Amazon Stock Falls after Jeff Bezos ‘Exposes Pecker’, Do Investors Need to Worry?

Should Amazon investors be concerned that Jeff Bezos' personal woes seem to be dragging on his company's stock price? | Source: Jim WATSON / AFP

Amazon CEO Jeff Bezos announced his divorce on January 5. In the days following his announcement, revelations of a potentially ongoing affair with Lauren Sanchez rocked the world.

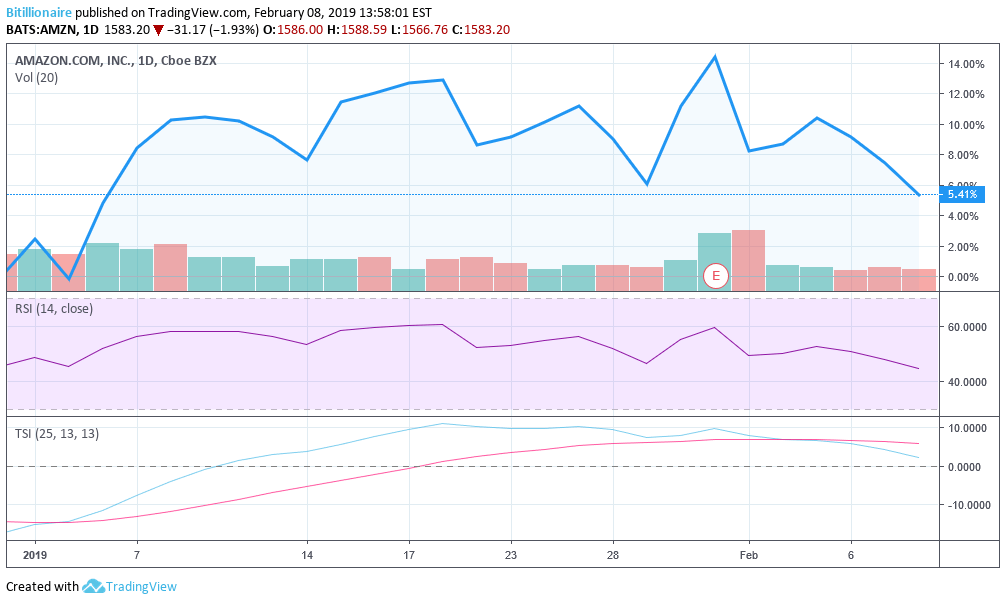

Amazon Stock Down 5% Since Divorce Announcement

Late yesterday, it was revealed that the National Enquirer attempted to extort Jeff Bezos in relation to some naked pictures of himself. There are concerns that a government agency might have been involved in the personal data leak. Amazon stock has fallen over 5% since the divorce announcement and nearly 2% today, but industry analysts aren’t concerned .

