traders dump Apple shares?

Traders were underwhelmed by the lack of details in the Apple TV+ announcement. We saw plenty of celebrities including Oprah, Jason Momoa, and Steven Spielberg outline their vision for Apple TV+, but no concrete facts.

No price indication, no launch date, no timeline, no details on how it will integrate other services like HBO.

More than that, traders wanted a “wow” moment. As CNBC’s Jim Cramer said :

“The stock rolled over because these are all, I guess, pedestrian applications… [Traders] want Apple to change the world.”

Not everyone is bullish on Apple stock

Some analysts weren’t convinced by yesterday’s launch. Goldman Sachs was particularly harsh , which is ironic since Apple’s new credit card is powered by Goldman Sachs. And Citi told investors :

“We do not believe today’s announcement is a major catalyst for the shares as consumers are slow to change their behavior.”

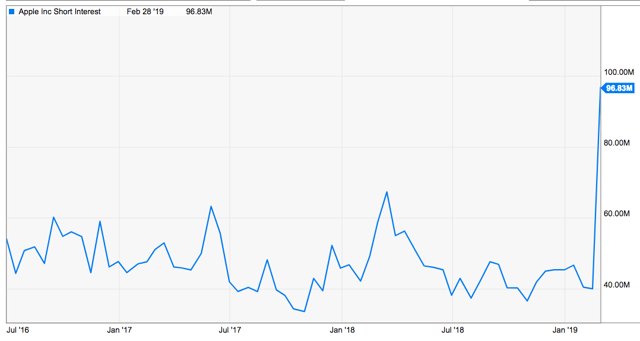

Meanwhile, short interest in Apple stock is at a three-year high after climbing 143 percent. More and more traders are now betting against the shares.

Apple services are a long play

The days of big, sexy Apple product launches are coming to an end. Apple is pivoting towards a reliable ecosystem of deeply integrated services. It might not impress traders right now, but the world’s largest company is building an unstoppable long-term strategy.