Apple’s Latest Hype Train Won’t Be Enough to Save the Stock

Apple made its biggest reveal in 2019 but its stock is taking a pounding in the face of a possible antitrust probe. | Source: Apple

By CCN.com: Apple wowed conference goers at Monday’s 2019 World Wide Developer’s Conference (WWDC) in San Jose, Calif. Despite the tech giant’s glittering new offerings, however, Apple’s stock faces a tough road ahead.

The escalating trade war with China, recession signals from global markets, and a new DOJ antitrust probe are creating enormous downside risks for owners of AAPL shares.

Announcements: WWDC 2019

iTunes Cancelled

The Cupertino-based computer and smartphone giant confirmed pre-conference rumors that it’s retiring iTunes. To cater to the new ways consumers buy and stream media, Apple is breaking iTunes up into three apps: Apple Music, Apple Podcasts, and Apple TV.

Mac Pro

The hardware maker has souped up its new Mac Pro, its most powerful computer, to the latest specs. It inspired many jokes for looking an awful lot like a giant cheese grater, but the peanut gallery can’t deny the latest Mac Pro is cutting edge.

iPhone

iPhone will now have dark-mode for system menus and native apps. Launch speed or apps should double with the latest updates (which will not be available for iPhone 6 and earlier). FaceID will also unlock your iPhone 30% faster.

iPad

iPad is looking more and more like a desktop computer with a touchscreen after Monday’s WWDC announcements. Switching and multitasking between apps will be more seamless with new software updates. And iPad now runs the desktop version of Safari.

Sign in with Apple

Privacy advocates were thrilled to hear about ‘Sign in with Apple’. It will automatically generate email addresses for third-party apps to conceal iOS users’ email address.

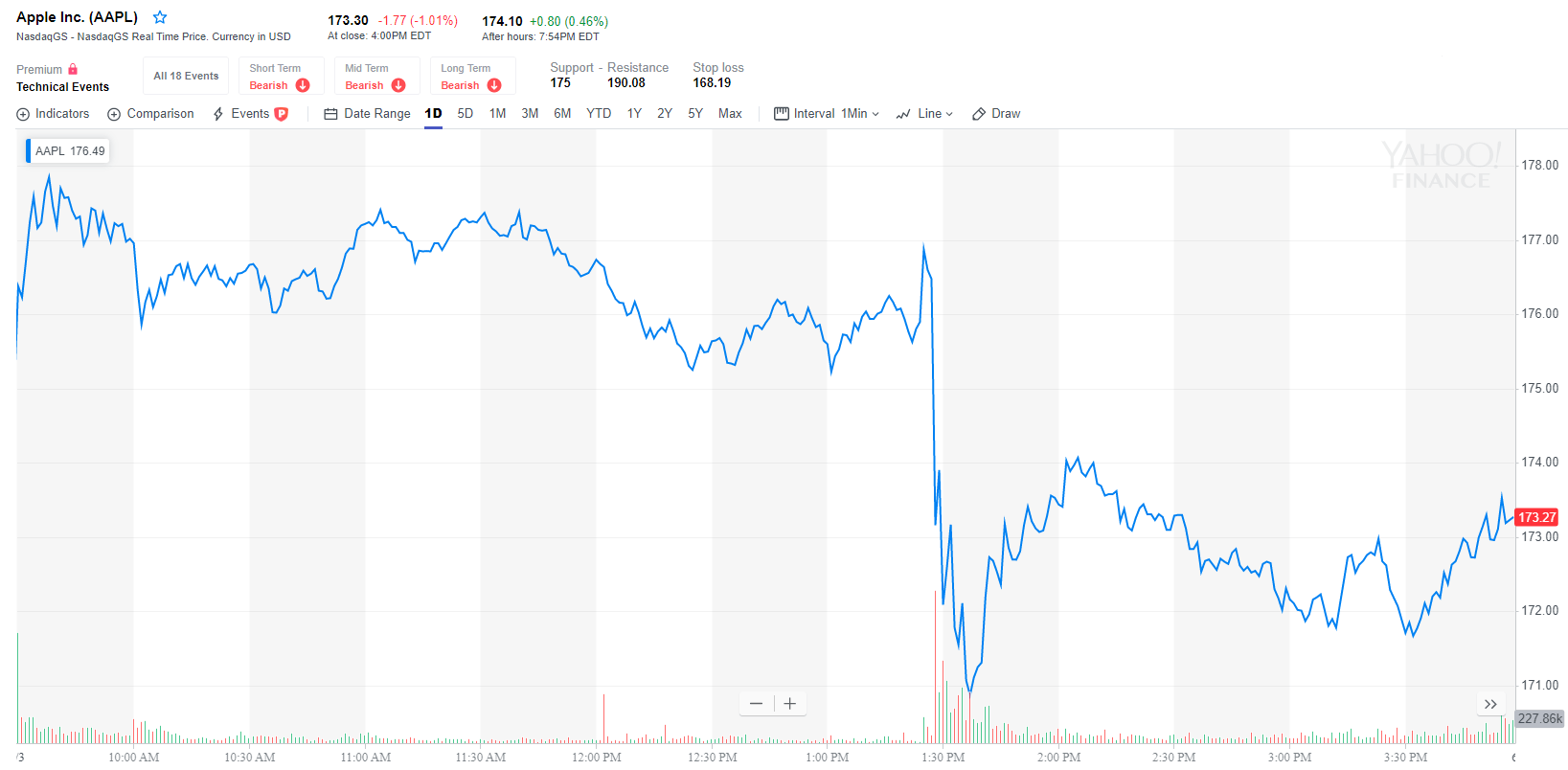

Apple Stock Hasn’t Bottomed Out Yet

While these are all enticing reasons for Apple fans to continue buying their products, investors looking for profits in the near term are wary of Apple’s stock.

That’s good news for long-term investors who plan to buy and hold for years or decades. Apple remains one of the most valuable brands in the world, with one of the most coveted product lines. And its quarter of a trillion dollar war chest is nothing to sneeze at.

Here are the risks for Apple stock in 2019:

1. Imminent Recession

A recession, which is looking increasingly more likely between now and 2020, will slow iPhone and all smartphone sales dramatically. In fact if you measure recession in terms of global smart phone sales– we’ve been in one since last November.

2. Trade War with China

Yahoo Finance reports that Citi warned iPhone sales could be cut in half by Trump’s trade war against China. That could be catastrophic for Apple’s stock.

Over the last year Apple, Inc. has had to reckon with the reality of iPhone market saturation in the West. While sales are still robust, expanding into foreign markets like China is essential to continue Apple’s big heyday of galactic year over year sales growth.

The company put an end to its practice of publicizing unit sales figures for iPhone and other products last November . That was a huge red flag for investors and Apple watchers.

3. Antitrust Investigation

While Apple’s developer conference was underway, news broke that the Department of Justice has secured jurisdiction to investigate the company under antitrust law.

The antitrust probe, along with concurrent probes of Amazon, Alphabet, and Facebook has tech investors spooked. The sweeping investigations into four Silicon Valley tech titans shows the feds are loaded for bear.

Last month the Supreme Court ruled that a separate antitrust case against Apple winding its way through federal court could proceed. Litigants in the suit are going after Apple’s lucrative 30% commission on app store sales.