Crypto ABBC Coin Skyrockets 65% in a Day: What’s Driving Price to the Moon?

ABBC Coin, a relative-unknown of a crypto is making tremendous gains. | Source: Shutterstock

A relatively silent cryptocurrency project has suddenly become a talk of the town thanks to a dramatic price rally.

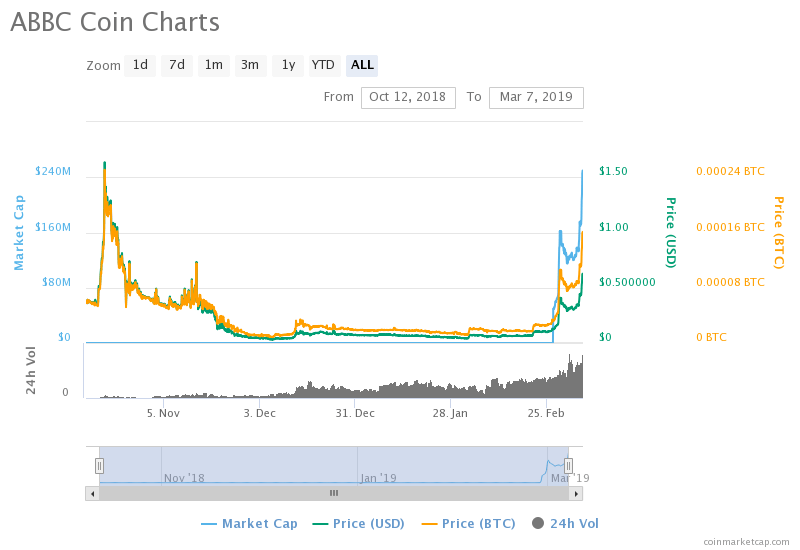

ABBC Coin is mooning so much that it has left even crypto hotshots like bitcoin and ethereum behind, strictly per its 24-hour performance. On Thursday, the ABBC-to-dollar rate surged as much as 65-percent. At the same time, the coin’s market capitalization more than doubled as it rose from $135.82 million to $249.74 million. The upside push helped ABBC gain entry into the top 25 cryptos club.

Speaking of volume, ABBC maximally changed hands with bitcoin, USDT, and ether, amounting to $46.75 millions worth of trading volume. Unregulated exchanges IDAX (Mongolia) and Bit-Z (Hong Kong) hosted a majority of these trades.

What’s Pumping the ABBC Price?

There are two straightforward theories attached to the ongoing ABBC price surge. The first one is related to an airdrop while the other concerns a fake pump. There is also a third theory that matters with ABBC as a blockchain project and its long-term prospects in the market. Let’s begin with the third – the most usual argument.

What a Lovely Blockchain!

It is about suspending one’s belief and accept that ABBC is a game-changing blockchain project. And the investors who have added circa $249 billion to its market cap since Feb 26 honestly believe in ABBC’s proposal: of creating a blockchain-based facial recognition platform that allows users to pay with their face. At least, that is what the selling point should be – and that is what should sustain the latest rally.

Let’s go back to the second theory, that of the fake pump.

Pump it like a Pro, Bro!

Given the proportionality of the ABBC price rally, there is a possibility that it is entirely artificial. It indicates that individuals are buying their assets and promoting them on social message boards to create a buying hysteria, leading the asset’s price to go higher.

https://twitter.com/poorbitcoiner/status/1103576033809317890

Nevertheless, the next part is scary. The individuals who “pumped” the asset price initially now thinks it is the right time to dump all their holdings at a higher rate. As they sell their profits, other investors are left holding their bags. That’s PUMP-AND-DUMP, noted across the history of financial markets.

Which brings one to the first theory: the airdrop.

Crypto Socialism

https://twitter.com/CoinBene/status/1098179983216787468

The ABBC Foundation – reminiscent of the Ethereum Foundation – announced that between Feb 20 and Feb 24, they were giving away 500,000 ABBC tokens via CoinBene, a Singapore-based crypto exchange with doubtful regulatory credentials. At the time of the distribution, the ABBC price was fluctuating between $0.068 and $0.106. After the giveaway was over, the price started rising, and by Feb 28, it marked a new monthly high towards $0.40.

A correction ensued, but ABBC later traced its bullish path, bringing the price to 0.62 today, its all-time high. The pump could have taken place around the giveaway hype, which is pretty standard in the cryptocurrency industry.

What’s Next?

A dump – may be. The numbers don’t add up. It is likely that traders would exit their long positions at higher highs, or whenever the first of the first lower highs begin to form. It would influence others to drop their ABBC holdings for a decent profit as well. If anybody is buying ABBC at its all-time high, he/she is in for an adventure.

Disclaimer: The opinions expressed in this article is of the author and author’s only.