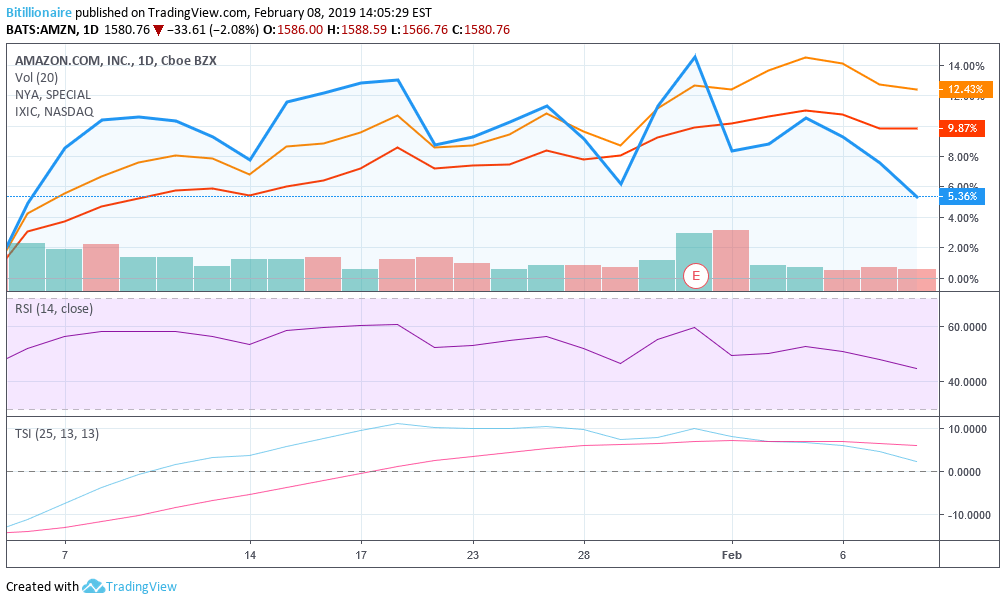

Amazon Underperforms Wider US Stock Market

Amazon is doing worse than both the NASDAQ and the New York Stock Exchange as a whole, as seen here:

Analysts say not to worry. The fundamentals of the company are what we should be following, and those are strong. An analyst for JMP Securities told CNBC:

“At the end of the day, we get back to the fundamentals of the company, irrespective of what executives are doing. I would be surprised if it had a negative impact on Amazon. It’s such a large business with a lot of different opportunities and operation. The way it’s set up with leadership across retail and AWS and the businesses underneath with logistics and advertising… there’s a lot of support here.”

It’s easy to be an Amazon bull, but let’s consider the prospects for the company if Jeff Bezos’ personal problems continue to take center stage. Would he step down from the company he built from the ground up? Effectively, he’s one of the largest shareholders in the company. His personal image would be hard to match with a replacement. He has consistently produced for the company and overseen it through its meteoric rise to the world’s most valuable company.

Beyond Personal Problems: Amazon’s Market Position Slipping?

Combined with other concerns about Amazon, like its slipping dominance in shipping superiority, insightful traders might begin opening up shorts on AMZN in anticipation of a compounding of these problems.

Another analyst from Evercore ISI tells CNBC:

“Certainly from a public relations standpoint, I don’t think it’s ideal. When you look at the fundamentals, it’s hard to imagine it will have a negative impact.”

Both of these viewpoints forget how important retail is to Amazon. It remains one of their biggest profit-makers. There’s more to it than the public perception of the company and its executives, as well. Retail giants like Walmart are aggressively fighting Amazon with everything they’ve got – and they’re not exactly losing, either.

Moreover, Amazon’s grip on the industrial computing market shouldn’t be viewed as a permanent situation. The field is extremely competitive. Google has really only become serious about the space in the past couple of years. When you enter a world where you’re competing with Alphabet, Inc, you’re going to have a bigger fight on your hands than you’re ready for. Amazon Web Services is another huge factor in Amazon’s profitability. Any significant losses there can contribute to sub-optimal quarterly reports, which will touch back into bearish trading.

Long-Term Amazon Outlook: Questionable

So while expert analysts are making the easy bull call on AMZN despite the recent problems in the boardroom, the long-term outlook might put Amazon in a more questionable position. If it loses dominance in retail or computer services or both, you’re looking at a whole different company in the future.

However, let’s not get ahead of ourselves. Amazon has consistently found creative ways to maintain its competitive edge, and plenty of these initiatives have been the brain children of Bezos himself. Perhaps a way to deal with the Google problem is to attack other areas of Google’s business, creating a war of attrition as Google encroaches on the web services market.

Amazon Alexa is already more successful than Google’s categorical products. What’s to stop Amazon from offering its millions of paying customers an alternative to Google Docs or even an answer to Slack? Anything can happen. If Amazon’s bearish trends continue, we can expect to see some interesting, creative moves from the company.

Jeff Bezos Image from Jim WATSON / AFP