Amazon Lost More Value Since July Than 2.5 Times Tesla’s Market Cap

Amazon stock has lost more value in the past month than the entire GDP of 23 countries and the market cap of 600 other stocks. | Source: (i) Drew Angerer / Getty Images / AFP (ii) Source: REUTERS/Mike Blake; Edited by CCN.com

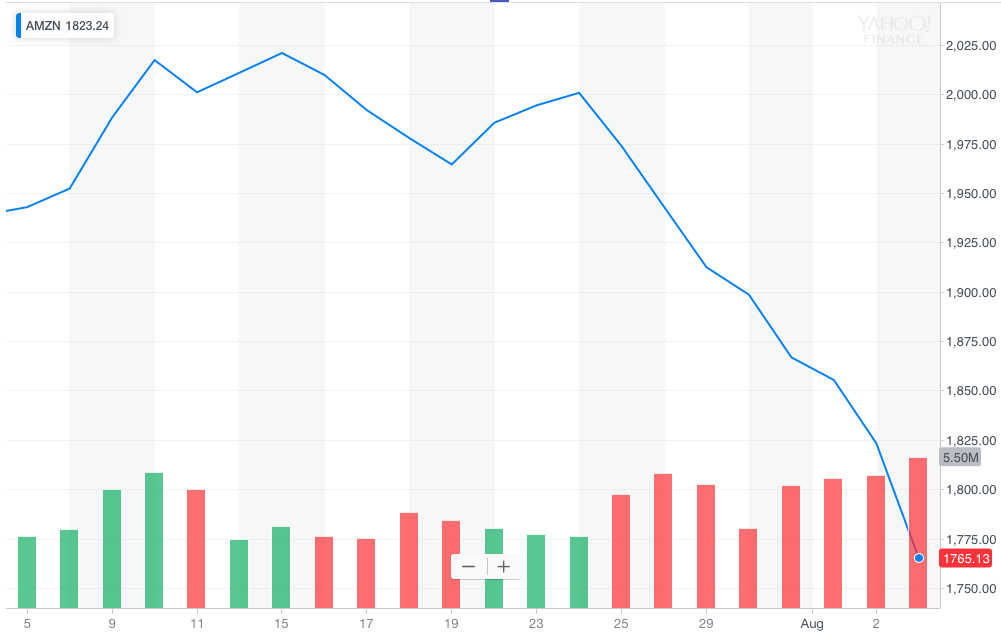

Amazon stock’s market value fell by a whopping $28 billion in Monday’s stock market slaughter. Since July 18, when Amazon reported its quarterly earnings, it’s market value has declined by $103 billion.

How huge is this loss? Let’s put it into perspective and then figure out why AMZN stock is getting hit so hard.

Amazon Lost More Value Than Some Nations Are Worth

The $103 billion market cap loss for AMZN stock is larger than the GDP of the world’s 23 smallest economies.

That’s 2.5 times Tesla’s market cap and more than half of Disney’s pre-Fox-merger market cap.

Of the entire large-cap stock sector – meaning stocks trading at over a $10 billion market cap – Amazon stock’s one-day loss was larger than the market capitalizations of 616 other companies. That includes American Express, which is valued at just about $100 billion.

Today’s decline in Amazon stock’s market cap is larger than the entire market value of each of the following companies: United Parcel Service, AbbVie, 3M Company, NVIDIA, Altria, General Electric, U.S. Bank, Charter Communications, Qualcomm, Booking Holdings (formerly known as The Priceline Group), and hundreds of other companies you’ve heard of.

Why Is Amazon Getting Clobbered?

There are several factors influencing the recent price action in Amazon stock.

Amazon has always been a highly volatile stock.

As one of the FAANG stocks, there is not only an extraordinary amount of media attention given to AMZN, but it is also widely held by both institutions and retail investors alike.

Therefore, it is going to be subject to more volatility than your average stocks and it will likely be the first to get hit badly in a market downturn. But it is also likely to be one of the first to recover.

Yet Amazon also has a couple of other longer-term concerns weighing on it. Everyone hates a winner, and everyone hates an elitist like Jeff Bezos. That the federal government should turn its attention to Amazon should, therefore, come as no surprise.

Here Comes the Big Bad Feds

The Department of Justice’s antitrust division has begun to investigate the company as being anti-competitive and potentially harmful to consumers. I don’t know if the DOJ has much of an argument in regards to Amazon being harmful to consumers. Consumers enjoy lower prices and faster delivery with Amazon.

However, investors may be waking up to the realization that the Department of Justice may very well have a case in regards to how Amazon may harm competition. There are plenty of retail stores, many of which used to be the biggest names in the business, that are now dying or dead.

Amazon’s online model devastated physical stores. As its cash hoard and cash flow continued to grow, Amazon was able to increasingly afford making thin margins or even taking losses on the sale of many products.

https://www.youtube.com/watch?v=cLgdgbMlcWs

Amazon is also being investigated by the Federal Reserve in regards to its cloud computing business. The Federal Reserve has concerns regarding the safety and security of all the data that Amazon now maintains in its cloud services.

There is a growing disdain for big tech companies in general.

While Amazon may be the least offensive of a group that includes Google, Twitter, and Facebook, investors may be starting to get jittery about how serious the federal government is going to be in cracking down on all of these companies.