5 Reasons Why the Dow Unexpectedly Struggled Today

Nearly two-thirds (62%) of U.S. CEOs believe the global economy is heading in the wrong direction. It's likely that only the Fed can prevent a mass exodus from stocks. | Source: AP Photo/Richard Drew

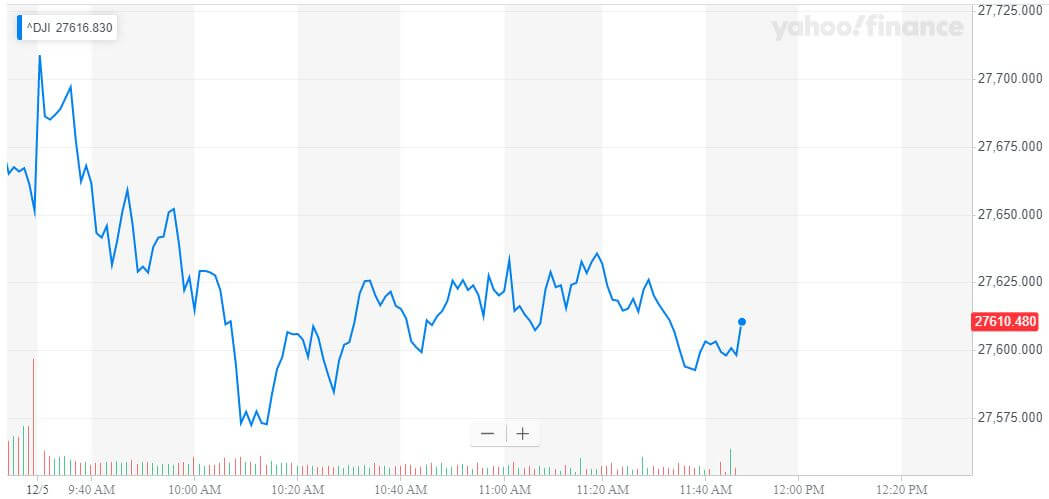

- The Dow appeared headed for a second straight gain following three consecutive losses.

- But stocks failed to secure those gains, and Wall Street’s primary indices slid into decline.

- We examine five reasons the Dow struggled on Thursday.

The Dow Jones Industrial Average shot higher when the bell rang on Thursday morning, but the index quickly relinquished those gains as stock prices slid into decline.

Here are five reasons why the stock market unexpectedly struggled today.

1. China’s latest trade deal commentary was less optimistic than advertised.

When China’s Commerce Ministry commented on the trade war for the first time since President Donald Trump infamously threatened to delay negotiations through the 2020 election, investors seized on one bullish statement: Washington and Beijing remained in close contact.

That was enough to prime the Dow for a second straight daily gain, but it wasn’t the entire story.

With just ten days remaining before a new round of tariff hikes, Commerce Ministry spokesman Gao Feng said that Beijing wouldn’t budge from its demand that a US-China trade deal – no matter how limited or comprehensive – must include tariff reductions.

2. The trade war status quo can’t last forever.

White House officials have forcefully denied that they will make this compromise , so US-China trade relations have essentially returned to their status quo.

That status quo can’t last forever, though, and the hourglass is running out of sand. Unless one side caves, tensions will escalate in less than two weeks.

Chinese advisers are already pressuring their government to retaliate against new US sanctions , and it’s not difficult to imagine a scenario in which tempers flare and relations devolve.

3. Economists warn that Dow bulls will be disappointed in 2020.

The precarious state of the US-China trade deal is just one reason that ING economists believe that Dow Jones bulls will be disappointed in 2020.

Writing in the firm’s December Economic Update , Chief International Economist James Knightley warned that the US economy is likely to fare worse than expected next year, potentially recording GDP growth as low as 1.4%.

There may not be a recession, but Knightley believes the Federal Reserve will have to cut interest rates two more times before 2020 is half over.

He writes,

After all, global activity remains subdued, inflation is benign and the latest news on trade is hardly encouraging so we struggle to see where meaningful upside momentum is going to materialise from.

4. Wall Street is growing less bullish on the stock market, too.

Equities analysts and deep-pocketed investors aren’t too confident about the stock market’s prospects in 2020, either.

4a. Deutsche Bank says the S&P 500 will stagnate in 2020.

Deutsche Bank Chief US Equity and Global Strategist Binky Chadha anticipates that a Santa Claus rally will carry the S&P 500 to 3,250 by the end of 2019. But then stocks will stagnate , and the S&P 500 will end 2020 at 3,250 as well.

Chadha told MarketWatch that the “economic slowdown is clear, unambiguous, and broad-based.” That’s bad news for an overvalued stock market:

Valuations are high, higher than they’ve been 90% of the time over the past five years.

Deutsche Bank’s gloomy forecast is echoed by darkening sentiment among institutional investors.

4b. Survey finds deep-pocketed investors are worried about a stock market correction.

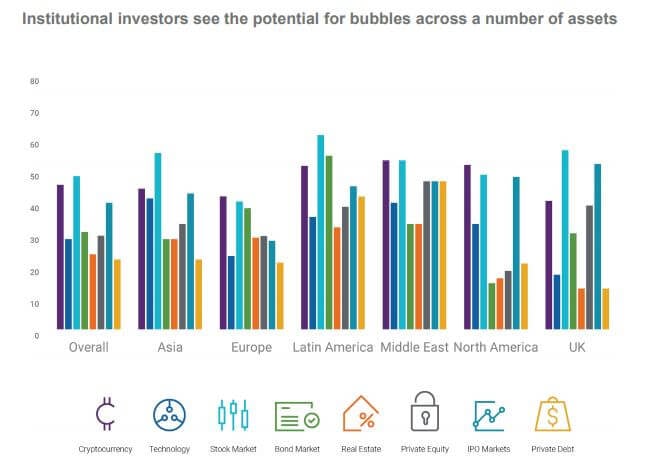

New research from Natixis Investment Managers reveals that 48% of the world’s largest investment funds aren’t just bracing for a sideways year for equities in 2020. They expect a full-blown stock market correction.

That’s a significant increase from last year, when 41% of respondents said that stocks would correct in 2019.

Also notable: the 48% of respondents who fear a stock market correction is greater than the number (46%) who believe cryptocurrencies are due for another setback.

5. Friday’s jobs report could make investors forget about today’s positive jobless claims data.

Today’s jobless claims report smashed estimates, but those statistics won’t factor into tomorrow’s Labor Department employment report.

ADP’s report came in far worse than expected, and investors may fear a surprise in Friday’s data. In addition to non-farm employment numbers, the government will also release data on hourly earnings and unemployment.

The University of Michigan’s Consumer Sentiment Index will also print its preliminary December reading on Friday morning, presenting another moderate risk factor to the Dow.