Amazon Survived an Asset Bubble — Bitcoin Will Too: Crypto VC

Bitcoin isn't high on the list of things online shoppers wish was available on Amazon. | Source: Shutterstock

For the co-founder and partner of cryptocurrency firm CryptoOracle, Lou Kerner, patience is key when it comes to investing in bitcoin.

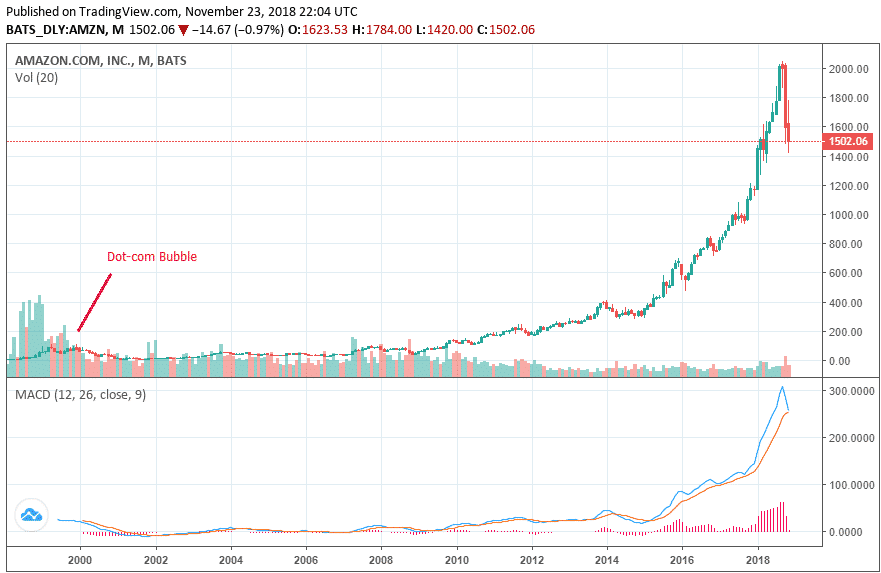

Speaking to CNBC , Kerner said bitcoin investors should take comfort in the example of tech giant Amazon, which lost significant value when the dot-com bubble burst but has now emerged as the world’s largest online retailer by market capitalization.

“If you go back to the internet bubble, which is what a lot of us in crypto look at for direction, Amazon, arguably one of the greatest companies in the history of the mankind, was down over 95 percent over two years,” Kerner said in an interview with the business news channel.

Not for the Faint-Hearted

According to Kerner, investing in bitcoin and other cryptocurrencies requires one to have the stomach for handling volatility. The current market weaknesses of crypto, per Kerner, can be attributed to the fact that digital assets lack underlying value other than confidence. In Kerner’s view, the bearish sentiment will, however, pass as the case for bitcoin as a store of value takes hold:

“I think it’s a store of value. I think it’s the greatest store of value ever created. It should surpass gold over time. It won’t happen overnight.”

With the market capitalization of bitcoin currently under US$80 billion at current prices, the flagship cryptocurrency would have to appreciate more than a hundredfold to reach gold’s status.

In his own words, much of the faith Kerner has in bitcoin can be attributed to a law coined by Roy Amara, a professor at Stanford University, which states that in the short term, the impact of transformative technology is overestimated while in the long term the impact is underestimated.

Bulls Still Standing

Kerner is not alone in holding a bullish view of bitcoin despite the prevailing bearish conditions. As CCN.com recently reported, the co-founder of Fundstrat Global Advisors, Tom Lee, still maintains that bitcoin will hit the US$15,000 price target by the end of this year.

Terming the recent market downturn an “awkward transition,” Lee is optimistic that institutional investors will embrace crypto in larger numbers once there is regulatory clarity.

Another diehard bitcoin bull who has not wavered in the current bearish climate is the co-founder and CEO of Blockstream, Adam Back. Earlier this week, Back projected in a tweet that in the coming years bitcoin could be trading in the US$250,000 to US$500,000 range:

“I consider $250k-$500k/BTC plausible in the years ahead, from the digital gold, censor-resistent competitor to physical gold, and internet native digital money.”

Featured Image from Shutterstock. Charts from TradingView .