Since early 2018 prices have been falling with the usual upward and downward cycles.

However, as technology and prices rarely come hand-to-hand, what’s important to remember is of late we’ve seen some conceptual improvements started being implemented, such as Bitcoin’s LN and Superspace or Ethereum side-chains and plasma.

My goal today is to pave the way towards the discussion of economic concepts and how I believe cryto-projects could potentially leave a mark in the 21st century economy.

The Best Economic System

“There are always a greater number of things that could go wrong, than ones that could go right”

When I started studying economics, most economics were taught by comparing East and West philosophies. This is, what economic theory should drive the world forward? Capitalism or Communism?

Of course we now know there are plenty of alternatives which don’t focus solely on growth or on a egalitarian distribution of wealth, the two selling points of each school of economics.

Interestingly enough is the fact both philosophies teach important values about human behavior, that can be extrapolated into new hypothesis and theories. The most important, to me, are:

- Ownership: by allowing people to own land and property, governments create an incentive for private agents to gather resources and put those resources to productive use. Examples vary from farming to airbnb.

- Trust: by allowing governments to allocate resources in order to improve wealth redistribution.

Capitalism promoted the good use of both values, leading to unprecedented growth. Over the past 50 years technology has grown exponentially, elevating society to a whole new level of consumption. People were able to find better jobs with higher salaries, hence becoming more comfortable day by day — as they could plan for the future, save up, go places, have food on the table and a house to live in.

In its essence, capitalists believe self-interest and individual utility maximization to be the root cause of growth. If all people try to achieve what’s best for them, how can the economy ever fail?

The Path Of Capitalism

In a capitalist market economy, decision-making and investment are determined by every owner of wealth, property or means of production, whereas prices and the distribution of goods and services are mainly determined by competition in goods and services markets. In Europe and Canada the picture is a little bit more colorful, as we see a mixture of capitalism and socialism, where the role of the government is intended to be more interventionist, in order to promote free (or near-free) public-goods such as healthcare or education.

Capitalism and its variants are therefore characterized by:

- The degree of competition in markets,

- The degree of intervention and regulation by governments, and

- How are firms organized.

The Current Model

Capitalism has its philosophical roots on the belief that the universe is a kind of “soulless Darwinian machine”. Its roots are connected to the Theory of the Firm, which entangles the purpose of contracting resources to perform daily tasks with the most effective resources organizational form. In other words, Capitalism is linked to how firms organize in order to manage resources, either in a decentralized fashion or in a centralized one, which was a main driver for 19th and 20th century corporations organization models.

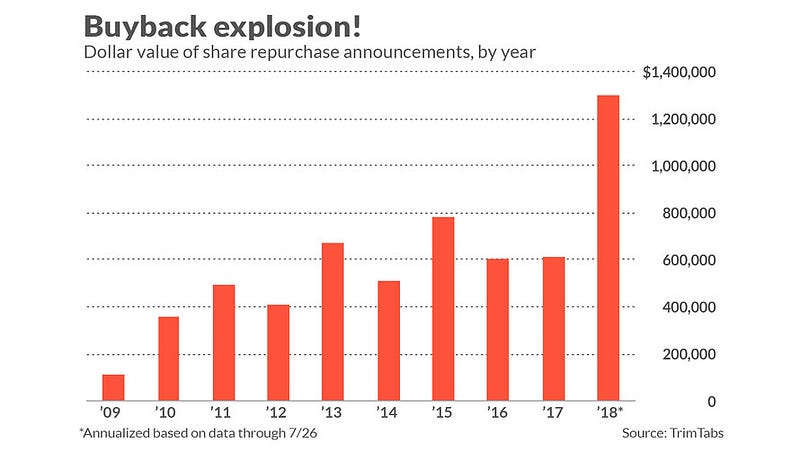

It seems the current Western Capitalism operates solely through the survival of the fittest and by maximizing shareholder profits.

If “nature” is predatory, greedy, self-interested, violent, brutal, red in tooth and claw — then society should be too, right?

Of course, that sort of mentality may create a few monsters, hard to slay. Some of the darkest are increasing wealth inequality and citizens selfishness.