Amazon Alarms Dow Jones Antiques as Elon Musk Shuts Superficial Tesla ‘Stores’

Founder and chief executive Jeff Bezos is reportedly bringing Amazon into the grocery sector beyond whole foods. | Source: Photo by JASON REDMOND / AFP

There has been a sizeable amount of interest in the US regarding the health of giant retailers amid a mass of store closings . Included in this talk has been what effect this might have on US stock markets.

In the Dow Jones , Nike leads the way as a top retail pick, having posted 17% gains this year while concerns have grown for stores like Walmart who face a possible assault from delivery behemoth Amazon . The closure epidemic has even touched Elon Musk and the pioneering Nasdaq listed company Telsa who have been forced to close stores .

US retailers are shutting stores at a record pace, Tesla included.

There are a couple of sides to this coin. Don’t immediately assume that Tesla closing stores are the same as JC Penney putting a red line through 18 properties. Traffic to US malls has been dipping for a while , and as a result profits for the companies that rely on this have naturally declined. Amazon’s online revolution is probably a significant cause of this. Dig a little deeper into Tesla’s decision making, and you realize that their retail presence was always going to be temporary.

https://www.youtube.com/watch?v=TlGcBBYY3pQ

TSLA stores little more than “awareness centers.”

Following an awareness approach, many of Tesla’s stores were focused in popular malls to raise interest in the brand. Due to regulatory restrictions, they couldn’t even make sales in many locations as local government adopted a protectionist approach for its car dealers . Ultimately at this stage of Tesla’s development with media attention close to all-time highs, a purely online sales model makes more sense anyway.

Dow Jones bolstered by Walmart resilience

This glass half full approach to Tesla’s cut-backs also applies to the Dow Jones listed Walmart. There is an old saying among investors that the market is always right. What the market is telling us is that yes, Amazon might be coming for the grocery space, but Walmart can still adapt and counter this assault . The stock wouldn’t be up 5% this year if that weren’t the perception. It’s worth considering that the media might generate talk of Amazon overrunning the budget-grocery market, but only one store is definite and five more planned . Walmart has 11,695 stores around the World !

Elon Musk makes marketing and strategy one beast

For companies like JC Penny or Macy’s stop looking short term and start looking at the board. What are they doing right now to adapt to the online revolution? Change doesn’t have to kill a business; as an investor, you want profitability and sustainability. Success starts and ends with the board , but it’s remarkable how many people invested in DJIA companies can’t even tell you part 1 of the long-term strategy . Publicity is what Elon Musk does well at Tesla. He makes the marketing and the business approach one cohesive entity. This transparency is both refreshing and at times edgy, as his run-ins with the SEC have demonstrated.

The Dow Jones index has been particularly vulnerable to Jeff Bezos’s grand vision for Amazon. Naturally, Walmart, Home Depot and Nike have found their businesses impacted , but others could also face scrutiny. Bezos has often indicated an interest in getting into pharmaceuticals and healthcare. Walgreens is affected, but the largest market cap in the DJIA is United Healthcare, making the Dow particularly vulnerable to any grand plans for socialized healthcare or disruption by Amazon. No-one can see the future, but we can understand the present. Amazon is not going to overrun Walmart or offer health care with Warren Buffett anytime soon.

Dow Jones, FANG and Tesla might be overvalued, but where else would you put your money?

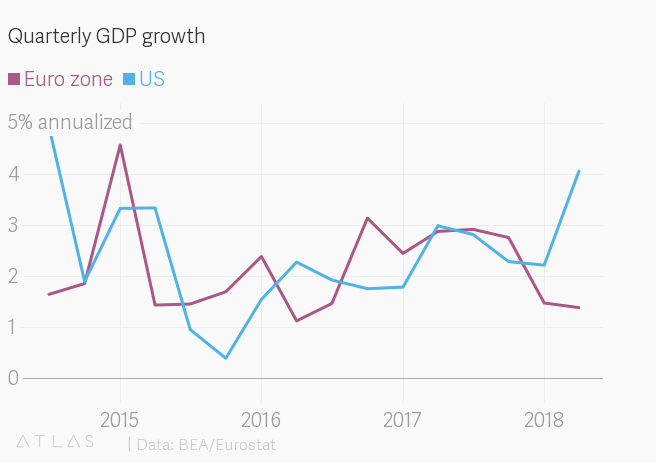

Waiting for better growth and innovation from the EU has proven to be a fruitless endeavor. For this reason, US stocks have maintained their edge on the rest of the world. Sluggish global growth makes it hard to write off the Dow Jones staples, or the overbought Nasdaq’s Tesla or Amazon. They might be overvalued, but that is just a natural outcome from being the only game in town.